Today’s CPI Report Includes A Methodology Change To New Vehicle Prices: Here’s Why It Matters

With all eyes on today’s CPI print, where new car prices have emerged as one of the key variables in month-to-month swings, markets will be curious to learn that today the BLS is changing its methodology – starting with the April data – to estimate new vehicle prices directly from transaction data from J.D. Power.

What does this mean for the headline and core data? Bank of America explains.

The BLS has been monitoring and assessing this updated computation for new vehicles for several years (see Williams and Sager, 2019). We’ll spare you the details and discuss the inflation implications.

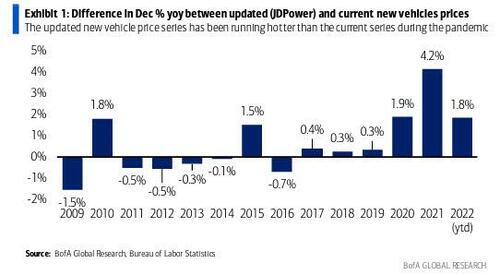

Williams and Sager found that the updated series under-paced the current series on average, at the time of their report. However, the pandemic seems to have flipped the script. As Exhibit 1 shows, the updated series has been far outpacing the current series, with Dec % yoy 1.9pp higher in 2020 and 4.2pp higher in 2021. And through the first 3 months of 2022, the updated series is 1.8% higher. Considering weights, this would have added 0.09pp to core CPI inflation in 2020/22 and 0.20pp in 2021, while core PCE would be 0.04pp higher in 2020/22 and 0.11pp in 2021.

In fact, the updated series has come in stronger than the current series in 7 of the last 8 years (if you include this year), dating before the pandemic. It is difficult to know the exact reason for the recent bias. One potential explanation is that the product cycle has changed, especially in the current environment with constrained production and auto inventories at historically tight levels. News articles have flagged dealers charging higher than the manufacturer’s suggested retail price (MSRP). Auto analysts believe restocking is more of a 2023 and beyond story, which means the updated series could continue to run hotter than the current series.

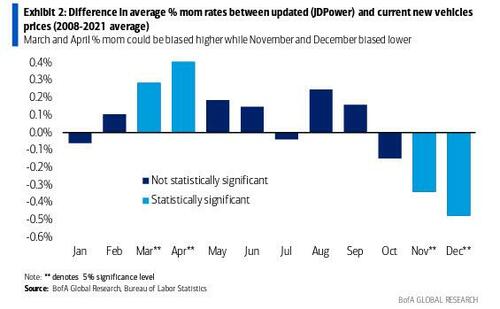

The other potential impact from the methodology change is residual seasonality. CPI NSA data are not revised and seasonal factors are calculated based on the historical NSA data. As a result, if the updated methodology has different seasonality it will take a few years for the seasonal factors to “catch up,” with biases showing up in the seasonally adjusted data. BofA finds that March and April % mom SA are likely to be biased higher going forward, while November and December are biased lower.

The upshot is that the updated methodology for new vehicle prices is unlikely to materially impact the broader inflation outlook. We could see marginally stronger vehicle prices and some seasonal noise from month to month with stronger new car prices in March and April but weaker November and December prints. Looking ahead, BofA expects core CPI inflation to moderate to still-elevated levels, ending this year at 5%, as we are probably past the peak of the commodity shocks. However, wage and labor-driven inflation pressures are accelerating and the true upside risks reside in an upward sloping Phillips curve.

Tyler Durden

Wed, 05/11/2022 – 08:26

via ZeroHedge News https://ift.tt/OJPQYE9 Tyler Durden