Bonds, Bullion, & Black Gold Bid As Putin Sparks Stock Skid, Dollar Dump

So much for all that ‘peace’ optimism. Russia’s defense ministry stole the jam out of the market’s euphoric donut earlier this morning with comments that indicated the war is only just beginning and comments from the peace-talks suggested no progress had been made whatsoever. That spoiled the party (even with a decent ADP jobs print) and more hawkish talk from Fed Speakers likely did not help as it seems like the gamma-squeezers finally ran out of ammo.

Small Caps led the charge lower followed by Nasdaq and the Dow was the least worst horse in the glue factory…

Notably Nasdaq and Small Caps both reversed close to their 100DMAs…

It appears the short-squeeze is over…

Source: Bloomberg

AAPL’s near-record (2003) streak of positive days (11 in a row and up 20%!) is over…

Bonds were bid across the board today with the short-end outperforming today (3Y -7bps, 30Y -4bps). On the week, only 2Y yields are higher…

Source: Bloomberg

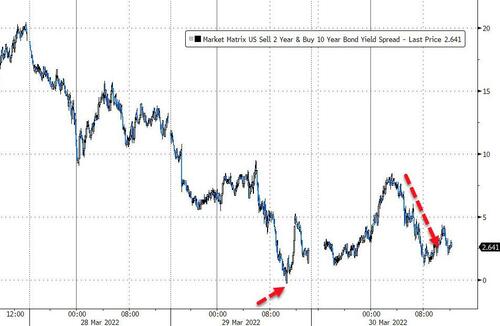

The yield curve (2s10s) held just above inversion today…

Source: Bloomberg

2Y German bond yields closed with a positive yield for the first time since Aug 2014…

Source: Bloomberg

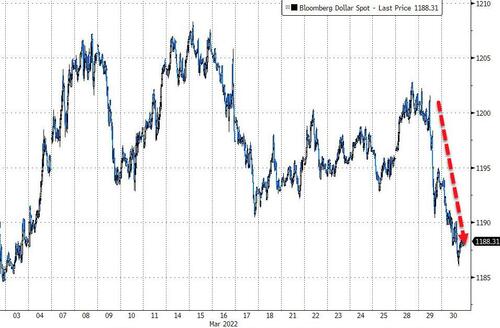

The dollar continues to slide, back near the lows of the month…

Source: Bloomberg

Bitcoin slipped lower today but is generally holding the jump from the weekend…

Source: Bloomberg

Gold extended yesterday’s rebound off $1900

And oil surged back up to erased yesterday’s “peace” premium plunge…

Finally, the market continues to price in at least 3 rate-cuts starting next year…

Source: Bloomberg

Clearly expecting that the 9 rate-hikes priced in this year will bring recession… and the normal volte face response from the pavlovian seat-fillers in The Eccles Building.

Tyler Durden

Wed, 03/30/2022 – 16:00

via ZeroHedge News https://ift.tt/qgMZuDe Tyler Durden