Tesla Earnings Preview: Autopilot Scrutiny, Raw Material Shortages, Shanghai Will All Be In Focus

As regulatory scrutiny grows around Autopilot, as Elon Musk continues to figure out a plan to try and buy Twitter, and as Wall Street watches Shanghai closely, Tesla is set to report earnings after the bell today.

Analysts are expecting a revenue increase of 142% from a year ago and, as Barron’s noted, “the company compiled consensus calls for earnings per share of $2.30 from $18.1 billion in sales. That compares with earnings of $2.54 a share and sales of $17.7 billion in the fourth quarter of 2021.”

Automotive gross profits margins are expected to be about 27.7% and regulatory credit sales are expected to be about $312 million. Operating profit is estimated to be $2.6 billion.

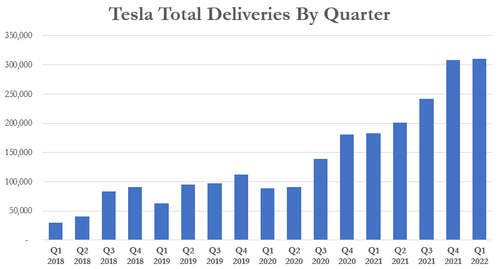

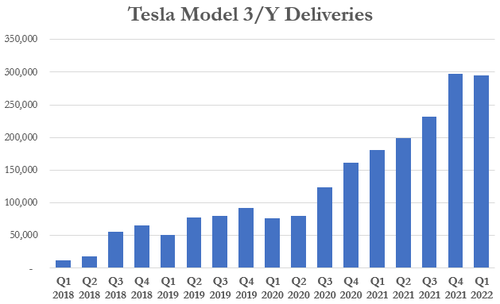

Recall, for Q1 2022 the company reported earlier this month a record 310,048 deliveries. The results slightly exceeded expectations, which stood at an average of 309,158 deliveries. Tesla said the record was “despite ongoing supply chain challenges and factory shutdowns”.

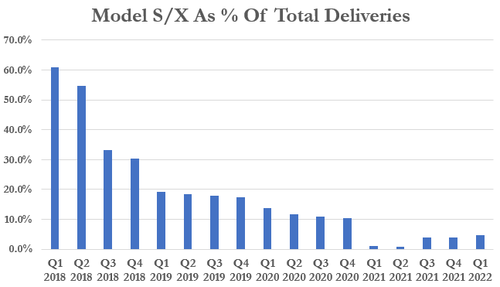

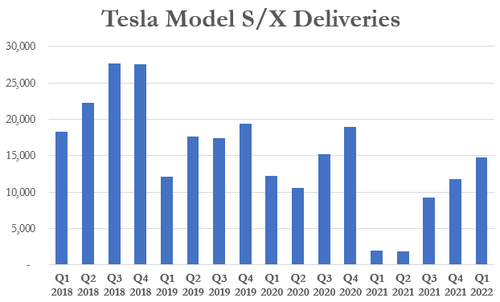

The share of Model S/X of total global vehicles continued to wane at 14,724 deliveries for the quarter. This represented 4.7% of all total deliveries.

Model 3 deliveries dropped slightly from the prior quarter, as Model S/X took up slightly more of the company’s total deliveries.

For 2021, the automaker delivered “over 936,000” vehicles. Those numbers were up about 87% from the year prior, according to Bloomberg. The report also reminded that Tesla has said “repeatedly it expects 50% annual increases in deliveries over a multi-year period”.

For Q1 2022 – that was not yet the case. Deliveries were up less than 50% from Q1 2021’s total of 182,780.

Shanghai

Investors are definitely going to want clarity coming out Shanghai. Tesla resumed production at its Shanghai plant on Tuesday, according to local China media reports and Reuters.

The company’s factory had been shut down for about three weeks as a result of the ongoing Covid lockdowns in China. We also reported that the company was “sputtering” to re-open and dealing with supply chain issues that were holding it up.

“To prepare for the restart, Tesla has recalled workers to its Shanghai plant where they will need to live on site, in line with China’s ‘closed loop management’ process,” two sources told Reuters this week.

Dan Ives, tech analyst with Wedbush Securities, told CNN: “The main focus of the earnings call must be around supply coming out of China. That’s the biggest overhang for the stock right now. They’ve already lost about 50,000 cars of production so far in the second quarter. The question is are they going to give any guidance?”

Tesla had been preparing to re-open Monday but was forced to push its restart back by a day due “to logistic problems with its supplier”. We also noted yesterday that competitor Volkswagen has reportedly restarted production in China. General Motors is also considering plans for re-opening this week.

At the same time as this re-open, China continues to extend its lockdowns across parts of the country creating not only chaos domestically, but another coming shock to the supply chain for countries like the U.S., who are highly reliant on importing Chinese goods.

Raw Materials Challenges

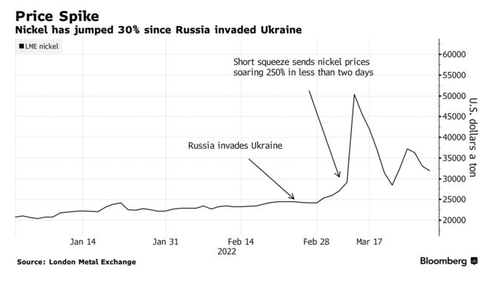

Like everyone in the EV world, Tesla is facing challenges in procuring raw materials necessary for battery production. We noted a couple weeks ago that Tesla had secured a “secret deal” that helped it sidestep rising nickel prices.

