Buckle-Up, Buttercup

Authored by Mike Shedlock via MishTalk.com,

If You Think I’m Bearish Please Read John Hussman

John Hussman’s latest post is a real gem. Let’s tune in.

Image courtesy of John Hussman

Former Fed Chair Ben Bernanke:

“Having experienced the damage that asset price bubbles can cause, we must be especially vigilant in ensuring that the recent experiences are not repeated.”

– Ben Bernanke, Federal Reserve Chair, January 3, 2010

Nowhere

Hussman kicks off his latest post, “Repricing a Market Priced for Zero“, with that quote.

Buckle up, buttercup.

The most challenging financial event for investors in the coming decade will be the repricing of securities to valuations that imply adequate long-term returns, following more than a decade of reckless and intentional Fed-induced yield-seeking speculation.

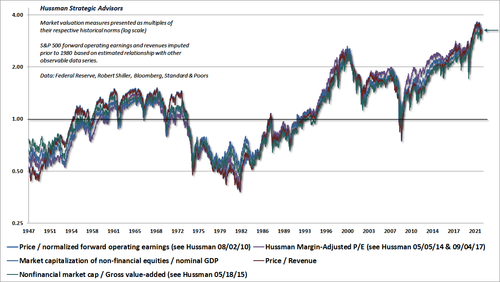

The chart below updates the status of our most reliable stock market valuation measures, based on their correlation with actual subsequent S&P 500 total returns in market cycles across history. Their historical profiles are largely indistinguishable. The arrow shows the current level of valuation, which remains above every valuation extreme observed prior to 2020. Indeed, our Margin-Adjusted P/E (MAPE), for which a century of data is available, remains beyond its 1929 peak.

Each measure is shown as a ratio to the historical norm associated with run-of-the-mill subsequent S&P 500 total returns of 10% annually. To say that recent market highs approached 3.6 times those historical norms is essentially to say that average S&P 500 total returns are likely to be nowhere near 10% annually during the coming 10-20 years.

Indeed, measured from the recent market peak, I expect S&P 500 total returns to be negative, on average, for well over a decade – an outcome I also projected at the 2000 market peak. That said, if a steep market decline was to front-load those losses, investors could also enjoy prospects for satisfactory long-term returns even a year or two from now. It’s current valuation extremes, and the dismal long-term returns they imply, that long-term investors may want to think twice about locking in.

Hussman Strategic Advisors – We Are Here

Chart Courtesy of John Hussman

Meanwhile, be careful not to interpret valuations as near-term market forecasts. That’s not how valuations work. The main thing that determines whether an overvalued market continues to advance, or drops like a rock instead, is whether investor psychology is inclined toward speculation or risk-aversion. When investors are inclined to speculate, they tend to be indiscriminate about it. When investors become risk-averse, they tend to be skittish and selective. For that reason, our most reliable gauge of speculation versus risk-aversion is the uniformity or divergence of market internals – across thousands of individual stocks, industries, sectors, and security types, including debt securities of varying creditworthiness.

As I wrote at the 2000 bubble peak, “When the market loses that uniformity, valuations often matter suddenly and with a vengeance. This is a lesson best learned before a crash rather than after one. Valuations, trend uniformity, and yield pressures are now uniformly unfavorable, and the market faces extreme risk in this environment.” That’s the same environment we face at present, but as those conditions change, so will our market outlook.

Put simply, the most severe market losses tend to emerge when elevated valuations are joined by deterioration and divergence in market internals, suggesting risk-aversion among investors. Conversely, the strongest opportunities tend to emerge when a material retreat in valuations is joined by broad uniformity in market internals, suggesting speculative psychology among investors.

Year 2000 Flashback

“Over the past 5 years, the revenues of S&P 500 technology companies have grown at a compound annual rate of 12%, while the corresponding stock prices have soared by 56% annually. Over time, price/revenue ratios come back in line. Currently, that would require an 83% plunge in tech stocks (recall the 1969-70 tech massacre). The plunge may be muted to about 65% given several years of revenue growth. If you understand values and market history, you know we’re not joking.”

– John P. Hussman, Ph.D., March 7, 2000

Just before, well, an 83% plunge in the tech-heavy Nasdaq 100 Index

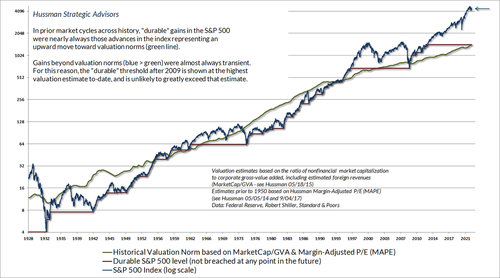

Historical Valuation Norm

Historical Valuation Norm chart courtesy of John Hussman

Policy Errors

Many observers are hyperventilating about the risks of normalizing Federal Reserve policy, but most of those consequences are unfortunately already baked in the cake after years of speculative recklessness. As I noted in The Fed policy error that should worry investors, the most profound “policy error” of the Fed is well behind it. That error was to abandon, for more than a decade, any systematic link between their policy variables and observable data.

