It Is “Just A Matter Of Time” Before Gold Rises 5x Or More: Lawrence Lepard

Submitted by QTR’s Fringe Finance

Friend of Fringe Finance Lawrence Lepard released his most recent investor letter a few days ago with his updated take on the seismic changes occurring in monetary policy globally as a result of the Russia/Ukraine conflict.

He takes us through history as to how this landscape has changed in the past, and what could be coming in years ahead.

Larry had joined me for several interviews last year and I believe him to truly be one of the muted voices that the investing community would be better off for considering. He’s the type of voice that gets little coverage in the mainstream media, which, in my opinion, makes him someone worth listening to twice as closely.

Larry was kind enough to allow me to share his most recent thoughts. Part 1 is below, where he lays out his case for massive upside in gold, and Part 2 will be published later this week.

Reviewing the history and structure of the world monetary system is instructive given recent political developments with the kinetic war launched by Russia in the Ukraine. It can help us as we try to determine what happens next (Many of you know this, but allow us to review).

Bretton Woods I: 1944-1960s Period

Toward the end of World War II, in July 19441, the leaders of the free world convened a monetary conference in Bretton Woods, NH to establish the rules for a post war monetary system. This is now referred to as Bretton Woods I.

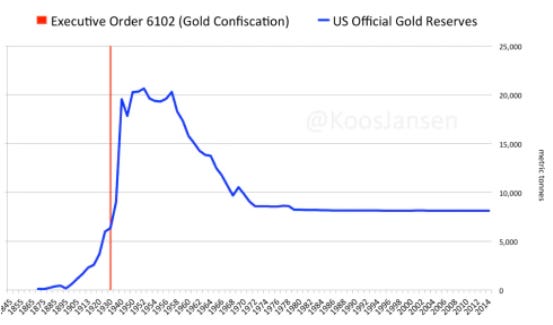

At this conference, the US Dollar was made the international reserve currency for the world financial system. The dollar would be backed by gold and could be exchanged for bullion at the price of $35 per ounce. (US citizens did not have that exchange privilege due to Roosevelt’s 1933 Executive Order 6102, which made it illegal for US citizens to own gold; this was repealed in 1975).

All other foreign currencies would be pegged to the dollar at fixed exchange rates.

The exchangeability of dollars for gold was credible because the US had 650,000 ounces (20.5 metric tonnes) of gold on deposit. In the early post war period, this arrangement worked fairly well, and the dollar was further supported because the US was the leading industrial nation; Japan and Germany’s economies had been devastated by the war.

From 1946-1957, US economic growth was solid, and the US Federal government was generally fiscally responsible and ran budget surpluses in 6 of those 11 years. Deficit years contained small deficits and only the Korean conflict spiked the annual deficit in 1953. Inflation was present in the late 1940’s and 1950’s, but the Fed kept interest rates in check through financial repression (yield curve control). The US dominated the world militarily. US economic growth was robust as returning GI’s started families, bought houses and cars.

The US was a net exporter with a positive balance of trade. There was a high level of trust in the dollar and its exchangeability for gold was a backstop.

1960s: Deficits Drive a “Run on Gold” and the Ultimate Failure of the London Gold Pool

However, the pot started to boil in the 1960’s with the US entering the Vietnam War, along with President Johnson’s “Great Society” social programs (welfare, Medicare, Medicaid). This spending was called “Guns and Butter” at the time and led to significant US Fiscal deficits.

The net result of these deficits, and the monetization (money printing) employed to finance them, was that foreign creditors began to doubt the value of the dollar as measured in gold terms. Thus, many of those creditors began to take the US up on its offer to exchange dollars for gold.

As you can see in the chart below, the trend of foreigners exchanging dollars for US gold bullion began in 1959 when the US ran a fiscal budget deficit of $13 billion (at the time considered very large). Those deficits persisted and grew throughout the 1960’s, and so did the outflow of US Treasury gold.

The leader in the repatriation effort was France, and its President Charles de Gaulle, who was advised by economist Jacques Reuff.

Reuff pointed out that the US Dollar, as the world’s reserve currency, enjoyed an “exorbitant privilege” where foreigners see themselves supporting American living standards. As American economist Barry Eichengreen summarized:

“It costs only a few cents for the Bureau of Engraving and Printing to produce a $100 bill, but other countries had to pony up $100 of actual goods in order to obtain one.”

