A New Gold Standard? Kremlin Confirms Intention To Back Ruble With Gold And Commodities

Submitted by Ronan Manly, BullionStar.com

On Tuesday 26 April in an interview with newspaper Rossiyskaya Gazeta (RG), the Secretary of the Russian Federation’s Security Council, Nikolai Patrushev, said that Russian experts are working on a project to back the Russian ruble with gold and other commodities.

The interview, which is in Russian, can be seen on the RG website here.

For those who don’t know the name Nikolai Patrushev, Patrushev is one of the Russia’s most powerful security / intelligence officers and a close ally of Putin. After serving between 1999 and 2008 as Director of the Russian Federal Security Service (FSB) (the successor organization to the KGB), Patrushev moved to being Secretary of the Russian Security Council since 2008. In fact, Patrushev took over as Director of the FSB in 1999 from the previous incumbent, Vladimir Putin.

The Security Council of the Russian Federation is chaired by Putin, with Patrushev as Secretary, overseeing the Security Council and answering directly to Putin. The deputy chairman of the Security Council is Medvedev Dmitry, the former Russian president and prime minister. Among the other member of the Security Council are current Russian prime minister Mikhail Mishustin, and Russian foreign minister Sergei Lavrov.

So when Nikolai Patrushev says that Russia is working on a plan to back the ruble with gold and commodities, it is not just anyone saying this, it is being said by the highest echelons of the Russian Government.

Media coverage (in English) of Patrushev’s 26 April comments can be seen on the Russia Today (RT.com) website here. For those who cannot access RT.com due to it being locally blocked and who don’t want to use a VPN, the RT.com article can be seen on ‘thethreadtimes.com’ website here.

Intrinsic Value

Since its good to go right back to the source of Rossiyskaya Gazeta (RG), I have added an English translation of the relevant sections of Patrushev’s interview with RG (using Yandex Translate) below.

RG Question: And what do we need to do to ensure the ruble’s sovereignty?

Nikolai Patrushev: “For any national financial system to be sovereignized, its means of payment must have intrinsic value and price stability, without being pegged to the dollar.

Now experts are working on a project proposed by the scientific community to create a two-circuit monetary and financial system.

In particular, it is proposed to determine the value of the ruble, which should be backed by both gold and a group of goods that are currency values, and to put the ruble exchange rate in line with the real purchasing power parity.”

So there you have it. The Russian Government is actively working on creating a gold and commodity backed Russian ruble with intrinsic value which is outside the orbit of the US dollar.

For the above paragraphs, Google Translate produces a nearly identical translation into English as Yandex Translate does, except whereas Yandex calls it a ‘a two-circuit monetary and financial system’, Google says a ‘dual-loop monetary and financial system’. ‘Two-circuit’ or ‘dual-loop’ refers here to a ruble backed by both gold and commodities.

A New Orthodoxy

Following Patrushev’s remarks about a gold and commodity backed ruble, the RG interview probes further:

RG Question: Similar ideas have been voiced before. However, a number of experts stated that they contradict the conclusions of economic theory…?

To which Nikolai Patrushev replies:

“They do not contradict the conclusions of economics, but rather the conclusions of Western economics textbooks.

The West has unilaterally appropriated an intellectual monopoly on the optimal structure of society and has been using it for decades…

We are not opposed to a market economy and participation in global production chains, but we are clearly aware that the West allows other countries to be its partner only when it is profitable for it.

Therefore, the most important condition for ensuring Russia’s economic security is to rely on the country’s internal potential, a structural adjustment of the national economy on a modern technological basis.”

Sanctions – An Own Goal

On the subject of the financial sanctions themselves, and the freezing of Russia’s FX reserves held abroad, Patrushev states that by imposing sanctions against Russia, the “the West is hitting not only Russia, but also itself”, and has damaged trust in the US dollar as the world’s de facto reserve currency:

“The current global financial system is built solely on trust, including in the United States as the issuer of the world’s reserve currency. Half a century ago, the gold factor was present, but in 1971 the States untied its currency from its quotes, which made it possible to issue money virtually without control.”