Mish Comments

I encourage anyone who got this far to read the entire Hussman’s article in entirety. It’s loaded with gems.

Many of my readers will complain Hussman has been too bearish.

That’s not at all the case. Hussman never once said “go short” that I am aware.

Rather, Hussman commented on market valuations, I believe accurately. The fact that valuations kept getting more and more extreme does not in the least detract from the message.

The Hook

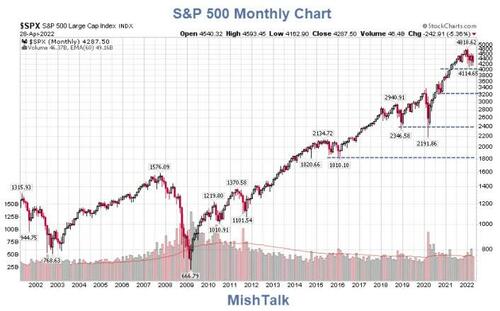

S&P 500 Monthly chart courtesy of StockCharts.Com, annotations by Mish

The hook now is looking at declines and thinking along the lines of “stocks are down 15% so they are cheap.”

Stocks on average will not be cheap if the S&P declines 50% from the top.

If the S&P declines 70% then we can discuss cheap.

Where will support hold?

As I have stated before, I am confident the 4000 level will not hold. I suppose 3200 could hold but more likely it won’t.

But let’s assume it does. The market could meander around that level going “nowhere” for a decade.

It’s more likely for the 2400 level to hold. But that only takes back 5 years of the bull market.

What About Earnings?

It’s not about time or percentage declines per se, but valuations. Earnings still need to catch up.

Both fiscal and monetary policy goosed earnings. That is why Shiller uses CAPE (cyclically-adjusted PE) ratios and Hussman uses MAPE (margin-adjusted PE) ratios.

Earnings mean revert. Most of the forward earnings are total nonsense. They do not reflect higher inflation, higher interest rates, or trade flows which looking ahead will increase costs.

Housing-Adjusted CPI Inflation Hits New Record High Dating to 1987

On April 27, I commented Housing-Adjusted CPI Inflation Hits New Record High Dating to 1987

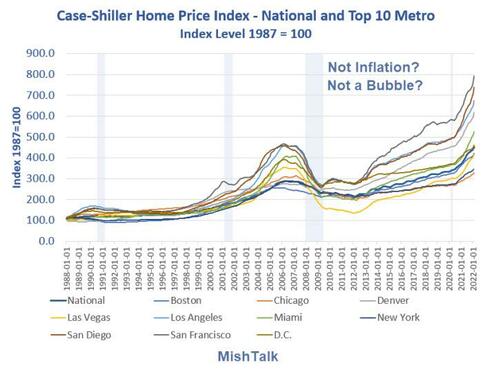

Case-Shiller home prices via St. Louis Fed, chart by Mish

Home prices disconnected from reality. Regardless of what anyone may think about supply or demand or it’s OK because interest rates are low, that’s an obvious bubble.

And that bubble made people feel wealthy. When you feel wealthy, you spend more money.

The stock market did the same.

Demand destruction looking ahead will not only crush demand, it will raise PEs. This is another reason to distrust forward PEs we see from analysts today.

Cathie Wood’s Ark Open Source Model Predicts Tesla Shares Will Hit $4,600 by 2026

As an example of nonsensical forward earnings estimates, please consider Cathie Wood’s Ark Open Source Model Predicts Tesla Shares Will Hit $4,600 by 2026

Her 2030 model is even more nonsensical. Wood thinks

By 2030 ARK predicts a share price of about $22,500 equating to a market cap of roughly $22.5 trillion.

US Real GDP in 2021 was $19.8 Trillion.

ARK is predicting the valuation of Tesla will exceed the entire US real GDP by the early 2030s.

Yes, this is more than ridiculous. It also says something about ARK’s open source share price model.

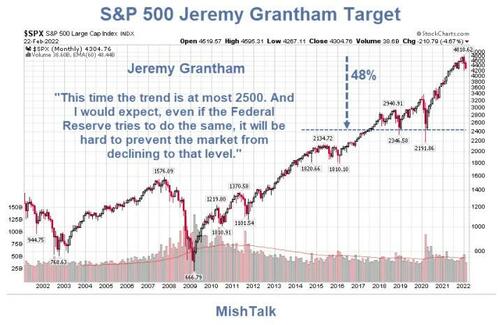

Jeremy Grantham Target

S&P 500 chart courtesy of StockCharts.Com, annotations by Mish with thanks to Jeremy Grantham.

Expect More Stock Market Pain Because It’s Coming

I repeat my April 22, 2022 message Expect More Stock Market Pain Because It’s Coming

On February 23, 2022 I commented Most People Have No Idea How Much Stocks are Likely to Crash

In that post I discuss value investor Jeremy Grantham’s thesis on “super bubbles” and his target for the S&P 500.

The post has a link to a Grantham video where he discusses his target.

Those are a few opinions to consider. Whom you believe is up to you.

* * *

Tyler Durden

Sat, 04/30/2022 – 13:30

via ZeroHedge News https://ift.tt/sAS3hgv Tyler Durden