“Absolutely Historic” – Harvard’s Rogoff Admits US’ Weaponization Of Dollar Could End Dominance Within 20 Years

During a lengthy interview with Bloomberg TV on the role of cryptocurrencies in the world, when asked by anchor Matt Miller if we will look back at this moment as the beginning of the end of the dollar as the world reserve currency, Harvard University economics professor Kenneth Rogoff started by claiming “…that’s a little hyperbolic but it could be true… a long time from now.”

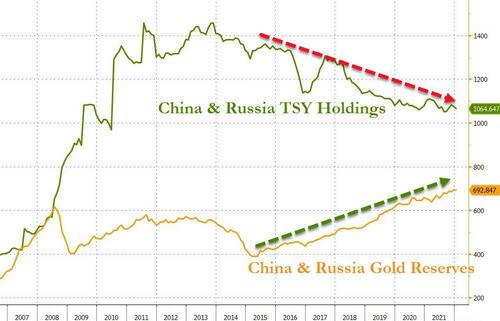

However, Rogoff then quickly admitted that “China and Russia have been looking for an alternative to the dollar for a very long time.”

Indeed they have Mr.Rogoff, as we have detailed over the past few years, de-dollarization of the world has been gathering pace and the recent actions taken by the US and its allies to restrict Russia’s access to the dollar-dominated global financial system – the so-called ‘weaponization of the US Dollar’ – could further stimulate moves to develop an alternative to the greenback.

For the largest nations, the Harvard prof says challenges of displacing the dollar include “huge network effects, not to mention that in China the rule of law isn’t what it is in the United States,” but, he says, “for smaller, emerging countries, [crypto] is something of an alternative to the dollar.”

He continues to expound on this by admitting that “China and Russia are going to be looking for something like this… maybe not on a public blockchain but more centrally-controlled,” raising the probability that, as we have noted previously, a ‘de-dollarization alliance’ could be forthcoming, to diminish the economic heft of Washington’s sanctions powers, and its de facto control of SWIFT, the primary inter-bank messaging service via which banks move money from country to country.

“The move that the U.S. did of shutting down the reserves, or blocking the reserves of the Russian central bank – absolutely historic” Rogoff says, warning that this precedent “will probably accelerate moves in the international financial system” to compete with the dollar.

“But they’re not going to take place at warp speed. Something that would have taken 50 years maybe is going to take 20 years.“

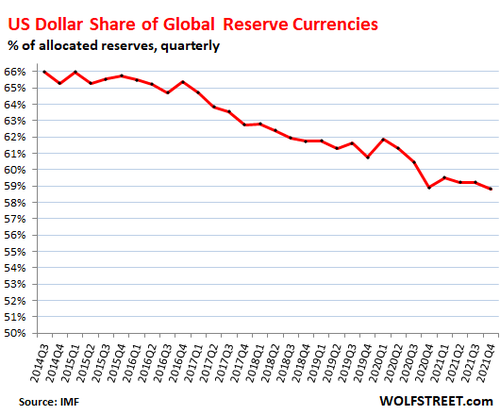

Bear in mind, as Wolf Richter points out, that the global share of US-dollar-denominated foreign exchange reserves fell by 40 basis points from Q3 to 58.8% in Q4, setting a new 26-year low, edging out the low in Q4 2020, according to the IMF’s COFER data released at the end of March.

Over the past 20 years, since 2001 – just before the official arrival of euro banknotes and coins – the dollar’s share has dropped by 12.7 percentage points, from 71.5% then to 58.8% now.

“Until now, the Chinese authorities have had an ambivalent view of internationalization,” wary about “the loss of monetary policy autonomy that could result from offshore trading in yuan and large foreign investments in the local bond market,” says Michael Spencer, chief economist and head of research, Asia Pacific, at Deutsche Bank AG.

But now, “the potential threat of being prevented from making or receiving payments in dollars or euros would likely encourage China to redouble its efforts to redenominate international transactions into yuan.”

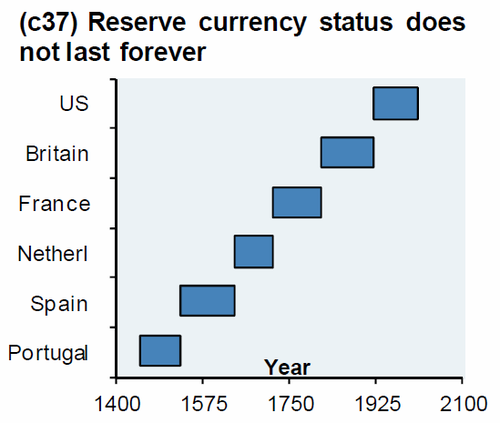

Don’t forget, the greenback is hardly the first “global currency”…

…and nothing lasts forever… not even bitcoin? as Rogoff opined on the future of the largest crypotocurrency, suggesting as Myspace ‘replaced’ Facebook, he “expects to see other things replace” bitcoin, as it becomes more regulated.

Tyler Durden

Tue, 04/05/2022 – 20:00

via ZeroHedge News https://ift.tt/WvH8cmA Tyler Durden