Vacation Home Demand Slows As Mortgage Rates Soar

Vacation home purchases are cooling as US mortgage rates continued their near-vertical ascent, soaring to levels not seen since late 2018.

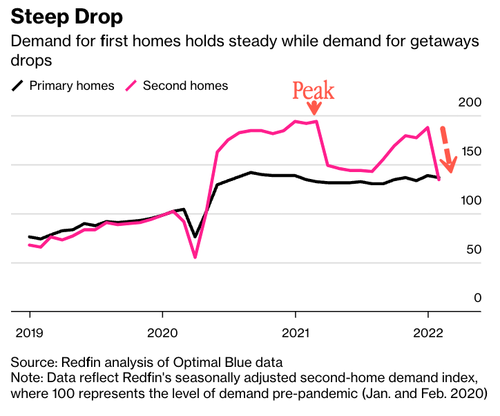

A new Redfin Corp. report, cited by Bloomberg, says the rush by affluent Americans, mainly white-collar, to purchase second homes dropped in February to the lowest level since May 2020. Though demand is still up 35% above pre-pandemic levels, the vacation housing market will cool as rates rise.

Before the pandemic, demand for second and primary homes grew at similar rates. But pandemic lockdowns and the Federal Reserve’s easiest monetary policies on record, coupled with FOMO and low inventory, unleashed a surge in buying panic in beach towns and mountain areas.

Redfin Chief Economist Daryl Fairweather said soaring mortgage rates and rising home prices amid low inventory had slowed the boom. He said the second-home market is being impacted “much harder than the primary-home market, largely because vacation homes are optional. People don’t need a second home.”

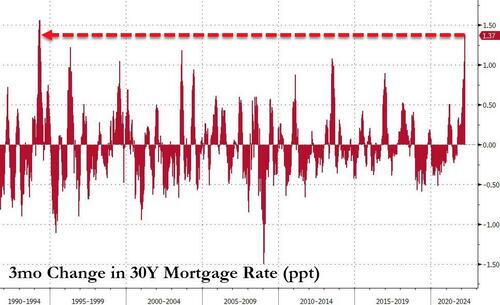

Redfin data showed secondary home demand peaked in March 2021 when the average 30-year mortgage tagged a record low of 2.65%. Rates have since jumped over the last year, hitting as high as 4.89%, sending ‘affordability’ spiraling lower.

For some context, the Fed’s move to quell inflationary forces by embarking on a super aggressive hiking cycle has driven mortgage rates on one of the fastest three-month rises since 1994.

The rapid rise in rates has also sent primary-home buyers to the sidelines as housing affordability becomes a significant challenge.

Secondary home buyers also face another hurdle, including a fee of an additional 1% to 4% for loans backed by Fannie Mae or Freddie Mac.

Given extraordinary supply challenges, housing prices are likely to remain elevated this year despite plunging housing affordability. This means 2022 could be the hurrah for the housing market as the cracks are beginning to appear as vacation home markets cool.

Tyler Durden

Sat, 04/02/2022 – 20:00

via ZeroHedge News https://ift.tt/TGpdCNn Tyler Durden