“Do You Feel Lucky?” – 8 Reasons To Question The Market’s Recent Rip

Amid an utter shitshow of macro, micro, political, and geopolitical chaos, the S&P 500 is less than 4% from its all-time record closing high in early January…

Source: Bloomberg

It appears Goldman was right since the past 11 days saw a 20%-plus surge in the ‘most shorted’ stocks – the biggest squeeze since the March 2020 lows liquidity-fueled rebound…

Source: Bloomberg

However, as the chart above shows, after getting-back-to-even for the year, the last two days have seen ‘most shorted’ stocks fade fast as perhaps the squeeze ammo has dried up.

So where do we stand?

Bloomberg’s Simon White has some ideas and offers eight reasons why it would be a surprise if the S&P were to make a new high before at least testing the recent low…

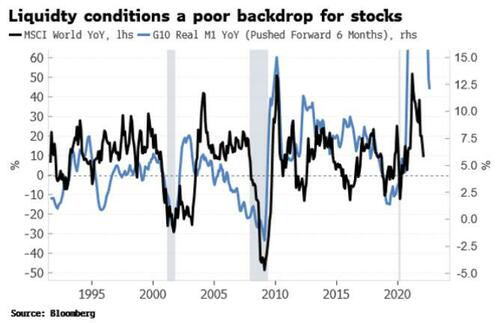

1) Poor liquidity.

Global liquidity conditions continue to deteriorate as central banks move into tightening mode, and rising inflation erodes the real value of money growth.

Risk assets will struggle while the impulse from liquidity is falling.

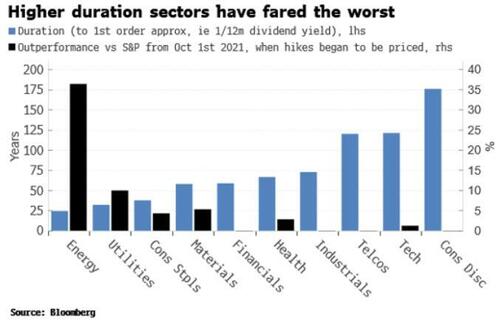

2) Tech sector lags.

While tech has led the most recent bounce in the market, the sector has heavily lagged since last year when the market started to price in higher Fed rates. Tech has one of the highest durations as it has lumpy future cash flows. The chart below shows a clear inverse relationship between duration and sector outperformance since Fed-pricing began to rise.

With tech the single largest sector in the S&P (at ~28%), it will be tough for the market to make a new high while the sector lags.

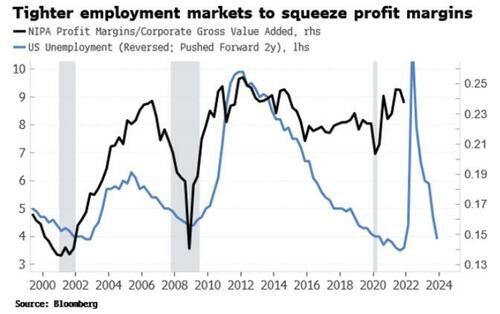

3) Profit margins fall.

Profit margins had been driving market returns, but high inflation and a tight employment market will soon compress them.

4) P/Es fall.

P/E multiples are unlikely to be able to pick up the baton from weaker margins. Earnings rise with inflation but the extra risk associated with greater and more variable inflation implies investors pay up less for this rise in (nominal) earnings, and P/Es fall.

5) Revenues fall.

Revenues track economic growth. Leading indicators such as wider credit spreads and a falling ISM new orders-to-inventory ratio suggest U.S. growth will weaken this year.

6) Buybacks don’t pick up.

Buybacks were a major driver of stock returns in the last cycle, but they are unlikely to do likewise this cycle. Buybacks will face headwinds from tighter monetary conditions, as well as a Biden plan to limit the amount of buybacks firms can do.

7) Few signs of capitulation.

We have not seen the signs of capitulation — e.g. sharp rises in number of stocks making new lows, plummets in the advance/decline line, spikes in put/call ratios, etc — normally seen at significant market lows.

8) The war is likely not over.

The recent bounce was driven by a belief peace will soon break out, but unless Putin has fully recanted his belief that Ukraine is not a de jure nation state, it seems folly to assume the conflict is over.

As White concludes, eight is considered a lucky a number in many parts of the world. Maybe it will be for the bears again in Q2?

As Goldman’s Tony Pasquariello noted, “this is what bear market rallies look like… These types of vicious rips higher are a feature, not an oddity.”

Tyler Durden

Thu, 03/31/2022 – 11:45

via ZeroHedge News https://ift.tt/meaYARH Tyler Durden