“I’m So Bearish, And Even I’m Miserable”: One Bank’s Clients Crack… Yet The Real Selling Is Only Just Starting

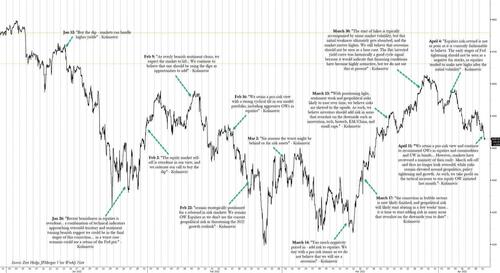

It is hardly a secret that over the past two years, JPMorgan’s Marko Kolanovic, who previously provided extensive original and insightful market analysis and commentary, has become synonymous the market’s permabullish, cleerleading “ying”, and is why after his latest weekly appeal to JPM retail clients to buy the dip (unlike the institutional clients who get a decidedly more balanced and skeptical assessment from the bank’s flow desk)…

… without prejudice, and in fact to buy both “growth and value” stocks, we said that this “should be the clearest signal that one should take chips off the table and go short.” And judging by the market’s Friday “trapdoor” performance, we were right.

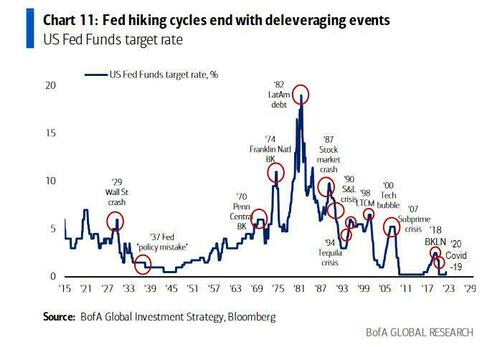

But while Marko’s recent “market value added” is all about getting faded, the same can not be said to the Croatian’s bearish nemesis, Bank of America’s Chief Investment Strategist Michael Hartnett, whose latest note was a chilling reminder of our favorite market maxim, namely that every Fed hiking cycle ends in crisis, or as Hartnett put it, “with default and bankruptcy of government, banks and investors.”

And since we now live in a time when hedge funds are selling every rip and deleveraging aggressively as even the Fed itself is pushing investors to sell – because somehow that will slow supply-driven inflation – Hartnett has something new and exciting to discuss every week, and in his latest Flow Show note, titled ominously enough “The Metacurse & the Charge of the Hike Brigade” (and available to all professional subscribers in the usual place), he talks about – you guessed it – the collapse of social media ETFs and the stunning hawkish reversal among central banks, which not only Hartnett but many other strategist are now convinced, will lead to the next market crisis (especially with the BOJ on the other end of the hawk-dove spectrum and China moving ever closer to a massive stimulus).

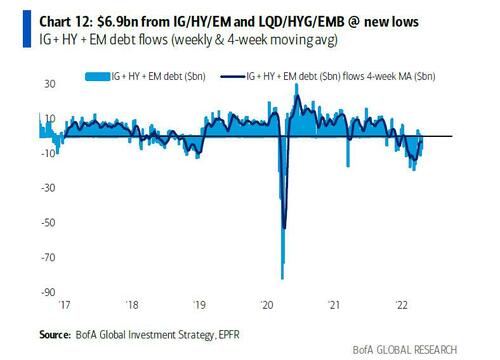

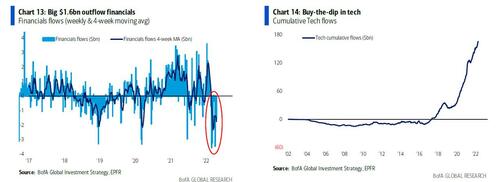

Hartett as usual starts with his usual market “flows to know” assessments, which last week saw the largest equity outflow in 2022 at $17.5BN, and with another $8.7 billion in outflows from bonds and a whopping $55.4 billion from cash/money markets, investors only allocated a paltry $0.9BN to gold. Expect much more capital going to the yellow metal. Here are some other notable flows:

- $6.9bn from IG/HY/EM (note LQD/HYG/EMB @ new lows)

