Bonds Becoming A Texas Hedge For Stocks

By Simon White, Bloomberg Markets Live commentator and reporter

Recent days have seen a phenomenon anathema to asset managers — stocks and bonds both falling together. Unfortunately, this is something we’ll have to get more used to.

The most recent bond-and-stock flop was prompted by Fed Governor Lael Brainard’s hawkish comments on Tuesday, but it is something becoming increasingly common. Over 20% of days over the last year saw lower stocks and lower bonds, with this percentage rising quickly since the pandemic.

Sure, the percentage of days where both stocks and bonds have both gone up has also increased, but not to the same extent and, anyway, asset managers don’t lose much sleep when their holdings rise. The negative correlation between stocks and bonds that is a built-in axiom to the asset-management industry and the cornerstone of 60/40 portfolio construction is a historical anomaly. Only about 30% of the last 100 years has had a negative stock-bond correlation, with the bulk of that period occurring since the millennium.

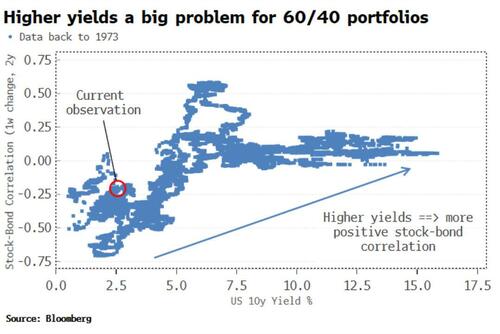

Rising inflation and concomitantly rising yields are pushing the stock-bond correlation higher. Currently, it sits at about zero, but looking historically we can see that higher yields are generally consistent with a continued rise in the correlation.

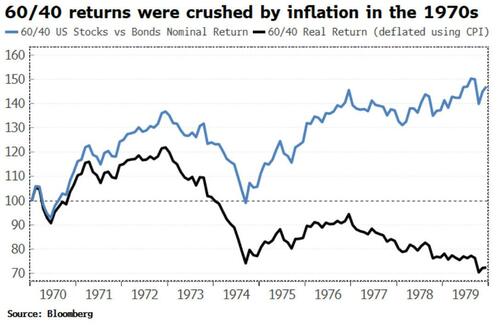

This makes life difficult for holders of portfolios with stocks hedged with bonds. That was certainly the case in the high-inflation 1970s. While a portfolio of 60/40 stocks and bonds apparently did well, nominal variables become misleading in high-inflation periods and everything needs to be viewed in real terms. A 60/40 portfolio made almost 50% in the 1970s in nominal terms, but in real terms it actually lost almost 30%!

With bonds increasingly becoming a Texas Hedge, what are holders of 60/40-like portfolios to do?

Well, there are no great alternatives to government bonds as a hedge for stocks. Corporate bonds have an even greater correlation to stocks than government debt, so they are not particularly suitable. Commodities’ correlation with equities has fallen, but as a market it has considerably less depth and size than sovereign debt. Gold has a similar problem. Buying downside protection on stocks helps, but this does not provide a smooth return profile.

Which leads asset managers back to TINA – There Is No Alternative – loading up on more equities and hoping for the best. It is not destined to end well.

Tyler Durden

Thu, 04/07/2022 – 12:12

via ZeroHedge News https://ift.tt/Kc1tviB Tyler Durden