Why The Sharp Selloff In Stocks And Bonds? JPMorgan Trading Desk Explains

As JPM desk trader Andrew Tyler writes in his morning market intelligence note, yesterday, the market sold off following hawkish comment from Brainard even if in reality Brainard offered no new information, and merely underscored what Powell had already said several times. Today, we receive Minutes from the last Fed meeting where Powell indicated that the market would receive color on QT.

So if this is “nothing new”, why the sharp drops across Equities and Treasuries in the past 48 hours (which JPMorgan’s permabullish stock evangelist, Marko Kolanovic did not expect and instead once again told clients to BTFD as he has every single week this year)?

For the answer we turn to JPM trader Ron Adler who writes that “over the past few weeks, there was a lot of lazy buying of growth stocks as economic concerns pervaded into value/cyclical stock sentiment. It felt like the NDX was due for a pullback following the ~18% rally from the March lows; we saw more profit-taking over the past few days.“

Additionally, with net & gross exposures remaining historically light (and performance challenged) “this move caught investors off guard. It led to some frustrating buying/covering along the way with little conviction. Many convinced themselves of the need to lean longer when the VIX dipped <25, and even longer once it breached <20. The news flow in the coming weeks will remain scant (financials earnings next week, NFLX on 4/19). This dynamic will leave the tape susceptible to more perceived Hawkishness from fed officials as the fears about the pace of shifting monetary policy remain paramount.”

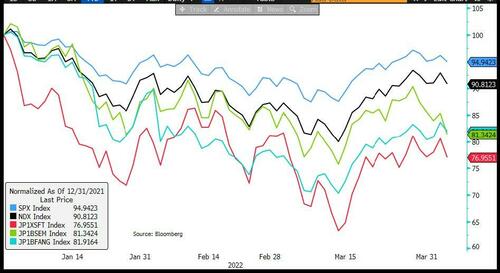

SPX v. NDX v. EXPENSIVE SOFTWARE v. SEMIS v. FANG

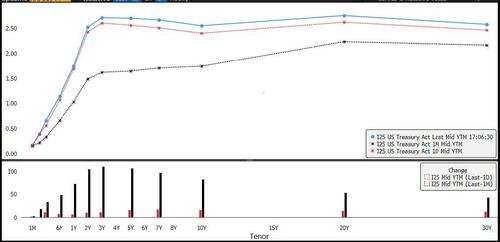

Meanwhile, adding to the pain for balanced 60/40 and risk-parity investors, in Rates we saw selling and steepening across the curve “as Rates folks viewed Brainard as being more hawkish than the norm.” The following from JPM trader Allison McNellis gives better context.

Brainard (voter) gave a very hawkish speech today that was largely repeated in moderated Q&A. Recall as a result of her ongoing confirmation she hasn’t had a public engagement since late February. She is considered a dove on the committee and many including myself thought she could possibly be the lowest dot in the plot in 2022. In the speech she confirms QT “as soon as May”, is open to the use of 50s, and in her view policy will be at neutral later this year. She used the word “expeditiously” in regards to rate policy and balance sheet, echoing both George and Powell. She did not mention asset sales but used the word “rapid” 3 times.

For the FOMC Minutes, Brainard expects this on caps: “I expect the balance sheet to shrink considerably more rapidly than in the previous recovery, with significantly larger caps and a much shorter period to phase in the maximum caps compared with 2017–19.”

Tyler Durden

Wed, 04/06/2022 – 11:25

via ZeroHedge News https://ift.tt/4b1zcrT Tyler Durden