Nomura Warns Of “Huge Fodder For Mechanical Short Squeeze” As ‘Event Risks’ Clear

With numerous ‘high-profile earnings event risks’ now in the process of “clearing”, Nomura’s Charlie McElligott notes that we are (at least locally) seeing some stocks now trade-UP on what are actually pretty weak qtrs and guides, a.k.a. nascent pockets of Equities which have now stopped going LOWER on bad news, as a general “bullish” signal for markets.

The Nomura strategist adds that amid all of the seeming macro calamity (central-bank-induced volatility and policy divergence and the DXY raging to 20-year-highs), US Equities keep seeing somehow stabilizing to the consternation of many with grossed-up short books and who are hedged for “FCI tightening / Inflation / Ukraine / Earnings disaster”.

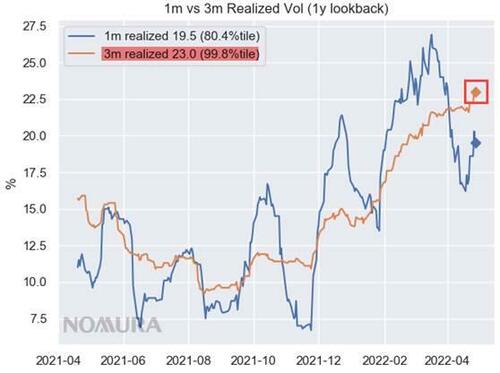

There are two factors supporting stocks here: the tendency for volatility to mean-revert, and the extreme (short) positioning that has once again appeared across the major markets.

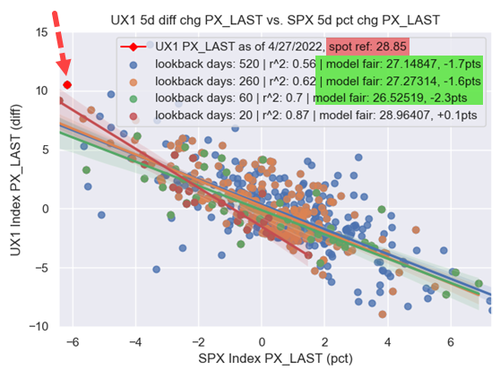

1) as the market will gradually lose its ability to sustain currently implied daily ~1.9% swings with UX1 @ 29.5 and “compress” without another Earnings or Fed “shocker” coming next wk), this then has capacity to kick-off second-order blasts of “mechanical flows” which impact the market virtuously:

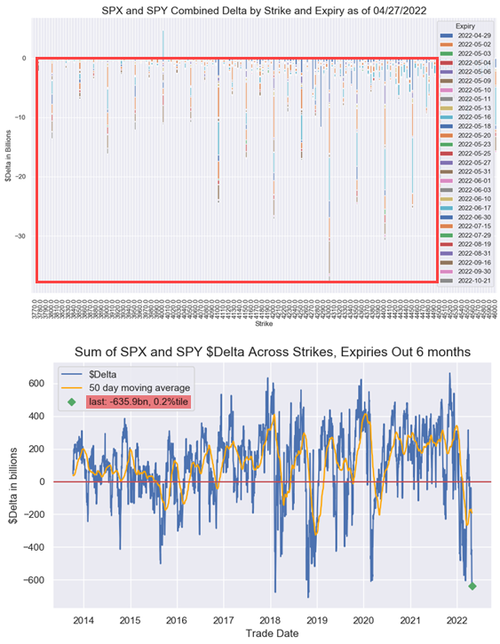

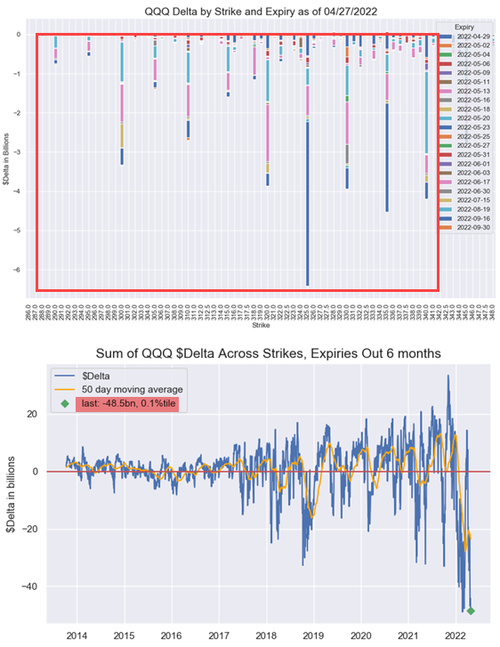

2) the currently EXTREME “Short Gamma / Short Delta” profile due the client recent grab into short-dated Puts and downside structures then sees those highly-convex Puts “bleed” and unwound on Spot rallies like this, with Dealers buying-back (covering) “short hedges” which acts to propel futures higher.As McElligott highlights, this is “huge fodder for mechanical short-squeezes on these spot-rallies and vol-meltdowns due to dealer-covering.”

Additionally, SpotGamma notes that Gamma Tilt is now flashing near its lower bound, as shown here…

…which suggests that put gamma is very high relative to call gamma, and downside is likely exhausted as markets break <4200.

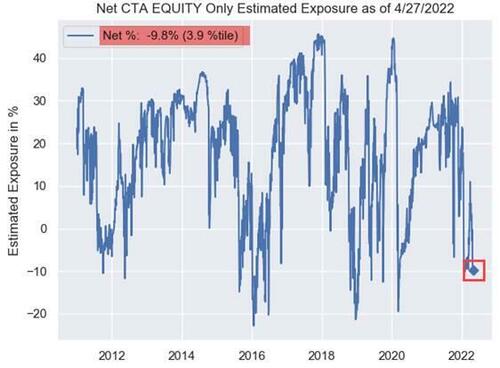

And in a world where “Volatility is the Exposure Toggle,” a trending-lower Vol input will mean “Systematic” reallocation flows for Target Vol and Risk Parity (with still “historically light” exposures), which too will go hand-in-hand with a Spot / Price rally that will dictate bouts of covering in current and largely “Short” Equities position signals – hence, “unemotional” buying that creates this “chop” and creates passive “buy” flows off the lows… with CTA positioning at just 3.9%ile and “buy triggers” close…

Are we about to see a second-half-of-March-meltup redux?

Deltas have neve been more negative. Smallest trigger could spark Hwangian squeeze (charts Nomura) pic.twitter.com/K8AiEnvr3a

— zerohedge (@zerohedge) April 28, 2022

The question is – will this rebound occur now and stall on the 5/4 FOMC/Russian-Default-Deadline?

However, if the squeeze-driven spike does not occur, SpotGamma warns that below here there is substantial longer-term support at 4050 due to large open interest at 4000.

Tyler Durden

Thu, 04/28/2022 – 12:01

via ZeroHedge News https://ift.tt/vVbD3Et Tyler Durden