Bad To The Bone

Authored by Peter Tchir via Academy Securities,

If last Friday’s price action was ugly, this Friday’s can only be described as mega-ugly!

This weekend’s T-Report follows in the footsteps of The Not So Good, The Bad, and The Ugly and Welcome to Thunderdome!!! Sadly, there is a theme emerging in the tone of these T-Reports and the markets – decidedly negative.

On Thursday, we asked the question Is The Worst Behind Us? We decided it was not, which seemed like a horrid decision as stocks skyrocketed ahead of Thursday’s earnings, but hasn’t looked so bad since 3:25pm on Thursday when stocks resumed their downward decent.

Today, we try to figure out where markets and the economy head next and try and identify a bottom!

Geopolitics

Academy published Around the World on Thursday night. This month’s topics include:

-

Update on the Russian Invasion of Ukraine.

-

China’s Solomon Islands Partnership and Influence in the Region.

-

Israeli / Palestinian Violence Escalates.

-

Protests in Peru Over Inflation Crisis.

General Spider Marks also discussed the latest on the war on CNN with Wolf Blitzer.

Bad to the Bone

With so much going on, we are going to try to address what’s next by focusing on:

-

Markets themselves. Price action and the alleged “capitulation” so many are talking about.

-

Earnings. What I think is playing out with earnings.

-

Bad Actors Behaving Badly. This will touch on Russia, but go beyond that as we examine risks (that are still a low probability), but are things we should be thinking about.

-

Inflation. This section will be brief, which is not actually the case with inflation. Food and Energy.

-

The Fed. We get the FOMC announcement and press conference on Wednesday. This will be the first opportunity for the Fed to address the market volatility and the last FOMC meeting set the stage for a strong rally!

What Are Markets Telling Us?

One thing the markets are certainly telling us is that they are as illiquid as heck! The Nasdaq 100 rose 1.5% on Monday, fell almost 4% on Tuesday, started Wednesday up 2%, back to slightly negative then back to up almost 2%, only to finish the day wildly unchanged. On Thursday, it was up 4.25% and finished up 3.5%, only to finish down 4.5% the next day.

It is concerning when the weekly drop of 3.7% doesn’t do justice to just how volatile and crazy the week was.

This “chaotic” trading occurred in almost every market I watch. I picked the Nasdaq 100 because a few of the juggernauts in that index reported earnings this week, but you name a market and “crazy” trading patterns were evident.

CDX IG had some vicious trading and closed the week at 84 bps, the highest since June 2020 (the Bloomberg Corporate Bond OAS isn’t back to mid-March levels, but a lack of liquidity is evident in credit trading as well based on all the reports I’m getting from customers).

These wild oscillations bring back memories of watching the Tacoma Narrows Bridge collapse in some elementary school class. Will the market’s oscillations resolve themselves in the same way as they did with the bridge? I hope not, but that seems to be a non-zero risk. I also must be cautious about getting too bearish as the lack of liquidity is evident in both directions! Rallies like Thursday’s will be just as sharp and vicious as the declines.

Last Week’s Chart – Updated

We have now broken through the 12,570 line I had on the chart. We had broken it on Tuesday and stayed below on Wednesday and made a valiant attempt to bounce on Thursday, but are now below that, and are at the lowest close on the Nasdaq composite since December 2020! I am concerned that we have to fall to the next rough level of support, which is below 11,000 (just over 10% further to fall).

PARA

Bill Hwang was arrested this week so I felt it was appropriate to bring out this chart of PARA, which traded under a different ticker during the time that was highlighted.

Based on the allegations made around the arrest, I think we can assume that at least some part of the rise can be attributed to “flows” (him buying more and more, because he could) and a substantial portion of the fall can also be attributed to “flows” (stop losses, triggering selling). In full disclosure, I own some of this right around current levels (it had been a nice contrarian dip buy for me until the recent plunge started about 2 weeks ago).

The point of this chart is to really hammer home the point about how important flows are, and how illiquid things can become, as that is an important part of my current view on where markets are headed.

I would like the “capitulation” story to be a little more obvious!

Speculative Fund Flows

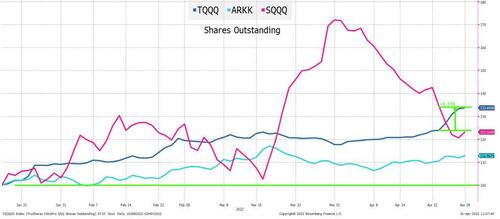

I am closely watching 3 funds:

-

The $13 billion TQQQ, which is a triple leveraged ETF on the Nasdaq 100 (so it represents over $40 billion of “QQQ” purchasing power).

