FOMC Minutes Signal Bigger, Faster-Than-Expected QT, Multiple 50bps Hikes

Since March 16th’s FOMC Statement, and The Fed’s rate-hike, US equities have soared (giving some back in the last couple of days) and bonds have been battered…

Source: Bloomberg

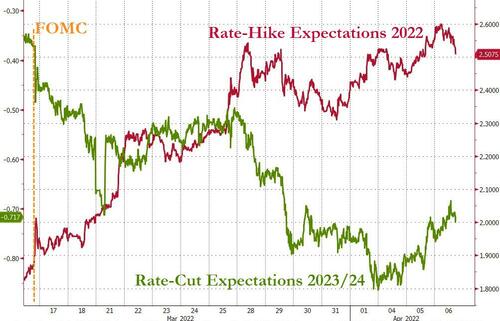

And thanks to the extreme level of hawkish jawboning, the market’s expectations for rate-hikes in 2022 have soared from 6 more to 9 more (with 82% odds of a 50bps hike in May)… and at the same time, rate-cut expectations for 2023/24 have soared from just over 1 cut to more than 3…

Source: Bloomberg

And the yield curve has collapsed (with 2s10s swinging into inversion and back out – the latter the real signal for an imminent recession)…

Source: Bloomberg

The big thing everyone is watching for in today’s Minutes is just how aggressive the balance-sheet reduction is going to be after Brainard’s comments suggested far faster-and-furiouser a contraction than anyone hoped for (an active ‘sell-down’ vs passive ‘run off’) because Powell specifically said at his Q&A that he is “sure there’ll be a more detailed discussion of our [B/S reduction] in the minutes.”

The Minutes were more hawkish than expected ($60-90 billion per month expected):

-

*FOMC: $95 BLN/MONTH CAP FOR ASSET RUNOFF LIKELY APPROPRIATE

-

*FOMC SUPPORTS $35 BILLION A MONTH ROLLOFF CAP FOR MBS

-

*FOMC SUPPORTS $60 BILLION A MONTH ROLLOFF CAP FOR TREASURIES

-

-

*FOMC BACKS ROLLOFF-CAP PHASE-IN OF 3 MONTHS OR MODESTLY LONGER

-

*MANY FED OFFICIALS SAY 1 OR MORE 50-BPS HIKES MAY BE WARRANTED

Developing…

* * *

Read the full Minutes below:

Tyler Durden

Wed, 04/06/2022 – 14:04

via ZeroHedge News https://ift.tt/gvq6Eph Tyler Durden