- largest outflow US large cap since Feb’18 ($19.6bn);

- 10th straight week outflow from Europe ($2.9bn);

- big $1.6bn outflow financials;

- buy-the-dip in tech (8th week of outflows)

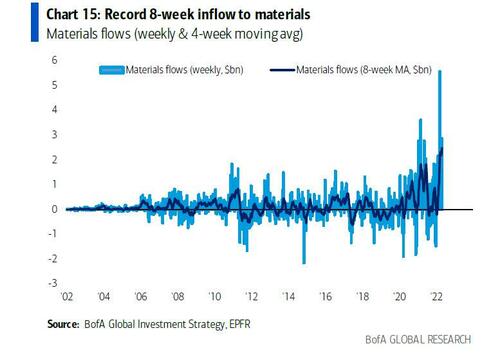

Record 8-week inflow to materials, just as China starts devaluing.

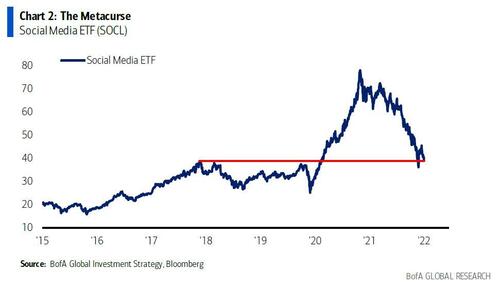

Here, a bit of a challenge emerges – with everyone knowing that the Fed’s aggressive tightening means that a crisis is now only a matter of when not if, the question is what catalysts to look for to decide if the crisis has officially begun. Well, according to Hartnett, one place to look at is the ongoing (and soon to get much worse) implosion in tech stocks in general, and social media in particular, something the BofA strategist calls “the Metacurse.“

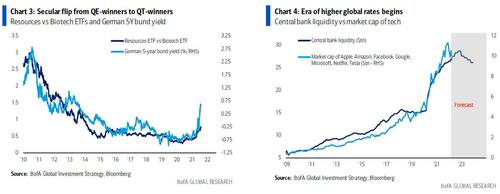

Warning that in a world of extreme inflation the rates shock is only just beginning (indeed, as Friday’s dismal action showed, “75bps is the new 25bps”) Hartnett sees an acceleration in the secular flip from QE-winners to QT-winners which is already well-underway – see natural resources vs biotech…

… as the era of higher global rates begins; Indeed the every stronger “rates shock” = tech trauma, which means that social media stocks are now back at spring 2018 levels!

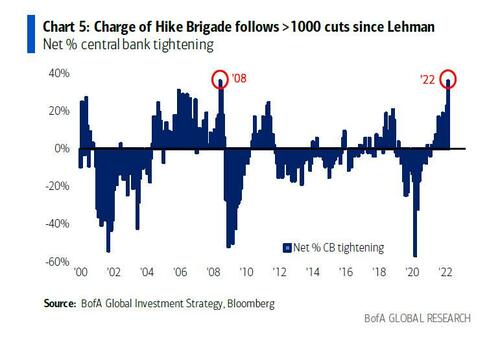

The biggest culprit behind the tech collapse are the same entities that enabled the biggest bubble in history (and which they are all trying to pop in a way that does not spark a “hard landing”). Calling it the “charge of the Hike Brigade”, Hartnett shows no less than 75 global rate hikes YTD – the highest net % central banks hiking since 2008…

… and says that “the era of higher volatility has begun” which of course is another word for lots more pain: the reason – the “hawkish” central banks have a lot of catching up to do – the “Charge of Hike Brigade” follows >1000 cuts since Lehman and $23tn of QE; asset, housing, consumer, commodity, consumer inflation of 2022 demands that coming Quantitative Tightening is draconian.

