Stocks & Oil Dump-n-Pump As Yield Curve Un-Inverts

Stocks all bounced off technical levels intraday after an ugly start. Small Caps were unable to join the rest of their peers in the BTFD rebound into the green as a late day puke almost spoiled the party for everyone though…

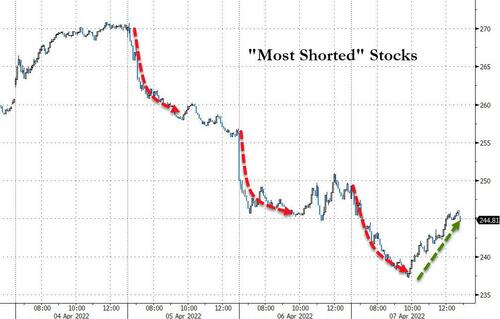

What is it about 1300ET that the trend in shorts stalls or reverses?

Never gets old sorry…

S&P bounced back above its 200DMA and Dow/Nasdaq bounced off their 50DMAs…

Treasury yields were broadly higher today with the long-end underperforming (3Y unch, 30Y +6bps), leaving 2Y flat on the week and 10Y lagging with a 27bps increase…

Source: Bloomberg

Real rates continues to surge to cycle highs…

Source: Bloomberg

2s10s, 2s30s, 3s10s, and 5s30s all steepened today, uninverting intraday (which as a reminder is the actual trigger for the starting gun timer to recession…. as opposed to the actual inversion)….

Source: Bloomberg

Multiple factors steepened the yield curve today.

-

There have been big profits on selling the short-end and on Treasury curve flatteners. This has forced some short-covering.

-

Wednesday’s FOMC minutes brought forward the May 4 Fed meeting by a month and the discussions on the balance sheet were very detailed – taking almost all the mystery out of the event.

-

The aggressive runoff story is pressing the street to keep some risk premia in 2s10s and 5s30s, traders say.

-

The Fed has the yield curve in mind. Today, St Louis Fed James Bullard, a voter and the most hawkish Fed member said the Fed needs to hike 300 bps but also to watch yield curve inversion.

The short-end appears set on 9 more rate-hikes this year (but the last few days have seen the subsequent rate-cut trajectory actually reduced)…

Source: Bloomberg

The dollar extended its recent gains, hovering at the spike highs from March 16th’s FOMC day…

Source: Bloomberg

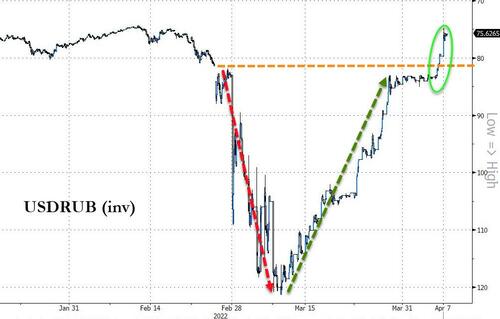

The Ruble continued to surge higher against the greenback, now at its highest in two months…

Source: Bloomberg

Bitcoin slipped lower today but found support at $43,000…

Source: Bloomberg

Gold rallied on the day…

Oil prices tumbled along with stocks early on, but also like stocks they rebounded hard (though WTI remains below $100)…

Finally, the good news-ish, is that this new lower oil price will bring down gas prices at the pump (if it holds) but only to around the level it was at when Putin invaded Ukraine…

Source: Bloomberg

So what will Biden blame the still-high gas prices on then?

Tyler Durden

Thu, 04/07/2022 – 16:00

via ZeroHedge News https://ift.tt/4SEGXyP Tyler Durden