Drawdown Delerium: Bezos Warns “Markets Teach, The Lessons Can Be Painful”

Just how bad was it?

The Nasdaq’s 13% plunge in April was its biggest monthly drop since Lehman’s collapse in 2008.

That is the 12th worst month ever. To be the worst month ever you have to beat October 1987 that has a 27% decline. The poster-child of this bear, ARK Innovation, actually managed to (-28% in April).

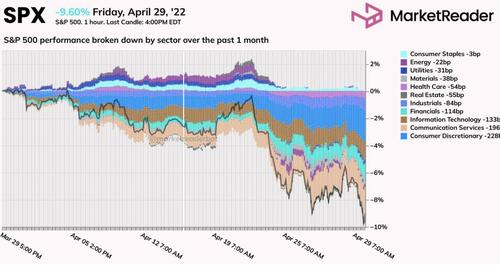

The S&P 500 slipped -9.60% in April, marking its worst month since the COVID-19 shock in March 2020 (-12%). And as The Market Ear details, tech was not even the worst drag. The most significant sector drivers were: Consumer Discretionary (-2.28% drag), Communication Services (-1.96% drag) and Information Technology (-1.33% drag).

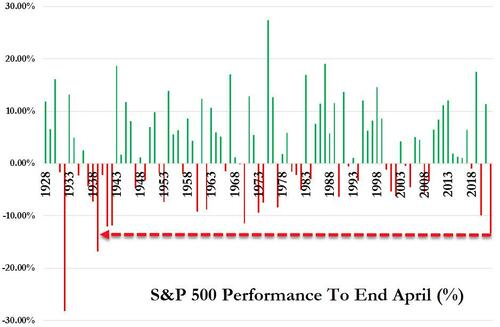

And the S&P is now suffering its worst start to a year since the start of World War 2!!

Is the worst start to a year since 1939 a buying opportunity? The 4 other “top 5 worst starts” all then rallied 13-28% for the remainder of the year.

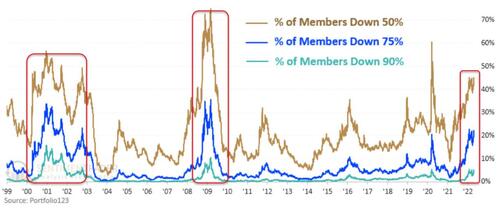

But it’s even worse under the surface of the headline indices, with 45% of stocks down over 50%, 22% of stocks down over 75%, and 5% of stocks down over 90%…

The only comparisons are Oct 2000 – Oct 2002 and Nov 2008 – Apr 2009.

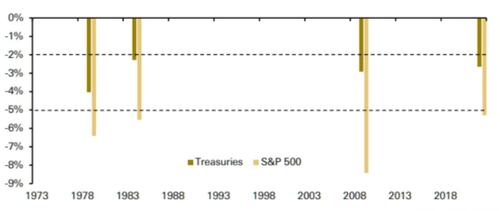

And it’s not just stocks, this is only the 4th month since 1973 when the S&P was down over 5% and Treasuries down over 2%…

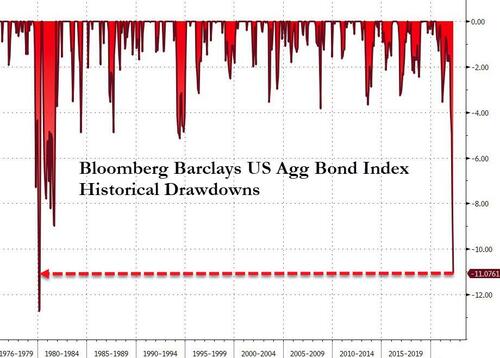

At -11%, this is the largest drawdown in the US bond market since 1980. Back then the 10-year treasury yield was at 12.6%. Today it’s at 2.9%.

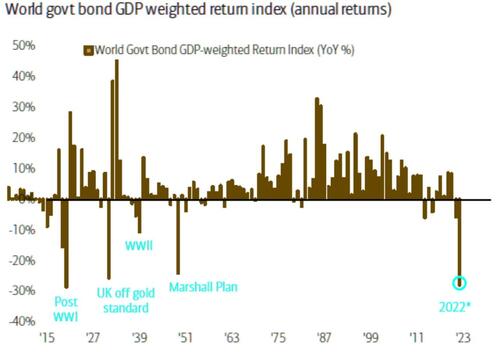

And Global Bonds suffered their biggest loss since 1920…

So to answer the question we posed at the start – it’s bad, really bad.

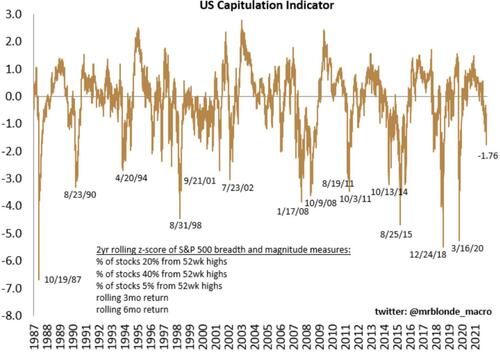

But there’s no ‘capitulation’ yet… “Closer but not yet real capitulation which tends to come with readings of -2.5 or worse. just not enough stocks that are 20-40% off of highs as “good” groups not yet corrected…staples, utes, energy, materials come to mind”

Legendary investor Bill Gurley tweeted some pearls of wisdom:

An entire generation of entrepreneurs & tech investors built their entire perspectives on valuation during the second half of a 13-year amazing bull market run.

The “unlearning” process could be painful, surprising, & unsettling to many. I anticipate denial.

Some thoughts:

Previous “all-time” highs are completely irrelevant. It’s not “cheap” because it is down 70%. Forget those prices happened.

Valuation multiples are always a hack proxy. Dangerous to use. If you insist, 10X should be considered AMAZING and an upper limit. Over that silly.

You may be shocked to learn that people want to value your company on FCF and earnings. Facebook trades at 14X GAAP EPS, & is growing 23%. What earnings multiple are you assuming?

Revenue & earnings QUALITY matter.

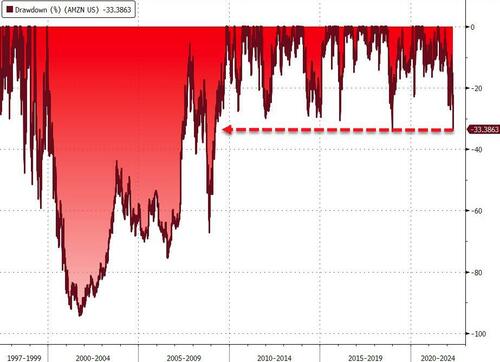

And, with AMZN facing its biggest drawdown since 2009…

…none other than Jeff Bezos had some thoughts on the shitshow that’s evolving, echoing Bill Gurley’s comments:

“Bill is without doubt one of the smartest people I know and always worth listening to.

Most people dramatically underestimate the remarkableness of this bull run.

Such things are unstoppable … until they aren’t.

Markets teach. The lessons can be painful.“

Which, roughly translated means – I got mine, you should all brace!

Tyler Durden

Sun, 05/01/2022 – 12:15

via ZeroHedge News https://ift.tt/4qWVOaJ Tyler Durden