The Yield Curve Inverts: What Happens Next

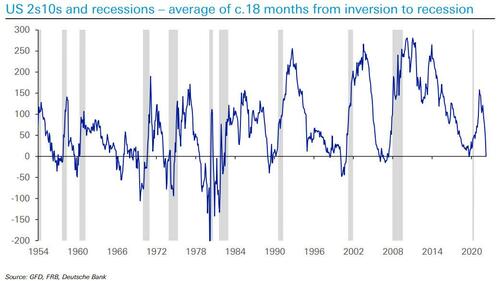

Shortly before the close on Thursday, the closely-watched 2s10s yield curve, better known as the recession harbinger, inverted again for the second time in three days, and this time it will likely fail to bounce as the US slides ever closer to its recession D-Day.

To be sure, the Fed and most of permabullish sellside strategists have spent most of their time in recent days to “explain away” why the yield curve doesn’t actually matter, with the Fed going so far as penning an absolutely idiotic paper titled “(Don’t Fear) The Yield Curve, Reprise“, in which the authors who have never had a real job in their lives reference FDR in making the point that the 2s10s is only notable in that “it can only make things worse if investors not only fear the prospect of a recession, but at the same time, are spooked by that fear itself, which is mirrored in inverted term spreads.” Instead of addressing a level of stupidity that once upon a time was prohibited at the Fed, we will merely show a chart comparing the 2s10s and superimpose the Consumer Optimism Gap (as defined by the spread between the Conference Board Expectations and Current situation), to show the clear correlation and that a plunge in the 2s10s coincides with a collapse in optimism… and the start of a recession.

Not convinced? That’s ok, because thanks to DB’s Jim Reid we have a full presentation (available to professional subs) which shows exactly what happens after every single inversion. Below we excerpt some of the key findings:

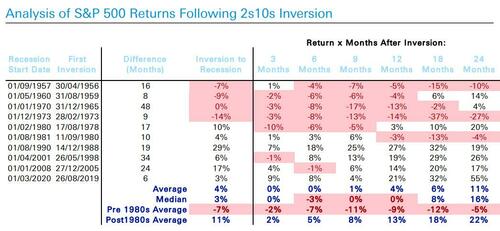

1. Every recession in the last 70 years has only happened AFTER the 2s10s has inverted. We have now seen an inversion on March 29th intra-day and again on March 31. History would say US recession risks now elevated 12-24 months out.

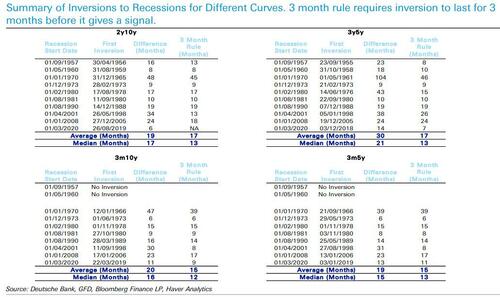

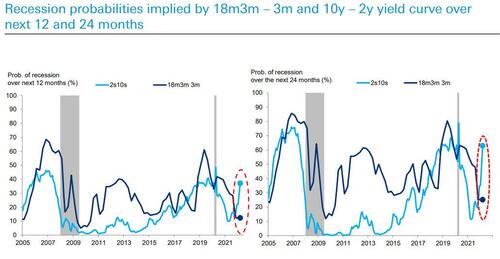

2. Bulls will point out that while all yield curves between 2Y and 10Y have inverted, anything involving 3M money is still historically steep, and that there is a record directional divergence between any yield curve measure including 3m money and those not. This argument is disingenuous as it only reflects that the Fed is so far behind the curve and anchoring the 3M. This, naturally, won’t last as Fed hikes aggressive over next 12 months…

3. While the steep 3M curve will invert soon enough once the Fed hikes a handful of times, which also means it only has “noise” value, it also means that it’s only the 2s10s matters as it’s inverted before EVERY recession going back 70 years (3 month money ones didn’t invert pre-50s/60s recessions). Also, it goes without saying, an inversion for 3 months is a stronger signal than a brief inversion.

