Fed’s Favorite Inflation Signal Hits 40 Year High As Savings-Rate Crashes

Both incomes and spending were expected to rise MoM in March and they did with spending rising 1.1% MoM (almost double the 0.6% rise expected) and outpacing the 0.5% MoM rise in incomes. This is the 6th straight month of rising incomes and 3rd straight month of rising spending…

Source: Bloomberg

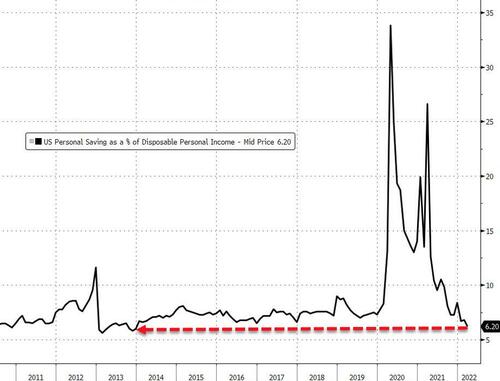

For the 3rd straight month, the increases in spending outpaced the rise in incomes pushing the savings rate to its lowest since Dec 2013

Source: Bloomberg

Finally, The Fed’s favorite inflation rate – the PCE Deflator – rose by 6.6% YoY (slightly less than the 6.7% YoY expected) but still the highest since Jan 1982 (while the core PCE deflator fell back very modestly from multi-decade highs)…

Source: Bloomberg

No breathing room for The Fed here.

Tyler Durden

Fri, 04/29/2022 – 08:39

via ZeroHedge News https://ift.tt/GgMTnzx Tyler Durden