Shocking US Consumer Credit Numbers: Savings Long Gone As Credit Card Debt Soars

While it is traditionally viewed as a B-grade indicator, the February consumer credit report from the Federal Reserve was an absolute stunner and confirmed what we have been saying for month: any excess savings accumulated by the US middle class are long gone, and in their place Americans have unleashed a credit-card fueled spending spree.

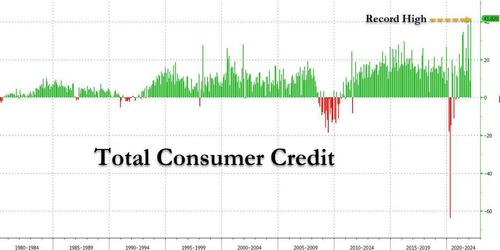

Here are the shocking numbers: in November, consumer credit exploded by a whopping $41.8 billion, more than double the expected $18.1 billion print, nearly five times more than the upward revised $8.9 billion January number (revised from $6.8 billion), and the highest on record!

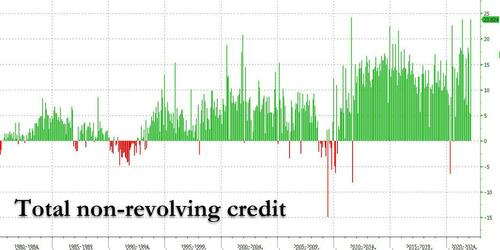

And while non-revolving credit (student and car loans) surged by a near record 23.8 billion, the third highest on record…

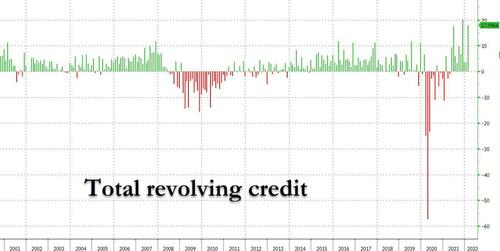

… the real stunner was revolving, or credit card debt, which soared nearly six-fold February to $18 billion from $3.1 billion in January, the second highest print on record.

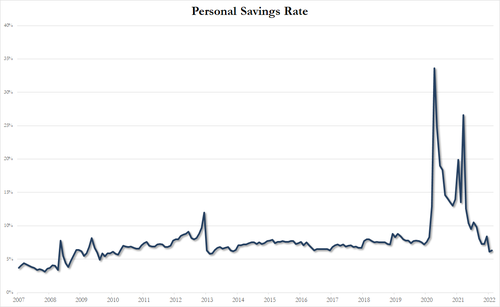

While this unprecedented rush to buy everything on credit at a time when there were no notable Hallmark holidays should not come as much of a surprise, after all we have repeatedly shown that for the middle class any “excess savings” are now gone, long gone…

… the fact is that most economists – such as those at Goldman Sachs – had previously anticipated that continued spending of savings by consumers (who they fail to realize are now tapped out) is what will keep the US economy levitating in 2022. Unfortunately, as today’s consumer credit numbers clearly demonstrate, any savings that US middle class households may have stored away courtesy of stimmies, are now gone. The implications are profound: any model that projected that US spending will be fueled by “savings” can now be trashed. And since this is most of them, the consequences are dire as they confirm – once again – that the Fed is tapering, QTing and hiking right into a recession, which according to Deutsche Bank will begin in late 2023 and which according to Morgan Stanley can start in as little as 5 months. Today’s data suggests that Morgan Stanley is right…

Tyler Durden

Thu, 04/07/2022 – 15:21

via ZeroHedge News https://ift.tt/l6fuLvg Tyler Durden