The West vs The Rest

Elsewhere in the interview, Patrushev drops some bombshell comments about how Russia is intensifying cooperation with the non-Western world, comments which have yet to be appreciated by the mainstream Western media.

“I am confident that we will solve all the problems that have arisen as a result of the sanctions restrictions.

Today, Russia is moving from the European market to the African, Asian and Latin American markets.

We give priority attention to the EAEU, whose importance is growing many times over in the current conditions.

We are stepping up cooperation with the BRICS and SCO countries, which bring together about three and a half billion people on the planet.”

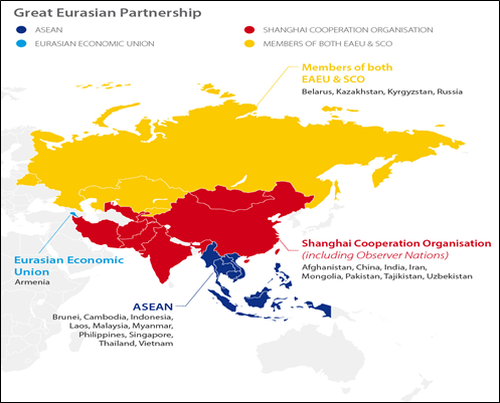

Note – The EAEU refers to the Eurasian Economic Union. The EAEU, which was founded in 2015, is a free-trade zone and customs union comprising Russia, Kazakhstan, Belarus, Armenia and Kyrgyzstan. See EAEU website here.

SCO refers to the Shanghai Cooperation Organisation. The SCO, which was founded in 2001, is an international intergovernmental grouping comprising the 8 member states of China, Russia, India, Kazakhstan, Pakistan, Uzbekistan, Kyrgyzstan, and Tajikistan, as well as 4 observer states of Belarus, Iran, Afghanistan, and Mongolia, and a further 6 dialogue partners in the form of Turkey, Azerbaijan, Armenia, Cambodia, Nepal, and Sri Lanka.

BRICS refers to the world’s 5 largest emerging economics and comprises Brazil, Russia, India, China and South Africa. BRICS was established in 2006 and is now a formal grouping, with the BRICS nations formally cooperating and meeting on an annual basis. The 2022 BRICS summit is being held in China.

EAEU. SCO. BRICS. Three and a half billion people. And now a gold and commodity backed ruble. Something for the Western media to ponder.

Conclusion – A New Gold Standard?

In late March when the Bank of Russia offered to buy gold from Russian banks at a fixed price of 5000 rubles per gram, this was the first step in linking the ruble to gold. That move also put a floor price under the ruble and acted as a catalyst for the ruble to re-strengthen ground against the US dollar that had been lost in late February / early March.

During the same week in late March, Putin also informed the global market that non-friendly importers of Russian gas would have to pay for Russian natural gas using rubles. That move (which we are now seeing playing out in the EU) was the other side of the equation, linking the ruble to commodities.

This was all laid out in the Q&A article that I wrote for RT.com and which can be seen here on the BullionStar website titled “Russian Ruble relaunched linked to Gold and Commodities – RT.com Q and A”, and which was a big hit on ZeroHedge with more than 650,000 views.

What we are seeing now is Nikolai Patrushev and the Kremlin confirming this simple equation of linking the Russian ruble to gold and commodities. In other words, the beginning of a multilateral gold and commodity backed monetary system, i.e. Bretton Woods III.

Anyone who wants to read an English translation of Nikolai Patrushev’s full interview with Rossiyskaya Gazeta can do so at this link.

* * *

This article was originally published on the BullionStar.com website under the same title “Kremlin confirms intention to Back Ruble with Gold and Commodities”.

Tyler Durden

Fri, 04/29/2022 – 10:55

via ZeroHedge News https://ift.tt/Aa6Ruqp Tyler Durden