Rabobank: Think Of What’s Happening As A Kondratiev Wave Vs A 7-Day Moving Average

By Michael Every of Rabobank

Political and geopolitical risk. It’s obviously on all the markets’ minds at the moment. However, for most in markets it is seen as a formless bogeyman or an abstract catch-all for things not going the way one had planned. Imagine if medicine worked the same way as “geopolitics” does: “Why is the patient getting so sick, doctor?” “Oh, biology.” “Why did that patient suddenly die?” “Biology.” “What do we need to do to help this patient get better?” “Easy: resolve the biological problem.” You get the point – and hopefully not that doctor, at any point.

As markets get caught out by developments –no, nothing is settled re: Ukraine!– some analysts can’t even use the word “war”. “This patient will recover, because biology!” We have the geopolitics equivalent of spot-chasing from others. Moody’s just released a statement saying: “as a result of Russia’s invasion of Ukraine, global military budgets, including those in Europe and the US, will climb, fuelling longer-term revenue growth in the sector.”

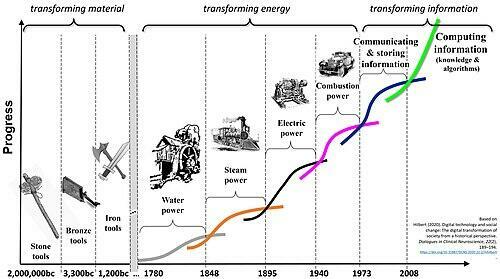

By contrast, while we weren’t pointing to Ukraine as a flashpoint –although we did in January this year– as far back as 2015’s ‘FX Wars’ we already argued that the historical pattern was global economic imbalances > financial crisis > rate cuts > FX wars > trade wars > war. Methodologically, think of it as a geopolitical Kondratiev wave vs. a 7-day moving average.

‘Political risk’ can be seen as waxing and wanes in a wave pattern –not a cycle: there is no fixed periodicity or amplitude– along fundamental channels set by geography, demography, and political-economy. That is, until it breaks to the topside or down-side. As such, yes, you can make money tactically within the bands of a ‘wave’; but you should always consider which way the channel is ultimately trending. Here is a *very* rough example in *very* condensed form.

The US broke diplomatic relations with Russia after the revolution of 1917; but as soon as Lenin re-embraced elements of the market economy, Wall Street wanted to do business there again; they got kicked out under Stalin; but US engineers and tech helped build Soviet industry via the likes of Amtorg; and then the head of Amtorg was shot by Stalin in 1938.

After being WW2 allies, with the Red Army backed by US Lend-Lease, we had 1950’s McCarthyism and ‘a Red under every bed’; in 1962, the Cuban Missile Crisis nearly killed us; yet by 1966 Hollywood was making comedies like ‘The Russians are coming! The Russians are coming!’, which portrayed Soviets in a sympathetic light; and we got US-USSR détente in the 70s; but then the tougher Cold War of the 80s; US heavy metal bands played to adoring Russian audiences in 1989; and the USSR collapsed in 1991, and US businesses poured in. I won’t repeat the messy history since then, the mistakes made, opportunities missed, and Great Power dynamics evident since De Tocqueville. But can you spot which way the channel is trending today? And to be clear, this is about far more than just Russia.

Russian Foreign Minister Lavrov and Chinese Foreign Minister Wang Yi just met in Beijing, and Lavrov made a public declaration that: “We, together with you, and with our sympathizers will move towards a multipolar, just, democratic world order.” Wang added: “China-Russia relations have withstood the new test of the changing international situation, maintained the correct direction of progress and shown tenacious development momentum…. China-Russia cooperation has no limits.”

So, Wall Street global business as usual then?!

One wonders what Western businesses in China and the 99% of funds that have not left despite the recent rush for the exit will make of that; or of the UK pulling its judges from Hong Kong’s Final Court of Appeal due to the impact of its National Security Law – and let’s see if others follow suite. Perhaps they will cling to the word “democratic”: then again, North Korea’s full name is the Democratic People’s Republic of Korea.

Back to markets, and echoing that 1966 movie and its “Emergency! Everybody to get from street!”, we have Germany declaring the first stage of an energy crisis plan, asking people to reduce usage –“E-Germany-cy! Everybody to get from street!”– and laying out contingencies for which parts of its industrial base face power cuts to minimize disruption to households if Russian gas is cut off. The Dutch are talking about energy rationing; and Spain is talking about rationing more than energy. This is about as dramatic a shift in policy as one can get during peacetime.