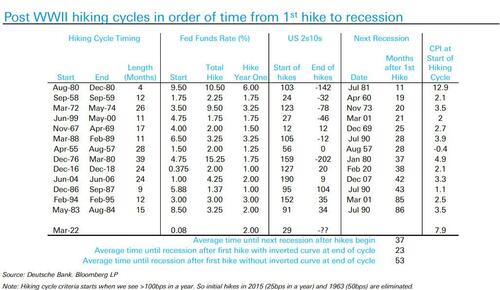

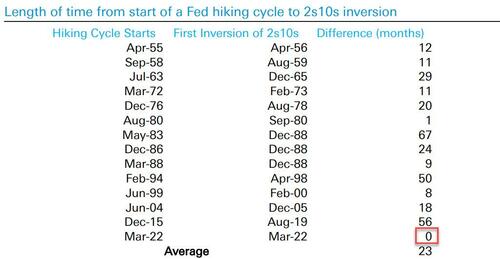

4. Furthermore, while bulls will argue that a 2s10s inversion means there is still a long time before the recession (roughly 18 months), the reality is that recessions after 1st Fed hike in a cycle occur sooner when 2s10s inversion happens during hiking cycle… Well, this inversion occurred in record time post the start of the hiking cycle.

5. Another remarkable datapoint: on average it takes around 2 years after the Fed starts hiking for the 2s10s to invert…. This time around it took just 2 weeks.

* * *

Now let’s take a look at how some assets perform after inversions.

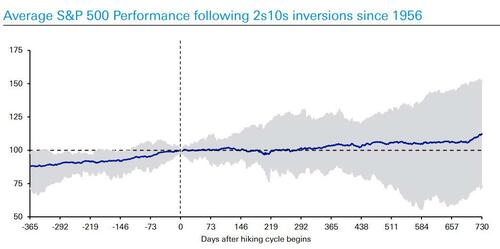

For S&P the supercycle matters: pre-1980 inversions almost always led to a sell-off. Post 1980, inversion and recessions have been relatively inconsequential hiccups in structural 40-year bull market.

… so as Jim Reid notes, the average performance following inversions is misleading as it’s a period of two dramatically different halves.

Yields still tend to go up for in the months after inversion starts with only one example of mildly lower yields around the 4 month point…

In any case, the 2s10s indicates that odds of a recession in the next 24 months are a solid 60%+ and rising by the day.

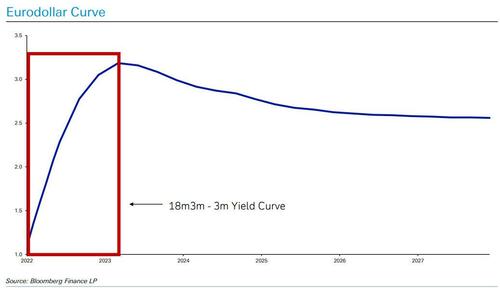

Meanwhile, in a humorous counter to the 3M polyannas, the reason why the 3M 3M18M is still steep is that with the Fed behind the curve,18m3m-3m is the steepest point on the yield curve, with cuts priced shortly after. Yes: in just over a year, the US will be in recession! The market likely will stop pricing additional hikes if they believe a recession is imminent. As Reit notes, “18m3m-3m should flatten soon as hikes are delivered, upgrading its implied recession signal over time.”

* * *

Two other observations why the inverted yield curve is a guaranteed signal of imminent recession: just before the 2008, Bernanke said this time was different, and to ignore the flat yield curve…

“I would not interpret the currently very flat yield curve as indicating a significant economic slowdown to come, for several reasons. First, in previous episodes when an inverted yield curve was followed by recession, the level of interest rates was quite high, consistent with considerable financial restraint. This time, both short- and long-term interest rates–in nominal and real terms–are relatively low by historical standards. Second, as I have already discussed, to the extent that the flattening or inversion of the yield curve is the result of a smaller term premium, the implications for future economic activity are positive rather than negative. Finally, the yield curve is only one of the financial indicators that researchers have found useful in predicting swings in economic activity. Other indicators that have had empirical success in the past, including corporate risk spreads, would seem to be consistent with continuing solid economic growth. In that regard, the fact that actual and implied volatilities of most financial prices remain subdued suggests that market participants do not harbor significant reservations about the economic outlook.”

… and also right before the bursting of the dot com bubble, William McDonough said the same in Feb 2000.

“Typically, the inverted yield curve is seen as a sign of a coming recession, McDonough said. ”I don’t see that as the explanation,” he said. He said an expected drop in supply of long-term debt, as a result of reduced U.S. government debt sales and announced buybacks, is more likely the reason. Without those conditions, the inverted yield curve probably wouldn’t exist, he said.”

Just a few days later, the dot com bubble burst.

There is much more in the full DB presentation available to pro subs.

Tyler Durden

Thu, 03/31/2022 – 22:40

via ZeroHedge News https://ift.tt/aMFZwGj Tyler Durden