This was the first instance of the world recognizing that the US Dollar as the world’s reserve currency allowed Americans to live better at the expense of the rest of the world – but it would not be the last.

As the chart above shows, the run on US gold that began in 1959 accelerated throughout the 1960’s. The US deficits from the Vietnam war grew larger, culminating in a US fiscal deficit of $25 billion in 1968 (again – deemed to be a very large deficit at that time), a figure that had not been exceeded since WW II.

(This post is free but if you have the means and would like to support my work, I’d love to have you as a subscriber by clicking here).

In fact, the free market price of gold in London was trading above the official $35 reference price. Investors realized that the US fiscal position was untenable, and foreigners who could legally buy gold were turning their dollars in for gold – well above $35 per ounce for delivery in London. Countries were also taking delivery of gold directly from the US treasury in exchange for the dollars that they had earned in trade.

This was now an accelerating bank run on gold. To mitigate this problem, in the 1960s a group of Central Banks formed the London Gold Pool in an effort to keep the free-market gold price close to the Bretton Woods reference price of $35.

These Central Bankers manipulated the price of gold through strategic selling, and threats of selling of paper gold. However, the run on gold situation in the 1960s ratcheted up in 1967. Overwhelmed by the demand for physical gold, the British were forced to devalue the Pound Sterling by 14% and gold was trading at $50 per ounce.

One by one and led by France, the Central Banks exited the London Gold Pool following 1967 and it failed.

1970s: Nixon Closes Gold Window, Given the Run on Gold

Failure of the London Gold Pool’s manipulation only buoyed physical demand for gold, as all recognized that gold is the ultimate form of scarce and sound money.

The US gold reserves were being drained at a very rapid rate; there was massive pressure on the dollar. On August 15, 1971, President Nixon (who had no interest in, or ability to, contain the war spending) “temporarily” closed the US gold window to thwart the “evil international speculators”.

Consequently, without the promised gold exchangeability, the US government had effectively defaulted on its foreign creditors. We were bankrupt, and confidence in the dollar was fading fast. The impact of the US abandoning the international convertibility of the dollar into gold did not take long to stimulate the price of gold.

The US Treasury Secretary, John Connally, went to the G-10 meetings in Rome in late 1971, after the default, and brazenly said “the dollar is our currency, but it is your problem”.

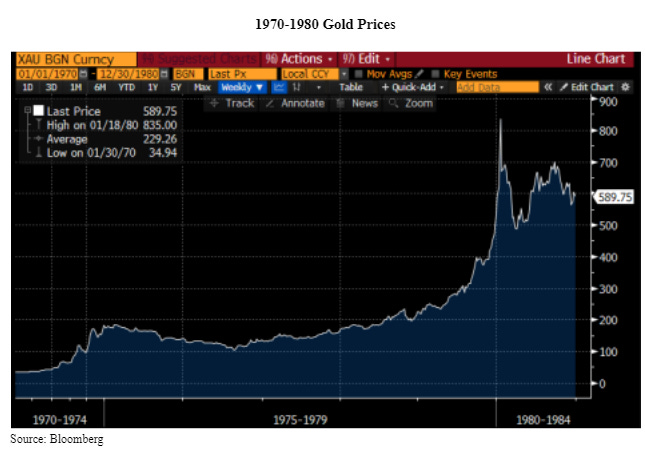

The sentiment was not lost on the other participants and the gold price responded accordingly:

Paper Gold Suppression

What is instructive about this history of gold price suppression is that the London Gold Pool tried to manipulate the gold price from 1962 to 1968, somewhat successfully, but ultimately physical gold demand overwhelmed the manipulation scheme and it failed.

Over the past 20 years, there is substantial evidence that a similar manipulation scheme has been used by Central Banks, the Bank of International Settlements (BIS) and the Fed, whereby they “sell” paper gold contracts to keep gold prices down.

Gold is the only commodity market where there are large, unallocated paper derivatives which many in the Gold community believe have been used to suppress and contain its price. The evidence for this is overwhelming and buried in many places. Suffice it to say, many analysts believe that there are between 20x, 50x and perhaps up to 1,000x paper claims on each physical ounce of gold in the world today.

In effect, the Central Banks, Sovereign Governments and London Bullion Market Association (LBMA) have run a fractional reserve gold market. This scheme will only stay intact if everyone who holds a paper claim on gold does not ask for actual physical delivery (i.e., another run on physical gold like the late 1960s).

