Global Bonds Suffer Worst Drawdown Ever As Massive March ‘Squeeze’ Rescues Stocks From Rout

Q1 was unreal…

-

Global Bonds – worst drawdown ever

-

US Bonds – 3rd worst Q1 since the Civil War

-

US Yield Curve – greatest Q1 flattening ever

-

Commodities – best start to a year ever

-

Oil – best start to a year since 1999

-

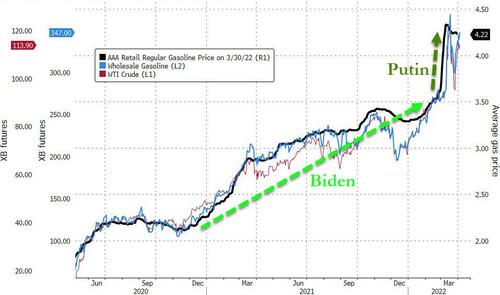

Regular Gasoline (at-the-pump) – fastest rise ever to record highs

-

US Stocks – 3rd biggest short-squeeze rebound in March since Lehman after worst start to a year for stocks since 2009 (2nd worst in over 30 years)

-

Ruble – stronger against the dollar in March after ugly Jan/Feb

Across the major asset-classes, gold outperformed with stocks and bonds ugly…

Source: Bloomberg

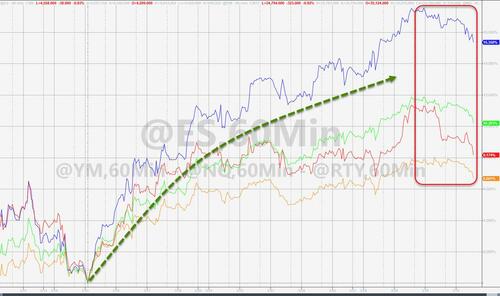

In US equity-land, Trannies ended Q1 unchanged while the Nasdaq ended down around 8%, despite March’s surge higher. This is the 2nd worst start to a year for stocks still since 2008 (with only the COVID crash worse)

All thanks to a massive short-squeeze in March…

Source: Bloomberg

For some context as to just how much of a bounce this was., Nasdaq rallied a stunning 17% off the mid-March lows (in 10 days) and S&P up almost 12% in the same period…

But the last two days have seen significant selling pressure resume into quarter-, month-end, with Small Caps down 3%, Nasdaq and S&P down over 2% in a big puke…

Energy stocks were Q1’s massive winner with Utes the only other sector to end green. Consumer Discretionary and Tech were the quarter’s biggest laggards…

Source: Bloomberg

Value stocks outperformed growth in Q1, but having reached up to the May 2021 relative highs, Growth stocks started to outperform and have shone in March…

Source: Bloomberg

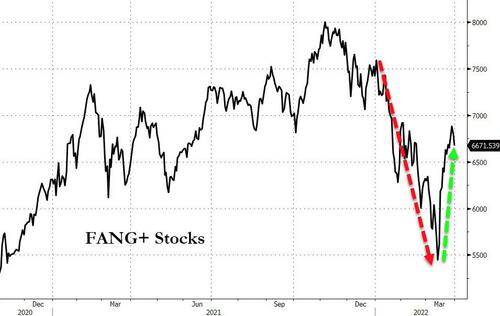

Mega-Cap tech stocks rebounded massively in late-March (but still remain lower in Q1)…

Source: Bloomberg

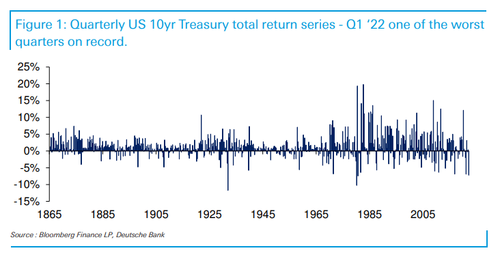

Today marks the end of the quarter and, based on Bloomberg’s data, the global bond market just suffered its greatest drawdown on record…

Source: Bloomberg

Domestically, according to BofA, Q1 is the worst quarter for their 10yr UST series since the early 1980s.

Indeed, since the US Civil War, 10yr US Treasuries (or equivalents) have only seen a worst total return quarter in the early 1980s and in Q4 1931 after we passed the peak of the Depression based rally.

