Apple Jumps After Smashing Expectations In Record Non-holiday Quarter, Boosts Buyback By $90BN

Just when traders were getting a deja vu sense of “oh shit, here we go again”, and were bracing for another collapse in the Nasdaq tomorrow after Amazon’s plunge driven by dismal guidance, moments ago the last remaining GAMMA stock, and the world’s most valuable company, Apple may have saved the Nasdaq – and the market – at least until next week’s FOMC, when it reported fiscal Q2 earnings that blew away expectations, and in fact, reported its best non-holiday quarter ever!

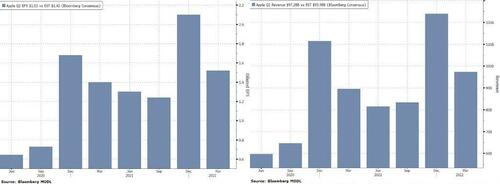

Here is what AAPL just reported for its fiscal Q2 quarter.

- Apple 2Q EPS $1.52, beating consensus estimates of $1.42

- Apple 2Q Rev. $97.3B, +8.6% Y/Y, smashing consensus estimates of $93.98B

A breakdown by product category

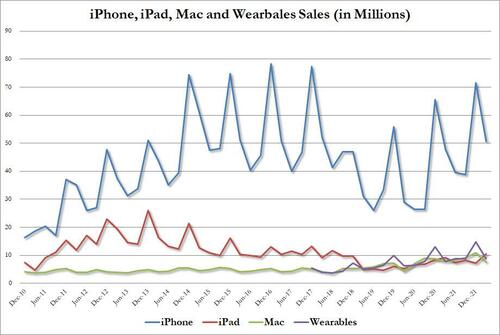

- IPhone revenue $50.57 billion, +5.5% y/y, beating estimate $49.16 billion

- Mac revenue $10.44 billion, +15% y/y, beating estimate $9.23 billion

- IPad revenue $7.65 billion, -2.1% y/y, beating estimate $7.19 billion

- Wearables, home and accessories $8.81 billion, +12% y/y, missing estimates $8.98 billion

What is remarkable, is that this was the best non-holiday quarter for AAPL in history. Some more details:

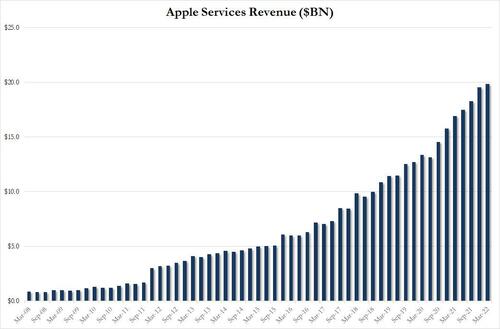

- Service revenue $19.82 billion, +17% y/y, beating estimates $19.78 billion

- Greater China rev. $18.34 billion, +3.5% y/y

- Gross margin $42.56 billion, +12% y/y

- Cash and cash equivalents $28.10 billion, -27% y/y, estimate $35.81 billion

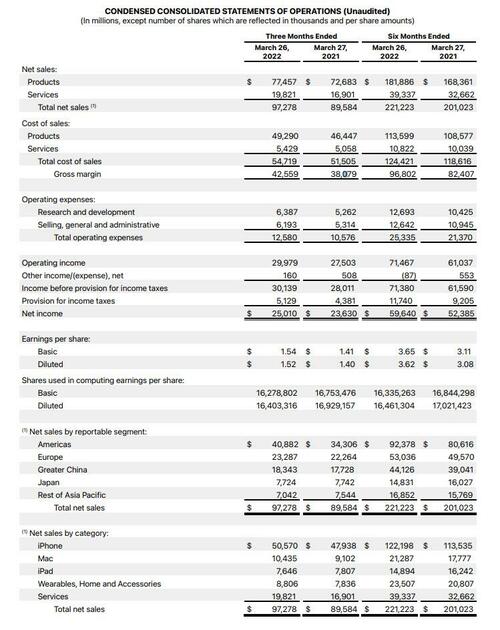

Earnings snapshot

Commenting on the quarter, CFO Luca Maestri said that Apple “set an all-time revenue record for Services and March quarter revenue records for iPhone, Mac, and Wearables, Home and Accessories. Continued strong customer demand for our products helped us achieve an all-time high for our installed base of active devices. Our strong operating performance generated over $28 billion in operating cash flow, and allowed us to return nearly $27 billion to our shareholders during the quarter.”

And just in case the blowout earnings were not enough, AAPL also announced that its board had authorized an increase of $90 billion to the existing share repurchase program.

As noted above, AAPL beat on all sales categories, except wearables, with IPhone sales hitting $50.6 billion, +5.5% y/y, and above estimates $49.2 billion. iPad sales came in at $7.65BN, down 2.1% Y/Y but also beating estimates of $7.19BN, while Mac sales also beat estimates of $9.23BN, rising 15% to $10.44BN. The only product miss was in wearables, which came in at $8.81BN, up 12% Y/Y, but below the $8.98BN estimate.

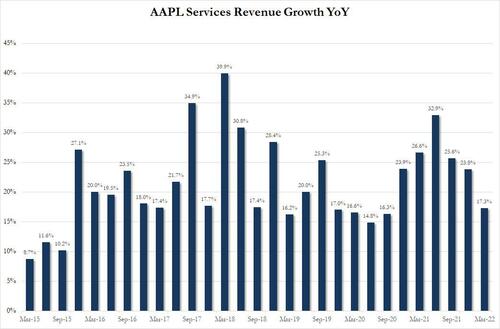

Apple also reported another blowout record quarter for Service Revenues, which rose to $19.82BN, beating expectations of $19.78BN.

… although the annual increase of 17.3% was a slight drop sequentially from the 25.6% increase last quarter

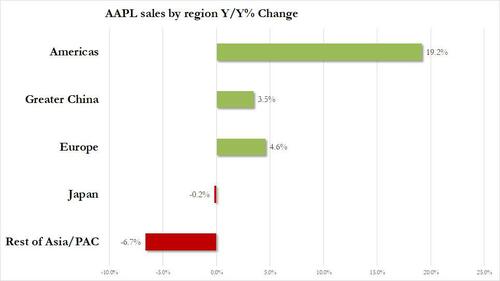

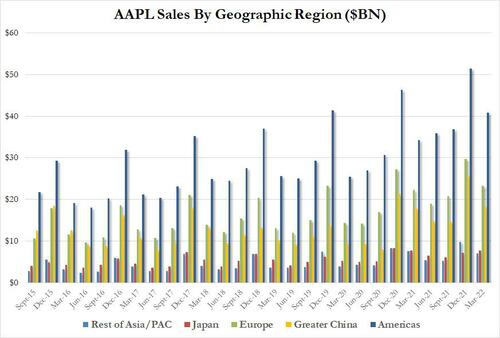

The geographic breakdown was also solid: most areas showed a boost in sales, apart from a minor drop in Japan and a notable decline in Rest of Asia/PAC. The Americas remains its largest sales area with $40.882 billion of revenue in the quarter. China was up to $18.343 billion, growing 3.5%, which however was well below the corporate average.

And in dollar terms:

In any case, the results were strong enough – at least initially – to push the stock higher, even if the initial surge is quickly fading after hours.

Tyler Durden

Thu, 04/28/2022 – 17:05

via ZeroHedge News https://ift.tt/F8l2Yie Tyler Durden