US Services Surveys Disappoint In March, Confirm Rise In Prices “Sharpest On Record”

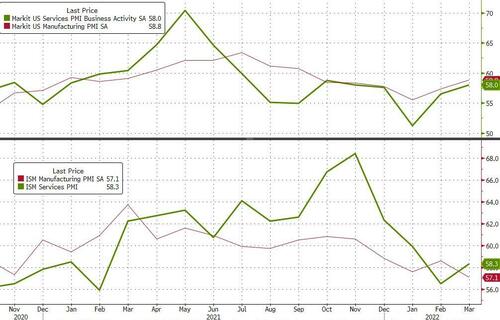

Following the mixed picture from US manufacturing surveys (PMI up, ISM down), the US Services surveys were both expected to rise in March.

-

Markit (S&P Global) US Services PMI rose from 56.5 in Feb to 58.0 in March (less than the 58.9 exp), but this was a drop from the preliminary print of 58.9.

-

ISM Services rose from 56.5 in Fed to 58.3 in March (after 3 straight months lower), but was lower than the expected rise to 58.5

This is as US macro surprise data’s recent improving trend stalled in March.

Source: Bloomberg

Only ISM’s Manufacturing survey dropped in March…

The rise in selling prices was the sharpest on record (since October 2009), as service providers reportedly passed through higher costs to clients, where possible. The rate of cost inflation accelerated to the quickest since December’s series-record high, and was the third-steepest on record. Where higher cost burdens were reported, firms linked this to broad-based increases in input prices. Companies once again highlighted hikes in fuel, energy and wage bills as driving inflation.

Chris Williamson, Chief Business Economist at S&P Global, said:

“Business activity in the vast service sector enjoyed a boost from the relaxation of virus-fighting restrictions in March, regaining strong momentum after the Omicron-induced slowdown seen at the start of the year. Demand for services is in fact growing so fast that companies are increasingly struggling to keep pace with customer orders, leading to the largest rise in backlogs of work recorded since the survey began in 2009.

“However, while this suggests that companies have a healthy book of orders to sustain strong output in the coming months, the downside is further upward pressure on prices as demand exceeds supply. With firms’ costs inflated by the soaring price of energy, fuel and other raw materials, as well as rising wages, prices charged for services are rising at an unprecedented rate. Consumer price inflation therefore looks likely to accelerate further as we head into the spring.”

The S&P Global US Composite PMI Output Index posted 57.7 in March, up from 55.9 in February (but down from the preliminary 58.5 print for March), with a familiar theme – inflationary pressures intensified as supplier costs soared. Input prices rose at one of the fastest rates on record, whilst costs passed through to customers drove up output charges at the joint-sharpest pace since data collection began in October 2009.

Tyler Durden

Tue, 04/05/2022 – 10:04

via ZeroHedge News https://ift.tt/lUrMbY2 Tyler Durden