Back to political risk. We had already flagged rationing as a logical next step in the face of surging commodity prices because, while anathema to “because markets” thinking, it is the logical and historical dot to join. Indeed, we might see a lot more of that kind of thing ahead. Economic wars also require sacrifice: in WW2, the Brits had to ‘Dig for Victory’ and grow their own food. With the UN food chief warning of the largest shock to global systems since WW2, lots of people may need to. And Europe and the US still don’t have a clear plan for what they are going to do NOW to prevent serious hunger ahead around the world.

Back to gas. While Europe is now trying to decouple from Russia as fast as possible, the immediate flashpoint is that today is/was the deadline for the switch from EUR to RUB payments for that energy. Europe refuses to do so, and Russia has implied it will turn off the taps if not. However, yesterday Russia said this would take a while longer, even if payment and delivery are not necessarily synchronised.

When discussing this with my colleague Elwin de Groot yesterday, we both agreed there was no way switching to RUB payments was feasible given the scale of Russian energy flows: how would that many RUB get into European hands when they can’t export to it? Our theoretical solution was the Central Bank of Russia swapping RUB for EUR via Gazprom, gas still being priced in EUR, and both the RUB and EUR then going back to Russia. Within hours, news broke that this is the kind of mechanism being proposed as a short-term solution.

However, that still leaves the geopolitical issues. Does Europe want to play along with a normalization –and stabilization– of RUB trading in commodities at a time when Russia says it is building a New World Order and Russia’s Medvedev declares “The Americans are no longer the masters of planet Earth”? Or when Russia is floating RUB payment for its other commodity exports such as grains and metals too, which will bifurcate already strained global commodity trading platforms? Germany says it won’t pay in RUB, full stop. In which case, or either case, it is an e-German-cy.

Again, this is about far more than just Russia. In another conversation yesterday, the topic of the inability of CNY to internationalize came up. The firm conclusion was that with capital controls, like Russia, and a huge trade surplus, like Russia, it won’t ever be able to do so. So, within an emerging New World Order, then what?

It involves the same political risk ‘waves’ and channels already flagged. We have an on-shore CNY and an off-shore CNH. The market view is inexorable progress towards unifying around CNH, i.e., removing capital controls. That can’t and won’t happen. Yet moving back to a purely on-shore CNY with no international role is not viable if World Order building is. And what we have now doesn’t work either. Logically, perhaps we will go back to a dual exchange rate mechanism: a scrip or digital CNY for use at home, to create an endless supply of goods; and an offshore unit backed by that flow of goods abroad, akin to the ‘transferable ruble’ used as a technical settlement currency within Comecon –not Comic-Con– the former Soviet-era trading bloc.

Of course, that was extremely inefficient. Comecon could not establish a system of multilateral clearing given the centrally planned nature of the members’ economies and the inconvertibility of their currencies. In 1987 the transferable ruble remained an artificial currency functioning as an accounting unit and was not a common instrument for multilateral settlement. To underline the point, if Poland built up a credit balance by running a trade surplus with Hungary, it could not use the credit to finance a deficit with Bulgaria. As such, each former Soviet-bloc country tried to balance its trade bilaterally with each partner. That was really hard to do then and would be impossible now.

Which is why he have a US global system: and why a real emergency for markets looms if it fractures – and some *are* trying to fracture it. As we speak. Note that in the past, when we did indeed have had multiple reserve currencies simultaneously, we also had a far from fragmented global trading and clearing system.

If you find this too technical, please watch this short comedy video from the UK’s Fast Show to underline how once you start to interfere in the global clearing system, said global system rapidly breaks down.

Or will we magically resolve this by ending up with a global neutral clearing house for Russia commodities and Chinese exports? Who can be our ‘Switzerland’? India? Really!?

Meanwhile, the US is rattling its sabre against China with one hand. Further US-listed Chinese stocks are in its sights, and US Trade Representative Tai just gave a blistering speech stressing: “The US will vigorously defend US economic interests and values against the negative impacts of China’s economic policies as Beijing doubles down on its state-centred economic system.” Yet, with the other, Treasury Secretary Yellen, says it’s still not appropriate to sanction China as a Russian partner. Then again, she said inflation was transitory, and now says the US economy is strong, ignoring the yield curve, and she is not seeing the end of globalization, ignoring the New World Order just declared.

Recall what I was saying about ‘Kondrateiv waves’ vs. 7-day moving averages? There are even worse ways to forecast geopolitical risk. Like ignoring it entirely, “because markets”.

Don’t end up like the former head of Amtorg.

Tyler Durden

Thu, 03/31/2022 – 14:05

via ZeroHedge News https://ift.tt/QVunkLK Tyler Durden