Fed Just Getting Started As Economy About To Slow

By Simon White, Bloomberg Markets Live commentator and analyst

The minutes from the Fed’s meeting in March, released on Wednesday, is likely to be the most tradeable event in a week fairly light on data. More FOMC members are advocating for 50bps hikes, with Mary Daly, President of the San Francisco Fed, in an interview on Sunday recommending a 50bps hike in May. The minutes will give further information on the likelihood this happens, and also more colour on the projected path for balance-sheet contraction. There is currently ~80% chance the Fed does lift rates by 50bps in May, and there are now over eight 25bps hikes priced in over the remaining six meetings of 2022.

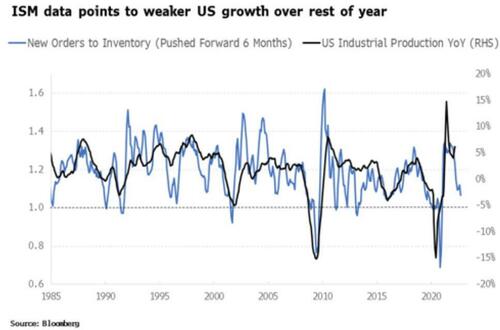

It seems, though, that the Fed is just gearing up its tightening as the economy is about to slow. Friday saw the release of the ISM manufacturing survey. The ratio of the new orders and inventory subcomponents of the survey slipped lower, closer to the critical value of one. This ratio gives a good lead on U.S. industrial production and indicates growth in the U.S. is set to slow quite sharply through the rest of the year. Unemployment will follow suit and begin rising, posing a problem for the Fed later in year. Suffice to say their zeal for tightening may fade somewhat when growth is looking shaky, and political pressure on dealing with inflation eases after the mid-terms in November.

In Europe, we also get the minutes from the ECB’s March meeting. The ECB is in a bigger quandary than the Fed where the economy and inflation are more sensitive to energy prices. Last week saw another big rise in Europe’s inflation rate, to 7.5% y/y, driven by a huge 12.5% m/m rise in energy prices. Growth in Europe is set to slow faster than in the U.S., especially as China struggles to get on top of its Covid situation. The weakening of the yen will also be an unwelcome development, and may prompt a more significant easing from China.

The Fed and the ECB are likely to underdeliver on rate-hike expectations as growth concerns resurface and inflation begins to slow. However, that will only fan the flames for a resurgence in inflation, possibly larger than the current spike. Then, they will have no choice but to deliver the sort of rate hikes that make the pips squeeze. No-one would envy being a central banker in the coming months and years.

Tyler Durden

Mon, 04/04/2022 – 22:20

via ZeroHedge News https://ift.tt/DRLtfiV Tyler Durden