Conversely, if all of the claims were presented and asked to provide physical ounces (e.g. think short squeezes in Gamestop in 2021, or more recently nickel) there would either be a Force Majeure (similar to what happened recently in nickel) or the gold price would rise to multiples of its current price to match supply with demand.

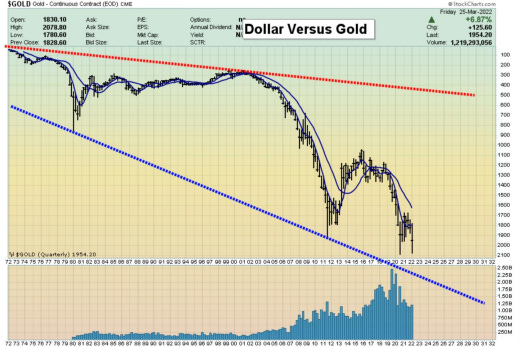

We believe that the gold price has been severely suppressed by Western Governments in order to mask the underlying inflation or dilution of value which has taken place in order to support fiat currencies, Keynesian economics, Western government social policies, and credit inflation. Even with this suppression, the price of gold has performed quite well over the long sweep of time since 1971. Note the chart below shows the decline in US Dollars priced in gold terms.

There are some interesting things in this chart above. First, you can see the effect of the raging inflation in the 1970’s (red line above) when gold went from $35 per ounce to $800 per ounce (inverted white line). Note that at $800 an ounce gold in 1980, the US Money Supply (M1) was nearly 55% backed by our gold reserves.

If the price of gold had been $1,459 in 1980, every dollar would have had 100% gold backing. So even though we were not legally on a gold standard the market had effectively taken us more than halfway there by 1983.

It is also interesting to see M1 money supply (green line above) and how much it has skyrocketed since the 2008 crisis and bank bailouts. It is interesting to consider these numbers in today’s terms which show how much the gold price has been artificially suppressed as a measure of monetary inflation. Today, in order to obtain the bare minimum (30% coverage) necessary to have the US Treasury reserves of gold backing the dollar, the price of gold would need to be $23,000 per ounce, and to get to the 1980 peak of 55%% coverage of M1, the price would be $42,000 per ounce vs. gold today at only $1,970 per ounce. Indeed, there has been quite a bit of monetary inflation in terms of gold!

As concerns our portfolio upside, we think it’s just a matter of time until we get that mid-late 1970s 5x+ gold price acceleration. The reason this has not shown up in the gold price is due to the suppression scheme which until recently was perfected by the Western Central banks and the Gold Cartel. Some Bitcoin enthusiasts like to say Bitcoin is going to steal all of gold’s monetary premium. Gold bugs laugh at this because there is not much premium in gold to steal. On average, gold costs about $1,200 per ounce to mine and the sales price of $1,970 barely compensates for the capital costs to build mines and replace reserves.

If gold were to trade at much higher prices, then perhaps there would be a monetary premium to steal.

(This post is free but if you have the means and would like to support my work, I’d love to have you as a subscriber by clicking here).

Part 2 of Larry’s letter, where he discusses Bretton Woods III and the state of monetary policy from 1980 onward will be published this week.

About Larry Lepard

Larry manages the EMA GARP Fund, a Boston based investment management firm. Their strategy is focused on providing “Monetary Debasement Insurance”. He has 38 years experience and an MBA from Harvard Business School. On Twitter he is @LawrenceLepard Managing Partner and, via email, he is llepard@ema2.com

Disclaimer: QTR is long various gold and silver miners and have both long and short exposure to the market through equities and derivatives. I have no position in Larry’s funds. Larry is a subscriber to Fringe Finance and has been on my podcast. The excerpts from Larry’s letter, above, shall not be construed as an offer to sell, or the solicitation of an offer to sell, any securities or services. Any such offering may only be made at the time a qualified investor receives from EMA formal materials describing an offering plus related subscription documentation. There is no guarantee the Fund’s investment strategy will be successful. Investing involves risk, and an investment in the Fund could lose money. The strategy is also subject to the following risks: Currency Risk, Non-US Investment Risks, Issuer Specific Risk.

Tyler Durden

Wed, 04/20/2022 – 10:15

via ZeroHedge News https://ift.tt/eutBrZa Tyler Durden