Expect More Stock Market Pain Because It’s Coming

Authored by Mike Shedlock via MishTalk.com,

Yesterday felt bad for bulls but it is not even a down payment on what’s coming…

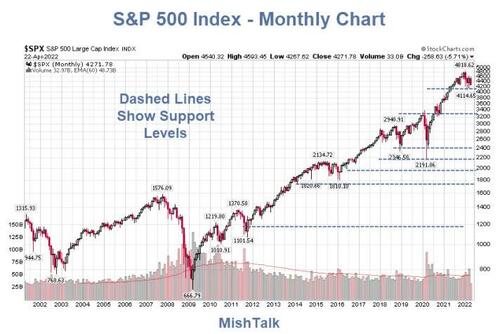

S&P 500 Index chart courtesy of StockCharts.Com, annotations by Mish

There was significant carnage in individual issues today. Yet, a step back to a monthly chart shows the decline in 2022 does not yet register.

Bear Market Action

In bear markets, support levels do not hold. There is almost no chance the 4200 level on the S&P 500 holds.

Although bear market bounces can happen at any time. the next technical support level is near 3200 or so. I would expect a bounce there for technical reasons, but there is no fundamental or technical reason to expect a bottom there.

Indeed, I expect to be at that level before a recession even hits. 2400 might hold but I doubt. Taking back all the gains to 2016 or 2014 is a strong possibility.

That would be a decline to the 1800 to 2000 level. Curiously, that level would not make stocks a scorching major bear market PE buy, but rather something reasonably priced.

Tweet of the Day

In the last 2½ hrs, vol players have started paying attention, w/ 3-mth $VIX curve dropping from a blissfull +3.1 to a “nervous giggling” +1.5. For reference, get-me-out panic is below -5, so still lots of pain left to get there. $SPY $QQQ $IWM

— FZucchi (@FZucchi) April 22, 2022

Lots of Pain Left

“In the last 2½ hours, volatility players have started paying attention, w/ 3-mth $VIX curve dropping from a blissful +3.1 to a “nervous giggling” +1.5. For reference, get-me-out panic is below -5, so still lots of pain left to get there.”

Those citing bull-bear survey ratios please pay attention. Those numbers reflect what people are doing, not what they are saying.

How Many Hikes Coming?

2/2

Many ask how does the Fed hiking help the poor? Doesn’t it risk making then unemployed?

The Fed does not think hiking will cause them to lose their job but will pound stocks lower (reverse wealth effect).

This reality is getting priced in.https://t.co/KvE7cgB1zJ

— Jim Bianco biancoresearch.eth (@biancoresearch) April 22, 2022

I think Bianco is wrong, but I easily could be. And what happens to equities if he is right?

Soft Landing?

Cartoon of the Day: Crashhttps://t.co/jfkynkMzzv pic.twitter.com/Zb1wvKSKu5

— Hedgeye (@Hedgeye) April 22, 2022

I suggest roughly a 2% chance.

Danielle DiMartino Booth on Art Cashin

It’s rare that Arthur Cashin chimes in twice in one day. And yet he did…emphatically “I can’t stress strongly enough how important that final hour action will be and if it turns into a route that can present big problems for next week.”

— Danielle DiMartino Booth (@DiMartinoBooth) April 22, 2022

The final hour was a rout.

Theme Trading

$NFLX is down 59.6% YTD and the worst performer in the S&P 500 this year$DIS is down 32.9% YTD and the worst performer in the DJIA this year

Both are in the streaming and movie business

I see a theme

— Jim Bianco biancoresearch.eth (@biancoresearch) April 21, 2022

In the “Oops” Department

This is pretty egregious. It’s self evident that he is doing someone connected with CNBS a favor… https://t.co/UQgvSqU0AX

— Michael Norinsberg (@Mnorinsberg) April 22, 2022

There is literally no logical explanation why @JimCramer still has a job. He’s the worst of the worst.

PS: Hey Jim remember that time you slandered Hedgeye and our short call on Linn Energy? We were right and the stock went to ZERO? We do.

Go jump in a sewer where you belong https://t.co/sU4e6lQpbe

— Hedgeye (@Hedgeye) April 22, 2022

Hoot of the Day

“We are going to have a crash landing if [the Fed] doesn’t slow it down,” @jimcramer warns after a rough day for stocks.

Slow it down??? FF are 0.25% and balance sheet hasn’t been reduced by a penny.

— Michael Lebowitz, CFA 🇺🇦 (@michaellebowitz) April 22, 2022

Cramer warns of a crash landing. That’s my hoot of the day.

David Hunter is Still Looking Melt-Up

That Tweet was last year. He is still looking for the melt-up. “Watch and learn” is a Hunter phrase.

More on Rate Hikes

Markets now expect 10 rate hikes thru the remainder of the year. pic.twitter.com/4FReXv05aM

— Hedgeye (@Hedgeye) April 22, 2022

Worst Case Scenario

Thanks Michael

But I also got a lot of things wrong.I never thought we would get to these levels.

In general, I called bonds better than equities. I blame myself hard.

In a worst case scenario, I think 1200 to 1500 level holds on S&P 500.

Playable bounces in many places.

— Mike “Mish” Shedlock (@MishGEA) April 22, 2022

Yeah Mish nailed. What so surreal is I was there as well, short subprime, wondering why Cramer was furiously pumping those companies on TV. Quite frankly I was pretty naïve back then. Those companies were already failing. I didn’t understand he was trying to help his buddies out.

— Michael Norinsberg (@Mnorinsberg) April 22, 2022

What If?

-

Assume the call is correct? What If?

-

Assume the call is incorrect? What If?

In case #1 inflation will still be a problem.

In case #2 how deep will the recession be?

So, forget about a soft landing.

The correct question is What’s the Shape of the Hard Landing?

And where will stocks be?

* * *

Tyler Durden

Sat, 04/23/2022 – 12:30

via ZeroHedge News https://ift.tt/DJyfoZC Tyler Durden