Recession On Deck: US GDP Shockingly Contracts In Q1 Driven By Inventory, Exports Plunge

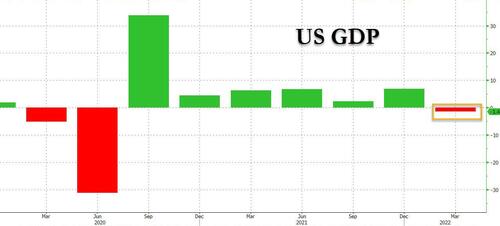

Heading into today’s first estimate of Q1 GDP, estimates were low – certainly far lower than the 6.9% final Q4 GDP number, the strongest since the third quarter of 2020. Commenting ahead of the print, Bloomberg said that “a slowdown in the first quarter will prove temporary, a consequence of omicron and the drag from volatile inventories and trad.” Maybe, but what if it’ not temporary. And how big of a slowdown? Indeed, moments before the print we said that with just 3 GDP report to go until the midterms, it wouldn’t be a bad idea for the Biden admin to “kitchen sink” the quarter with e negative print.

Probably not a bad idea to have a kitchen sink GDP quarter now ahead of midterms. Odds of negative print?

— zerohedge (@zerohedge) April 28, 2022

Well, we were right again, because moments ago the BEA reported that in Q1, the US in fact shrank by 1.4%, shocking consensus estimates of a 1.0% GDP print (to be fair, a few Wall Street analysts did predict a negative print but the consensus was by and large for continued growth).

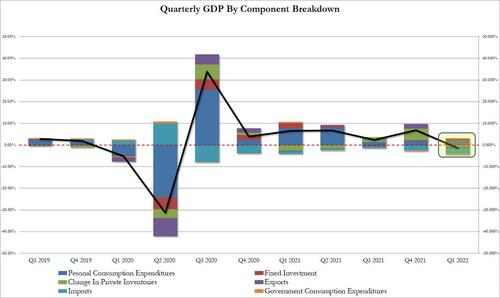

What was behind the shocking contraction in the US economy? Two things mostly: a sharp drop in changes in private inventory and a huge swing in net exports (more below).

According to the BEA, the first quarter decrease in real GDP reflected decreases in inventory investment, exports, federal government spending, and state and local government spending, while imports, which are a subtraction in the calculation of GDP, increased. Consumer spending, business investment, and housing investment increased

Looking at the components, we find the following Q1 data:

- Personal consumption rose 1.83%, up from 1.76% in Q4

- Fixed Investments 1.27%, also up solidly from 0.50% in Q4

- However, the change in private inventories was a huge hit to GDP (just as we warned last month it would be) subtracting -0.84% from GDP, vs adding 5.32% in Q4

- Net trade was also ugly, with exports collapsing to -0.68% vs an increase of 2.24% in Q4. At the same time, imports were largely flat at -2.53%, vs -2.46% last quarter, resulting in a net trade print of -3.21% in Q1, vs a -0.22% decline in Q4.

- Government consumption was unchanged at -0.48% vs -0.46% a quarter ago.

Bottom line: annualized GDP plunged from 6.9% growth in Q4 to a -1.43% shrinkage in Q4.

Some more details from the BEA:

- The decrease in inventory investment primarily reflected decreases in wholesale (led by motor vehicles) and retail (led by “other” retailers as well as motor vehicle and parts dealers).

- The decrease in exports reflected a decrease in goods (led by nondurable goods) that was partly offset by an increase in services (led by financial services).

- The decrease in federal government spending primarily reflected a decrease in defense spending on intermediate goods and services.

- The increase in imports primarily reflected an increase in goods (led by durable goods).

- The increase in consumer spending reflected an increase in services (led by health care) that was partly offset by a decrease in goods. Within goods, a decrease in nondurable goods (led by gasoline and other energy goods) was partly offset by an increase in durable goods (led by motor vehicles and parts).

- The increase in business investment reflected increases in equipment (led by information processing and related equipment) and intellectual property products (led by software as well as research and development).

Ok, what is really going on here? Well, in our view the US economy is already in a stagflationary recession, and the sooner the Biden admin admits this the better, which is precisely why it just did so. Why now? Because it hopes that after a brief recession in Q1 and Q2 – which it cane blame on Omicron and Putin – it’ hope is to present a Q3 GDP print, due just days before the midterm elections, that is solidly in the green for a hail mary bounce for Democrats.

We doubt it will work, but we are far more worried about just how serious the recession the US finds itself in, is.

That said, don’ worry – the odds of a Fed rate cut next week are still 0 as Powell scrambles to contain inflation which is now the primary directive of the Fed, economic growth be damned.

Tyler Durden

Thu, 04/28/2022 – 08:46

via ZeroHedge News https://ift.tt/KJf127M Tyler Durden