-

SQQQ, which is only $3 billion, but is a 3x short fund.

-

ARKK, which is just under $9 billion and is invested in “disruptive” companies.

Due to the leverage in the two funds and the volatility of the ARKK fund, I think these give some good insight into whether we are seeing “capitulation” or not.

ARKK, which is down 50% YTD and down 29% in April, had inflows. I appreciate the buy the dip mentality and a lot of the companies in the ETF have interesting valuations here (for full disclosure I am flat as of the close on Friday and am tempted to buy). But, regarding signs of “capitulation,” I just don’t see it.

But the TQQQ story is even more interesting because it got significant inflows last week! Even as the market has been selling off and getting more volatile, money poured into this triple leveraged fund, which was down 12% on the week, down 37% on the month, and down 56% year to date. From a “traditional” view where returns correlate with flows, these things wouldn’t happen. As a contrarian, I’m impressed that they are happening, but I cannot help but wonder if we aren’t nearing a breaking point? Every dollar that has come into TQQQ (and ARKK) this year is underwater, often by significant amounts. If we’d seen “real” capitulation, I would expect fund outflows, rather than inflows last week.

The SQQQ finally got some inflows late last week, so that at least is a sign that we are seeing some hedges.

Yes, there are all sorts of ways to determine positioning, and this sample set is really much more retail focused, but the lesson is:

-

Capitulation may be getting talked about a lot more than it is actually occurring.

-

In general, the bearish discussions do not seem to be getting backed up by fully bearish positioning (90% of my conversations are about dip buying and finding the bottom).

The Non-Virtuous Cycle

I am going to try and tie the previous charts and stories into a simple narrative. There was a group of people out there who had this happen to them during the pandemic:

-

They worked at fun, interesting, disruptive firms and had stock prices soar or were even able to participate in their companies’ IPOs.

-

That wealth was heavily tied to their company.

-

When they could access this wealth, they “diversified” into:

-

Other disruptive companies because they loved the disruptive mindset and they could relate to it, and the excitement was palpable.

-

Big buyers of crypto. Crypto met the “disruptive” and “change the world” feelings that were often pervasive during the wild rebound post pandemic. Bitcoin hit $60k in March 2021 and then again in November, but is languishing around $40k right now.

-

I would argue that you had a “virtuous” cycle that started after Covid and has been running out of steam. This “cycle” theory helps explain why crypto is so correlated to some volatile tech sectors (they are owned by the same people).

I cannot tell if this “group” (which I completely believe exists) has managed to properly diversify themselves, or if we have another leg down?

Maybe I’ve picked my charts too narrowly, but I am not getting a good “vibe” from the market itself. And I didn’t even bring up, at least not too much, that the cost of credit is rising and will be a drag on earnings.

Earnings and Multiples

I spend very little time on earnings, but this week was as good as any to pay attention to. What I think about earnings season, especially right now, is that:

-

It is not so much about what was made, but what will be made.

-

It is far more about the multiple the market is willing to pay, than about the earnings or even the outlook.

Going back to January of this year, we discussed the Valuation Evaluation. This earnings season is still more about what multiple we will pay for future earnings, rather than about the future earnings themselves. We are about to embark on balance sheet reduction and that is influencing what investors will pay for future earnings.

When I look at price action post-earnings, the bigger moves are related to this valuation evaluation, rather than the prospects of future earnings (though that plays a role given the global uncertainty and higher rates). So far earnings haven’t been a help for stocks (though I’d argue that is more about this valuation adjustment than the earnings themselves) and neither have some hefty buyback announcements. The buyback announcements will help over time as they are a flow that is going in the right direction for stocks.

At the moment, earnings and buybacks aren’t enough to create a bounce in stocks and risk assets, but they do set the stage for a nice long rebound once we get to that stage.

Bad Actors Behaving Badly

People keep wondering when China will abandon Russia. I cannot think of a reason for them to do so. Yes, they need us, but we need them far more than they need us, and we’ve already shown our colors (the West that is) by continuing to buy Russian oil. Xi cares about China and their long-term needs. I’m willing to bet that China sells military equipment to Russia long before they stop buying Russian commodities.

Any leader of an autocratic nation, whose behavior goes against what the U.S. stands for, has to be working to establish even better and closer relationships with China, as they have the money (and the need for resources), don’t care about internal politics, and haven’t weaponized their currency the way we did when we froze the Russian Central Bank’s dollar reserves.