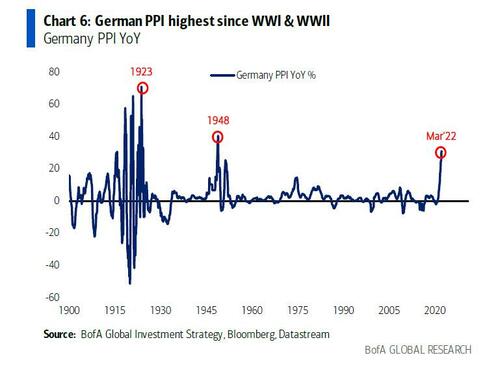

Of course, much more hiking is coming in no small part due to soaring prices as a result of the Ukraine war. Referencing the Weimar hyperinflation, Hartnett says that “Russia-Ukraine is 488th European military conflict of past 2000 years” yet it was more than sufficient to push German PPI up 30.9% YoY, the highest since 1923 (aftermath WW1) & 1948 (aftermath WW2). Of course, back then rates were higher… much higher: according to Hartnett, double “peak inflation” rates of 1974 when Bundesbank deposit rate was 7%, which is why the BofA strategist says that “ECB repo rate won’t remain -0.5% for long.” The problem is the crash that will follow the ECB’s rate hike but we’ll cross that bridge in time.

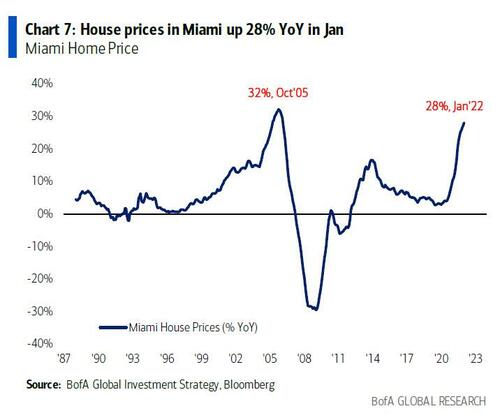

Then again, we didn’t really need Putin to send prices into overdrive – the Fed was already doing a bang up job on its own, having stocks the second massive housing bubble in under two decades. As the next chart shows, house prices in Miami were up 28% YoY in Jan, which Miami rents have shot up 58% past 2 years.

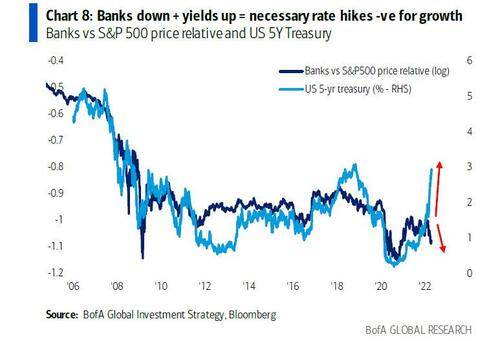

And with US house prices up 19% YoY, strong US housing activity in Q1 (the lead indicator for US consumer), and continued strong US labor market (the lagging indicator), the Fed’s and market’s zeitgeist has shifted from Fed 25/50bps to 50/75bps each meeting. It’s why both homebuiilders -25% & banks are down, while yields are up, a combination which hints necessary rate hikes won’t be positive for growth.

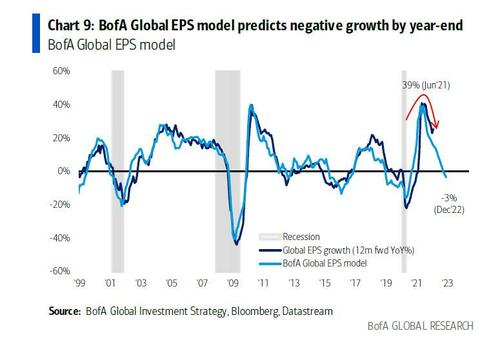

And while the economy will slow down (initially), then slide into a recessionary abyss (with the traditional lag), the earnings picture is already imploding and BofA’s Global EPS Model predicts deceleration in global EPS growth from 21% into negative territory by year-end driven by PMI’s, Asian exports, China FCI and the US yield curve model.

The silver lining: the recent resilience of Asian exports & global PMIs mean more moderate deceleration in EPS growth next 6 months.

