‘Short Gamma Runs Both Ways’: 4270 Is Today’s ‘Line In The Sand’ For The S&P

As we noted yesterday, options positioning was extreme and provided a lot of fodder for a short-squeeze (which we saw in yesterday’s panic-bid in US equities). However, AAPL and AMZN stole the jam out of that donut overnight and as Nomura’s Charlie McElligott notes, the pivot level which folks will be watching is ES 4270, where the Street is short 9100x Put at that strike that expires today (as part of a customer’s monthly Put Spread Collar program – where they are long 9100 SPX 29Apr 3600 / 4270 PS vs short the 4695 calls, a ~$4B hedge), which obviously lost Delta into yesterday’s booming rally and was clearly a large part of the “Short Gamma” scramble and hedging-squeeze higher in the market yesterday (the 4270 Put went from an 80 Delta put at 10am to a 46 Delta put, so Dealers had to buy ~$1.25B in futures to remain neutral).

But as we all know, “Short Gamma” goes two ways, so as the Put has now gone from a 46 Delta to a 57 Delta with the move overnight, this has created ~$600mm+ of Incremental selling pressure as well; FWIW, the customer tends to roll to a similar Put Spread Collar in June month-end around 11am (h/t J Pierce and H Homes)

Broad US Equities Index / ETF Options positioning accordingly remains “Short Gamma, Extreme Short Delta,” off lows of yday obviously, but remaining directionally the same for Dealers despite the violent Spot rally Thursday—and note, large amount of $Gamma rolls-off for today’s expiration

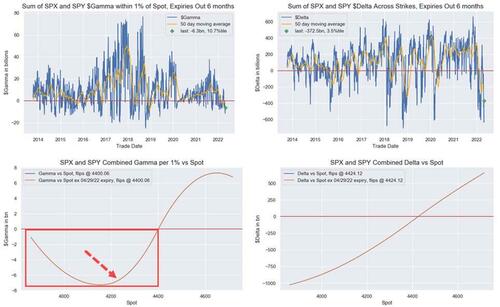

- SPX / SPY consolidated shows $Gamma -$6.3B (10.7%ile), ~$6.5B per 1% move, 21.5% total $Gamma expires today, “flips” above 4400; $Delta -$372.5B (3.5%ile), “flips” above 4424

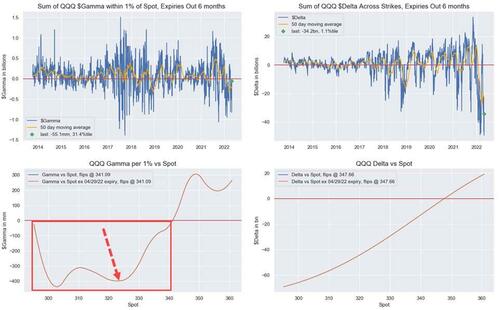

- QQQ $Gamma -$55.1mm (31.4%ile), ~$400mm per 1% move, 38.5% total $Gamma expires today, “flips” above $341.09; $Delta -$34.2B (1.1%ile), “flips” above $347.66

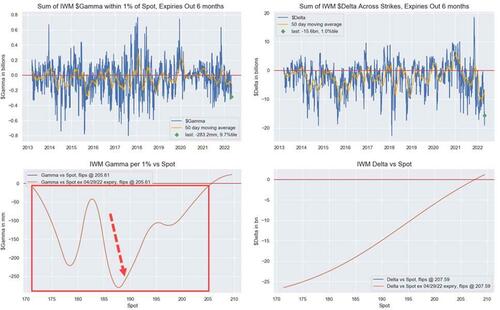

- IWM -$283.2mm (9.7%ile), ~$260mm per 1% move, 25.5% total $Gamma expires today, “flips” above $205.61; $Delta -15.6B (1.0%ile), “flips” above $207.59

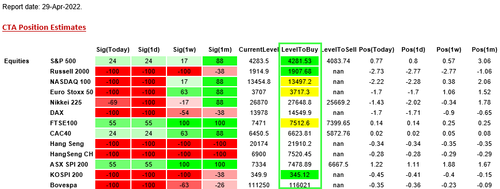

The Spot rally has CTA Trend signals across many Equities futs nearing “buy / cover” triggers, most proximate today in SPX, Russell, NDX, Eurostoxx, FTSE100 and Kospi 200, coming after a substantial “buy to cover” in NKY overnight…

…although with this morning’s pullback around Earnings and Expiration, we have slipped a bit from said levels.

Zooming out, SpotGamma notes that the game of “ping pong” continues, largely as anticipated.

As we’ve outlined, volatility and put positioning appears maxed out <=4200 (see “lower bound”), but we cannot have a release of IV lower until the 5/4 events pass (FOMC + Russian default). Therefore equity rallies are framed as short covering, and subject to quick and violent reversals.

Tyler Durden

Fri, 04/29/2022 – 09:25

via ZeroHedge News https://ift.tt/ZH82Yu6 Tyler Durden