Chinese EV Manufacturers Grapple With Rising Raw Material Costs, Shrinking Margins

Chinese EV manufacturers are facing similar problems as the ones we pointed out that Japanese manufacturers are facing: rising raw material costs and shrinking margins.

Many EV manufacturers are doing the only thing they can to help alleviate the pressure – and that means raising prices for consumers.

Bloomberg noted in a Monday morning wrap up that the problems China faces are slightly more unique to the country, because it is also trying to engineer a “soft landing” from EV subsidies, which Beijing has been rolling back – and will continue to roll back.

“What makes China unique is its commitment to simultaneously rolling back EV subsidies, setting up a delicate balance between growth and profit in the world’s biggest market for clean cars,” Bloomberg wrote.

Companies like Tesla, BYD, Xpeng and Li Auto all hiked prices in March, the report says. Among the manufacturers raising prices was also Contemporary Amperex Technology, the world’s biggest EV battery maker. They said they were making “dynamic adjustments to the prices of some of our battery products”.

Remember, we just wrote days ago that Japanese automakers were also grappling with the skyrocketing cost of raw materials and a shortage of semiconductors still.

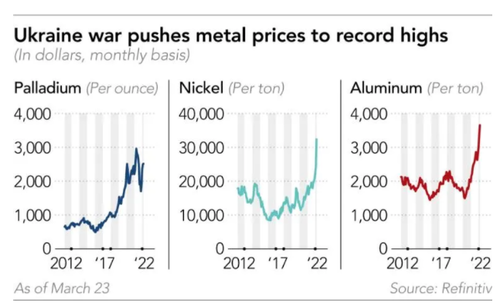

Even as some parts have become unavailable, raw materials for other parts have skyrocketed in price. For example, palladium, nickel and aluminum have all surged to record highs this month. The metals are used in automobile catalytic converters, batteries and other car parts.

The price hikes are likely due to the fact that 40% of palladium production comes from Russia, Nikkei noted last week. This has forced auto manufacturers to abandon buying from Russia and seek out alternative sources.

Hiroo Suzaki, president of South African metal producer Impala Platinum Japan, commented: “Losing Russian supply would leave a significant impact on the palladium market.”

Some demand for palladium will eventually wane due to the adoption of electric vehicles, Mikio Fujita, senior market analyst for Johnson Matthey, said. But for now, that doesn’t help automakers. Fujita commented: “As the auto industry shifts to electric vehicles, catalyst demand is expected to gradually shrink in the long run.”

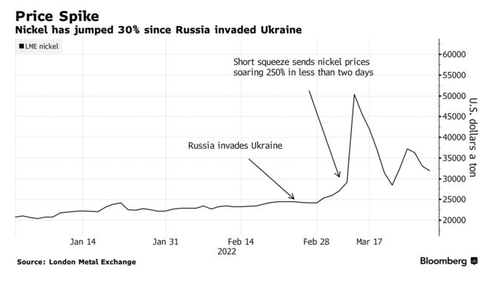

Nickel, on the other hand, is expected to see a significant increase in demand thanks to the adoption of EVs. “This has led to an even tighter market and premiums are soaring to record high levels in Europe,” one trader told Nikkei.

Recall, Tesla reportedly signed a “secret deal” to obtain nickel from Vale that is helping it sidestep a spike in prices.

Gene Munster of Loup Ventures said: “What Tesla has done with nickel is a hidden competitive advantage. Tesla continues to be a couple of steps ahead of the rest.” And Munster is right, in that Musk has “repeatedly” flagged nickel as a concern for the company amidst broader sector demand that is expected to more than triple by 2030.

On an earnings call two years ago, CEO Elon Musk urged: “Please mine more nickel. Tesla will give you a giant contract for a long period of time if you mine nickel efficiently and in an environmentally sensitive way.”

Meanwhile, other EV manufacturers are left scrambling. “The nickel price surge and the implications from the Russia-Ukraine invasion are likely to push battery manufacturers, particularly in the U.S., to secure alternate supply chains,” Bloomberg wrote.

Tesla’s “secret deal” is one of many it has put in place over the last year, the report says.

Tyler Durden

Wed, 04/06/2022 – 23:20

via ZeroHedge News https://ift.tt/MKniNJf Tyler Durden