Bloomberg reported last month that a multiyear supply deal for nickel has been in place and covers nickel from Canada. “Unlike most of its peer automakers, Tesla has spent years focusing on how to secure its own nickel supplies,” the report says.

Gene Munster of Loup Ventures said: “What Tesla has done with nickel is a hidden competitive advantage. Tesla continues to be a couple of steps ahead of the rest.”

And Munster is right, in that Musk has “repeatedly” flagged nickel as a concern for the company amidst broader sector demand that is expected to more than triple by 2030.

On an earnings call two years ago, CEO Elon Musk urged: “Please mine more nickel. Tesla will give you a giant contract for a long period of time if you mine nickel efficiently and in an environmentally sensitive way.”

We noted last week that Chinese and Japanese EV manufacturers have both been grappling with rising costs. Many EV manufacturers are doing the only thing they can to help alleviate the pressure – and that means raising prices for consumers.

“What makes China unique is its commitment to simultaneously rolling back EV subsidies, setting up a delicate balance between growth and profit in the world’s biggest market for clean cars,” Bloomberg wrote.

Companies like Tesla, BYD, Xpeng and Li Auto all hiked prices in March. Among the manufacturers raising prices was also Contemporary Amperex Technology, the world’s biggest EV battery maker. They said they were making “dynamic adjustments to the prices of some of our battery products”. Remember, we just wrote days ago that Japanese automakers were also grappling with the skyrocketing cost of raw materials and a shortage of semiconductors still.

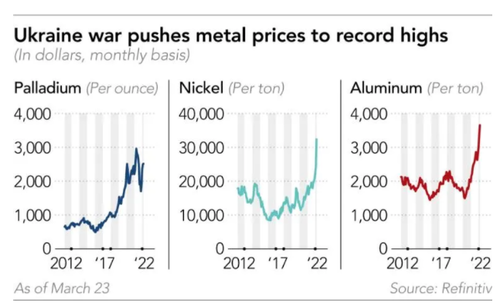

Even as some parts have become unavailable, raw materials for other parts have skyrocketed in price. For example, palladium, nickel and aluminum have all surged to record highs this month. The metals are used in automobile catalytic converters, batteries and other car parts.

The price hikes are likely due to the fact that 40% of palladium production comes from Russia, Nikkei noted last week. This has forced auto manufacturers to abandon buying from Russia and seek out alternative sources.

Hiroo Suzaki, president of South African metal producer Impala Platinum Japan, commented: “Losing Russian supply would leave a significant impact on the palladium market.”

Recall, Rivian Chief Executive RJ Scaringe warned this week of an even bigger crunch. He told the WSJ: “Put very simply, all the world’s cell production combined represents well under 10% of what we will need in 10 years.”

He continued: “Meaning, 90% to 95% of the supply chain does not exist.”

Regulatory Scrutiny

We also reported this week that regulatory scrutiny on Autopilot was increasing. Investors will be keeping an ear out for any company comment regarding developments with regulators.

Regulators have, for one reason or another, appeared to take a new keen interest in Tesla’s Autopilot system, according to multiple new reports, including one by Automotive News. Regulators are now “applying greater scrutiny to Autopilot than ever before”, the report says.

Autopilot has also been referenced as a “disaster waiting to happen” by Bloomberg. The outlet says that regulatory scrutiny around the feature is intensifying and that a “potential crackdown” could be looming.

In fact, the NHTSA is now working on two formal defect investigations that may cause Tesla to “have to retrofit cars and restrict use of Autopilot in situations it still can’t safely handle”. Recall, Tesla has issued a litany of recalls over the last 6 months.

Tesla just recalled 127,785 vehicles in China for possible inverter failures in April. It was reported that 34,207 imported and 93,578 China-made vehicles were being recalled. Meanwhile, more than one million Teslas had been recalled in the months prior.

- Tesla Recalls More Than 475,000 US Vehicles Due To Quality Issues

- Tesla Recalls Tens Of Thousands Of Vehicles On “Rolling Stop” Function, NHTSA Says

- Tesla Recalls More Than 800,000 Vehicles Over Seat Belt Chime Malfunction

Now Automotive News questions whether a clampdown on Autopilot could be on its way. The report writes that such a regulatory move “could tarnish Tesla’s reputation with consumers and spook investors whose belief in the company’s self-driving bona fides have helped make Tesla CEO Elon Musk the world’s wealthiest person.”

Cybertruck

Investors will also be looking for clarity on where the Cybertruck will be produced and when. They will want to know how quickly Tesla will be producing from its new factory in Austin and when the Cybertruck is coming, especially since Ford has made significant progress with its F-150 Lightning.

Will Musk Be On The Call?

Additionally, analysts and investors will be waiting to see whether or not Musk himself attends the company’s conference call. About a year ago, he told investors he would be less involved on company earnings calls and, with Musk dominating news headlines the past week, it’ll be interesting to see if Musk winds up making comments and fielding questions.

“From a perception standpoint, if he’s not on the call, it feeds into the thesis that he’s too busy with Twitter,” Ives said.

Tyler Durden

Wed, 04/20/2022 – 14:50

via ZeroHedge News https://ift.tt/9FvlX4k Tyler Durden