WTI Dips After US Crude Production Rise, Inventory Build

Oil prices have been volatile so far today but are higher for now after dropping on headlines from Bloomberg reporting that the International Energy Agency plans to deploy 60 million barrels of crude on top of the huge stockpile release already announced by the Biden Administration. Overnight saw dismal data from China which reinforced demand anxiety.

“Everything to me points to the market being in a pretty difficult place on the supply side,” said Callum MacPherson, head of commodities at Investec Plc.

“The main bearish point I can see is the China Covid outbreak, everything else looks pretty bullish.”

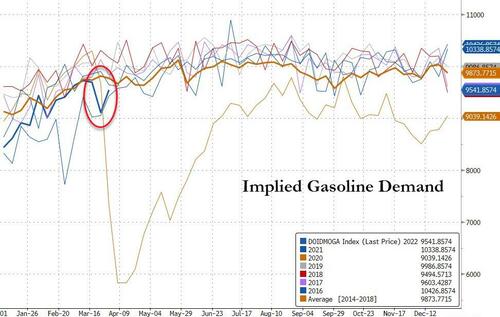

For now, all eyes on US gasoline demand for any signs of demand destruction…

API

-

Crude +1.08mm (-2.056mm exp)

-

Cushing +1.791mm

-

Gasoline -543k

-

Distillates +593k

DOE

-

Crude +2.42mm (-2.056mm exp)

-

Cushing +1.651mm

-

Gasoline -2.041mm

-

Distillates +771k

The official DOE data confirmed API’s reported build in crude stocks and a sizable rebound in stocks at Cushing…

Source: Bloomberg

Gasoline demand rebounded modestly last week but remains significantly below average…

Source: Bloomberg

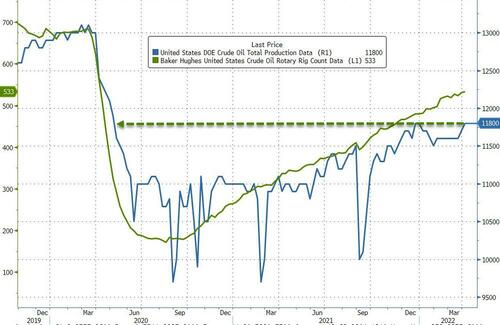

US crude production rose for the second straight week, back to its highest since May 2020…

Source: Bloomberg

WTI was hovering around $102.50 ahead of the official data and dipped on the bigger than expected build…

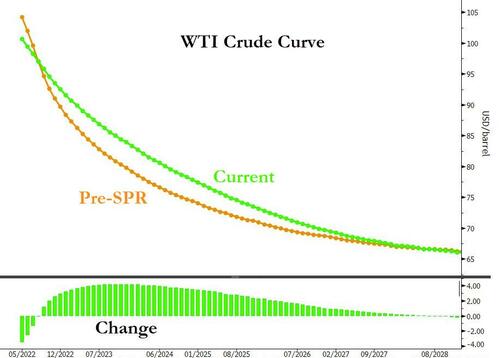

As Bloomberg notes, the possibility of new curbs is offsetting the impact in the global crude market of a vast release from the U.S. Strategic Petroleum Reserves (SPR,) beginning in May, in a bid to tame prices. Other countries have said they’ll also make drawdowns.

“Many who were long oil got out in the last week or so on the basis that the SPR was just too much for the market to handle without some real evidence of dropping Russian crude exports,” said Scott Shelton, an energy specialist at TP ICAP Group Plc.

That move has reshaped the oil futures curve, keeping a lid on nearby prices but lifting those further into the future.

But who cares about that… it’s after the Midterms! (and the next government will have to deal with the cost of refilling it at higher prices?)

Tyler Durden

Wed, 04/06/2022 – 10:37

via ZeroHedge News https://ift.tt/IFv2bEp Tyler Durden