OPEC+ To Stick To Existing Output Deal Despite Downward Revisions Of Pre-War Oil Glut

When OPEC+ meets on Thursday in what is set to be another extremely short meeting, the world’s largest oil exporters will ratify another scheduled oil production increase of ~400k b/d to avoid “public rupture” with Russia, RBC oil strategist Helima Croft said in a report. Still, “there could still be scope for a policy shift at a later date” if the Russia-Ukraine war drags on and the U.S. offers key Middle East members a new security arrangement. We would beg to differ with RBC, and we’d claim that in a market so jittery oil has traded from $98 to $128 to $98 to $121 to $110 in 30 days, expect OPEC+ to do absolutely nothing for a long time.

Meanwhile, separately OPEC predicted that the oil surplus in the first three months of the year was much smaller than the cartel had expected, even before Russia’s invasion of Ukraine upended the market. According to Bloomberg, OPEC analysts slashed their estimates of the first-quarter surplus to 600,000 barrels a day on Tuesday, down from a prediction of about 1 million a day earlier this month. Back in January, the group had projected a glut of 1.4 million a day.

While the committee’s deliberations – in preparation for a meeting of OPEC ministers on Thursday – are still ongoing and the figures could be revised, there are plenty of reasons why stockpiles haven’t piled up as much as anticipated. On the demand side, consumption has bounced back from the pandemic far more vigorously than predicted, as the easing of restrictions gets drivers back on the road and economic activity generally resumes. At the same time, the supply side has seen a variety of disruptions, from the impact of freezing storms in North America to militia sabotage in Libya. And the OPEC+ alliance itself has struggled to restore production halted during the pandemic.

Looking further ahead, OPEC has a softer view than it did before: the group now expects an excess of 2.5 million barrels a day in the second quarter, instead of 1.6 million. For the year as whole, that means an overhang of 1.3 million a day versus 1.1 million projected earlier this month.

But, as Bloomberg’s Grant Smith notes, with so much turmoil in the market, it’s hard to see those forecasts surviving the turn of events. In late March, Russia’s exports slumped by at least a quarter amid an international boycott, so if anything the outlook may turn even more bullish.

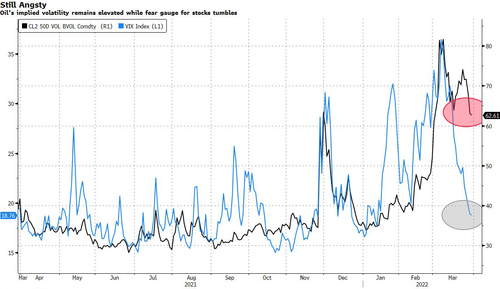

Meanwhile, speaking of oil price’s rollercoaster moves, the high level of anxiety in the oil market is a danger to the frothy risk rally under way globally Smith notes, adding that we had a glimpse of what a de-escalation in the war in Ukraine might look like overnight. However, oil’s implied volatility is still near multi-month peaks, even though the VIX index has tumbled to well below its pre-war levels.

Heading into tomorrow’s OPEC+ meeting, crude is already rebounding as its price risks remain tilted to the upside on multiple fronts, and while OPEC+ will stick to only a modest output gain despite calls for more supply, prices will stay supported as long as the war goes on, keeping traders on edge over supply shortage concerns in a tight market. In turn, sustained gains in energy costs should continue adding upward pressure to inflation.

Tyler Durden

Wed, 03/30/2022 – 12:25

via ZeroHedge News https://ift.tt/bGkKyaN Tyler Durden