In Q1, 2Y yields soared 156bps (while the long-end also rose, but ‘just’ 55bps)…(the last couple of days have seen bonds bid into the qtr-/mth-end as funds likely rebalanced)…

Source: Bloomberg

As the chart above shows, the yield curve flattened dramatically in the last month, accelerating the crash in the curve into inversion from the 2Y point out (this was the biggest flattening to start a year ever)…

Source: Bloomberg

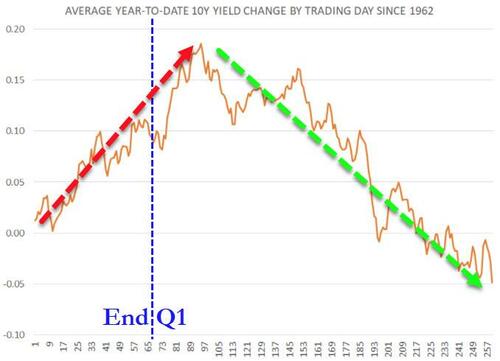

Seasonally, we could see more pain in bond land, before the trend shifts back in the favor of bond-bulls (the chart below shows the typical pattern in the 10-year yield going back to 1962)…

Source: Bloomberg

At the short-end of the curve, Q1 saw an unprecedented divergence as the market ripped from pricing in 2 hikes in 2022 to pricing in almost 9! And from pricing in 2 hikes in 2023/2024 to pricing in 3 rate-cuts!!!

Source: Bloomberg

Treasury yields finally caught up with Jeff Gundlach’s favorite indicator (copper/gold)…

Source: Bloomberg

The dollar was higher in Q1, trading back into the pre-COVID range (up in Jan and March and down in Feb) to highest monthly close since July 2020…

Source: Bloomberg

Cryptos had a tough Q1 with Bitcoin tumbling today back to unchanged on the first quarter and Ethereum down over 10%…

Source: Bloomberg

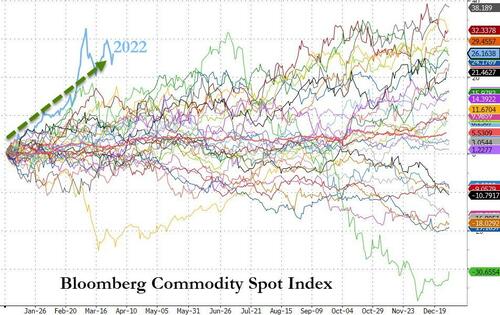

Commodities were all up in Q1 with Bloomberg’s Commodity Spot Index having its best start to a year ever, up 26% in Q1…

Source: Bloomberg

Oil was the standout for many, with WTI up around 40% (oil’s best start to a year since 1999). Copper and PMs rose around 6% in Q1. This was gold’s best start to a year since 2016…

Source: Bloomberg

And that has sent gas prices to record highs…

Source: Bloomberg

WTI traded lower today after Biden’s SPR release promo (but WTI found support at $100 again)…

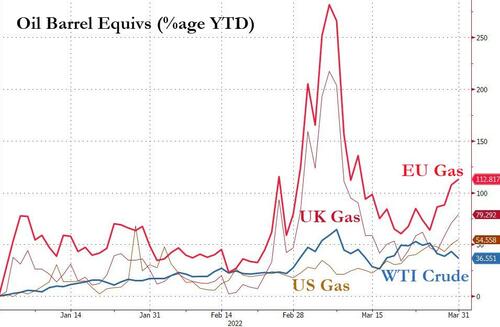

US Nat Gas soared to its best start to a year since 1990 but European Nattie exploded higher…

Source: Bloomberg

Finally, we note that financial conditions around the world tightened significantly in January and February, but eased in the second half of March (especially Japan as it swung to QE infinity and defended its yield curve channel) – as central banks actually began hiking…

Source: Bloomberg

We suspect this is not what the central banks want as stagflation strikes the world…

Source: Bloomberg

Do global central banks ‘need’ a recession to tamp down inflation? And will politicians allow it?

Tyler Durden

Thu, 03/31/2022 – 16:00

via ZeroHedge News https://ift.tt/vEPfsly Tyler Durden