Exxon Triples Buyback To $30 Billion As Energy Giant Prints Billions In Free Cash Flow

With the rest of corporate America shaking at the prospects of a stagflationary recession and/or rising interest rates and an uber hawkish Fed, one sector is printing money hand over fist, the best performing market sector of 2022 by a giant margin: energy.

This morning, the two integrated US energy giants, Exxon and Chevron both reported earnings, and with a few cosmetic exceptions, the results were blowout. And while Buffett energy darling Chevron posted the highest quarterly earnings in almost a decade, here will will focus on the bigger of the two, Exxon, whose profit surged after Russia’s invasion of Ukraine accelerated rallies in energy prices around the world.

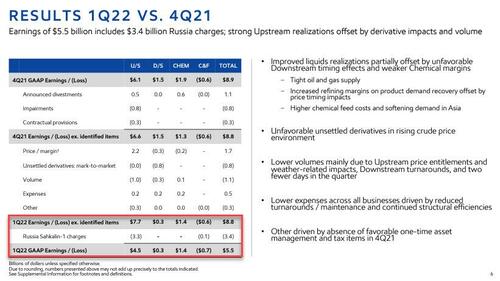

Exxon’s earned $2.07 a share in the period, missing the $2.24 consensus estimate, driven almost fully by one-time items; CEO Darren Woods blamed the miss on a dip in output from oil and natural gas wells stemming from adverse weather and other factors. Exxon. The company also reported a Russia-linked multi-billion dollar charge. More importantly, the higher than expected $90.5 billion in revenue resulted in adjusted net income of $8.8 billion was more than double the year-earlier figure.

The oil giant took a $3.4 billion writedown due to its planned exit from its Sakhalin-1 operation in Russia, compared with a previously announced estimate of as much as $4 billion. The company declared force majeure at the venture earlier this week and curtailed crude production (we are confident there is already a line of Chinese and Indian companies willing to replace Exxon in the key LNG joint venture).

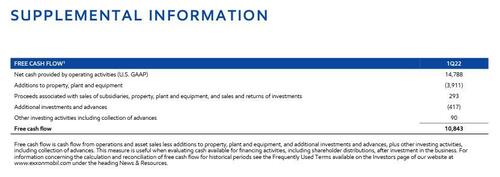

Similar to TotalEnergies, which reported earlier and announced that the French oil titan would buyback as much as $3 billion in shares before the end of June, Exxon announced that it would triple its share-buyback program to as much as $30 billion after the company generated a massive $14.8 billion in cash flow from operations…

… which translates into $10.8 billion in Free Cash Flow…

… of which it distributed $5.8 billion to shareholders (2/3 dividends, 1/3 buyback).

The repurchases will be made through the end of next year, the company said on Friday. Here are some more details from the quarter:

- Chemical prime product sales 6,737 kt, +4.5% y/y, estimate 6,744

- Downstream petroleum product sales 5,158 kbd, +5.7% y/y, estimate 5,160

- Production 3,675 KOEBD, -3% y/y, estimate 3,804

- Crude oil, NGL, bitumen and synthetic oil production 2,266 KBD, estimate 2,391

- Natural gas production 8,452 MCFD, estimate 8,697

- Refinery throughput 3,983 KBD

- Total revenues & other income $90.50 billion, estimate $89.57 billion

Some more details from the quarter courtesy of Bloomberg:

- Company is progressing plans to increase its global offer of certified circular polymer with capacity to process up to 500 metric tons of plastic waste per year by 2026

- Permian Crude Venture remains on track for phased expansion in 2023 and 2024

- Permian Basin continued to improve efficiency and grow production, reaching production of 560,000 barrels per day at the end of the quarter. The company remains on track to deliver a production increase of 25% this year versus full-year 2021, and to eliminate routine flaring by year end

- Corporation formed ExxonMobil Product Solutions, combining Downstream and Chemical businesses, and centralized Technology & Engineering and Operations & Sustainability groups; move is effective April

- “Earnings increased modestly, as strong margin improvement and underlying growth was offset by weather and timing impacts.”

- Exxon shares fall about 1.24% in pre market trading

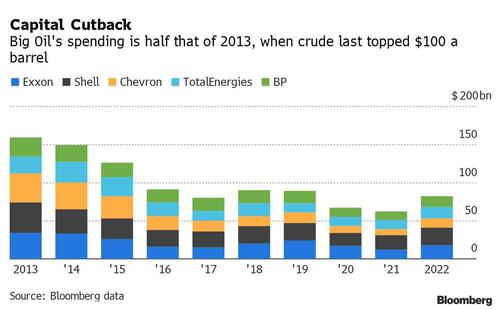

As Bloomberg notes, Big Oil’s stellar profits come as consumers feel the pinch of surging energy prices, prompting some politicians to demand explorers invest more in new wells to counter Russia’s growing isolation. So far, oil executives are funneling cash to shareholders through dividends and buybacks, fueling calls from some quarters for the imposition of windfall profit taxes, and keeping capex to a minimum.

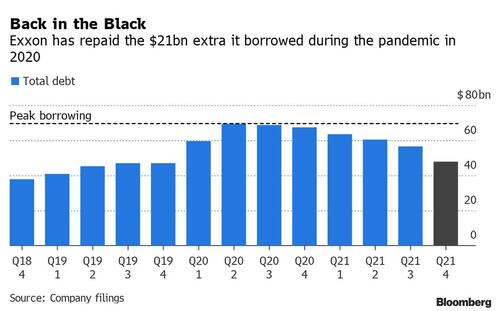

The surge in oil prices has come at just the right time for Exxon. As a reminder, in 2020, the Western world’s biggest oil company increased debt by 45%, or nearly $21 billion as oil cratered to record low; but the recent boom enabled it to repay the entire sum, as well as ramping up returns to shareholders. The stock is up about 40% this year, exceeding the return in the S&P 500 Energy Index.

Shareholders may be disappointed that Exxon failed to increase dividends this week as some analysts had been expecting, but that’ probably to avoid more political heat from cartoonish democrats who blame the surge in oil on oil firms instead of their own catastrophic policies; we expect the firm will significantly likely its dividend payout later this year or else it will just repurchase more stock.

CEO Woods said he is focused on boosting uickening production in two key areas: U.S. shale and Guyana, where it made the world’s largest oil discovery of the past decade. The oil giant plans to boost production from the Permian Basin this year and its Guyanese Liza Phase 1 operation is currently producing 10,000 barrels a day above nameplate capacity. Exxon’s third Guyana project, Payara, is running five months ahead of schedule and is due to come online before the end of next year, the company this week.

Such increases will not only help stabilize Exxon’s long-term production decline, but they’re also highly profitable barrels. About 90% of its investment dollars are expected to make double-digit returns even were oil to fall to $35 a barrel, the company said in March. Brent last traded at about $109.

In response to the modest earnings miss, XOM stock traded 2% lower although we expect this will be promptly reversed and XOM will be trading above $100 in the next few weeks as the Wall Street penguin parade begins and analyst after analyst boosts their price target on one of the few truly outperforming companies in this pre-recessionary environment.

The company’s full earnings presentation is below (pdf link).

Tyler Durden

Fri, 04/29/2022 – 08:28

via ZeroHedge News https://ift.tt/RuCQKq1 Tyler Durden