On Putin, I spend about 2% of my time thinking about how we come to a peaceful outcome and about 98% of my time thinking about how he can use a nuclear weapon to further his goals. The nuclear threat is there, but it seems so “binary” that it isn’t as powerful as it might be. Putin, of all people, would seem to benefit by making the threat of nuclear attacks more real! Yes, he needs to be careful with India and China to ensure their ongoing purchases in the event he does something. Yes, he has to be extremely careful about our retaliation. No, I haven’t come up with a way that seems plausible, but this is coming up in conversation after conversation. If Putin’s only option is to “win” and he is most definitely not “winning” by any true measure, what will he do to “win”?

Again, no one seems to have come up with a strategy that works for him to elevate his nuclear threat to get more from the West, but we have to believe he is exploring that option. One very sobering thought that came out of some of these discussions is that from the Russian (or Soviet) perspective, the only country to ever use a nuclear weapon was the U.S. I’m not sure what to say about that, other than it is sobering and may well factor into Putin’s thoughts.

On the subject of nuclear, every bad actor (most are already pursuing nuclear weapons, if they don’t already have them) will be aggressively pursuing them now, having seen what a deterrent they are. I believe they aren’t working as well as Putin would like, but there is no argument that they are working.

So far, Russia has held off on a full-scale cyber assault, but that remains a risk. I do have to say that our Geopolitical Intelligence Group has been spot on with their analysis that our defenses are thwarting Russian attempts. There have been a lot more cyber attacks than we hear about because our defenses (at a national and corporate level) have been so good! A big shout-out for the good team, but vigilance is still required.

We live in a world where bad actors feel more emboldened to act badly, which gets me back to my “closeness” of supply chains, which I won’t regurgitate here, but I think is crucial and the direction countries and companies are headed!

Inflation

High energy costs are here for some time as we need to spend to build out sustainable energy sources and we need to re-invest in traditional energy sources that in many cases suffer from underinvestment. Personally, I don’t understand why starting the Keystone Pipeline isn’t on the table, but that is a topic for another day. Food inflation is likely to be worse than energy inflation.

-

War in Ukraine. With the war dragging on, it is almost impossible to expect much of a crop out of Ukraine. Russia may get a crop, but how will they ship it? Or even transport it within Russia as the invasion is co-opting their rail system. More problematic is this has the risk of becoming a muti-year problem.

-

Fertilizer. Our conversations are literally filled with fertilizer. Nitrates, peat, natural gas, etc. are all working against the cost of fertilizer. That is a major problem and is still getting worse rather than better.

-

Equipment. Like with most heavy equipment, there are supply chain issues.

-

Farms are expensive to run. Not only is fertilizer expensive, but workers are also expensive and the fuel to power the equipment is expensive.

-

Ukrainian refugees. Countries in Europe are finding homes for millions of refugees from Ukraine. That is straining existing supply and delivery systems. The food distribution system will adapt, but the massive displacement of people is not helping the food problem as logistics need to catch up with this shift in consumption.

Since fuel and food inflation are real, I don’t see the politicians backing down on “fighting” inflation. I don’t really think that the Fed is in a great position to fight the type of inflation that we are getting. I also think that subsidies to help people purchase food and fuel are deflationary. They are potentially necessary as the poor are the hardest hit, but policies like that do more to offset the costs of inflation rather than stopping inflation.

The Fed

The Fed meeting is on Wednesday. The last Fed meeting sparked a big rally. There are two things that might be different this time:

-

Everyone knows the last Fed meeting sparked a rally, so they might be holding off selling risky assets until after the Fed meeting! I know that as a bear, I am deathly afraid of a post Fed rally, which might mean we don’t get it this time.

-

We will get balance sheet reduction and while that seems much more priced in, that could still be a scenario where we sell the news because it becomes real.

I am scared of a post FOMC rally (and that could be the turning point), but it seems almost too obvious to happen again!

On the bright side, I’m on the road for the next two weeks straight seeing customers, investors, and friends in person! That is the best part of this job, and I will enjoy it even if I still cannot get to the point of being bullish! I’m closer to being bullish, but not there yet! Small positions and nimble trading still seem to be the order of the day (and I don’t mind rates – the 10-year was only 3 bps higher on the week). I do hope that “Bad to the Bone” turns out to be a bad title, but that’s where I’m stuck right now.

Tyler Durden

Sun, 05/01/2022 – 18:40

via ZeroHedge News https://ift.tt/CWsOIuG Tyler Durden