* * *

Going back to central banks and the mass tightening, recall that as we noted on Friday, a major divergence has emerged: while most western central banks can’t hike fast enough, the BoJ is the last central bank left fighting the last war. As Hartnett notes, “BoJ Kuroda continues to vow unlimited bond buying in order to achieve…what exactl|: since BoJ introduced Yield Curve Control in 2016 Japan GDP growth has been 0.0%, CPI 0.2%; it’s always the unintended consequences that are the most consequential.” Albert Edwards had much more to say on the divergence in policies between the Fed and BOJ and we will address that in a latter post.

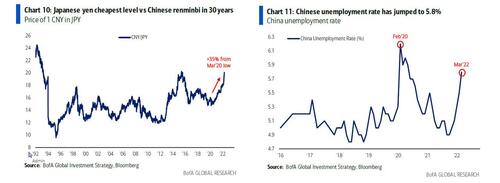

In any case, with the BOJ actively devaluting the local currewncy, the Japanese yen has been devalued to cheapest level vs Chinese renminbi in almost 30 years (Chart 10); Meanwhile, already suffering the consequences of a strong currency and a major slowdown, China’s new orders are contracting, retail sales are down 3.5% YoY, and most ominously of all, the Chinese unemployment rate has jumped to 5.8% (Chart 11), largely due to the latest shutdown rounds.

More importantly, as we also discussed on Friday, China is now responding to weak Japanese yen & Korean won via currency weakness, which in turn will lead to even more yen and won weakness, and so on. Looking ahead, Hartnett writes that the growing “FX war in Asia” could see super-spike in US dollar and signal temporary break in commodity fever (overbought, overloved).

Too much bearishness to process in one sitting? Well, that’s Harnett for you, but it’s also why as he wraps up his latest weekly thought, the Heard on the Street line this week is: “I’m so bearish, and even I’m miserable.”

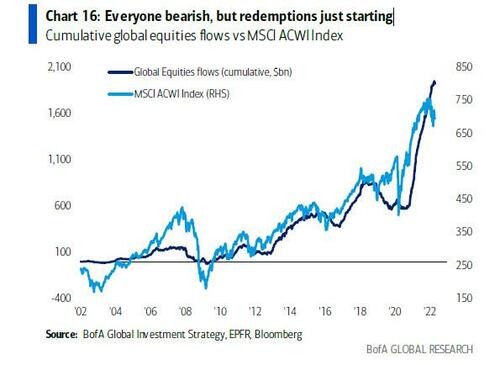

But just wait until the real selling begins: as Hartnett wraps up echoing what we pointed out was the biggest paradox in the latest Fund Manager Survey in which everyone was bullish, yet where virtually nobody wanted to sell stocks, the Bank of America Private Wealth Clients (i.e., Ultra high net worth) have $3.2 trillion in AUM of which 64.5% in stocks (well above the 55.7% average since ’05), 16.9% bonds, and 11.6% cash.

Still, as noted above, last week saw that biggest cash outflow since Sep’20. Stocks are next, and as Hartnett concludes, “Everyone bearish, but redemptions just starting.” Indeed, paradoxically since Nov 2021 Nasdaq peak inflows to stocks in 16 of 20 weeks ($229bn), private clients bought stocks 17/20 weeks. The selling has only now begun.

One final observation from Hartnett has to do with how to trade bear markets, because no matter how much Marko Kolanovic says the opposite, we are in one now:

- Trading bear markets: bear sentiment, waning war fear (see Russian ruble), inflation “peak”, set-up for bear rally not bad; but central banks the oncoming freight train, and will tighten until credit and/or consumer break; technicals to confirm SPX floor of 4200 tested before SPX ceiling of 4800…

- MOVE (Treasury volatility) index >150 & DXY >105 means “credit event” imminent, while copper breaking down, oil <$95/b & semiconductors (SOX) closing below 200-week moving average (2996) would imply growth taking turn for the worst, and incite rotation from last cyclical holdouts (resources) to defensives of utilities, staples, healthcare, low volatility, high quality, cash;

- note inability of the new FAANGs…US value (SPYV), resource rich indices (UK, Canada, Australia) to confirm new highs this week.

There is much more in the full Hartnett note available to professional subscribers in the usual place.

Tyler Durden

Sat, 04/23/2022 – 11:00

via ZeroHedge News https://ift.tt/IG18BKV Tyler Durden