Gordon Johnson: Tesla’s April Sales In China “Implode”, Fall 98% Sequentially, Despite Musk’s Comments To The Contrary

In Gordon Johnson’s latest note to clients, he reminds them that on Tesla’s April 21, 2022 conference call, Elon Musk said that Q2 production at Shanghai would be “roughly on par” with 1Q22, and “possible” to “be slightly higher”.

“Given TSLA has said it’s capacity constrained and sold out, this was also implicit sales guidance,” Johnson wrote.

In his note, Johnson takes exception with the media, who in his opinion seem to be making excuses for Tesla’s -98% sequential decline in April sales from China (versus a -41% decline in the overall BEV market for China).

However, the notion that these numbers were somehow “expected” stands at stark odds with what Elon Musk himself was saying leading into the end of April, Johnson says.

Johnson also claims that another shut down means that Elon Musk’s guidance for the quarter is likely incorrect:

“In addition to the above, when considering, as we warned weeks ago (due to parts shortages), TSLA’s Shanghai plant was shut down again (YES, YOU HEARD THAT RIGHT) – link – it seems nearly certain production (and, by default, sales) at the Shanghai plant will NOT be flat-to-up QoQ as E. Musk guided less than a month ago.

“Along these lines, while many say TSLA has a temporary “COVID” problem, we disagree. That is, with virtually every auto company outselling TSLA domestically in the world’s largest EV market of China in April, and, more importantly, TSLA selling just 1,512 of the 10,757 cars it produced in China in April (i.e., 14.06%) – WHICH IS THE QUENTISSENTIAL definition of a company with a demand problem – it is our opinion that TSLA, indeed, has a demand problem in China,” Johnson wrote.

He also continues to talk about Tesla losing market share, stating:

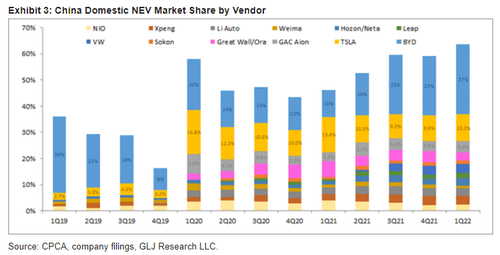

TSLA’s market share in China’s domestic EV market has been on a steady decline since peaking at 16.8% in 1Q20 (it came in at 10.2% in 1Q22, down -660bps from the peak). Stated differently, it is our opinion for TSLA to keep its sales growing in China, it will have to resort to aggressive price cuts, which will drive its “magical bean gross margins” lower (our opinion – we believe TSLA uses warranty “accounting shenanigans” to report margins that are higher than they should be [please contact our GLJ Research sales person for our detailed work on this topic]).

Johnson wraps up with his $67/share target price for Tesla by the end of 2023 and reiterates his “view that TSLA will go down as the greatest short (an over-hyped fantasy stock) in the history of financial markets.”

Recall, in Johnson’s last note from the end of April, we noted why he thought Tesla’s numbers, to him, looked similar to the growth fall off that Netflix just experienced.

At the time, he said he thought Elon Musk “likely lied” when he claimed on the conference call that “the most likely vehicle production in Q2 will be similar to Q1, maybe slightly lower, but it’s also possible we may pull a rabbit out of the hat and be slightly higher”.

Johnson wrote to clients in late April: “In short, we believe E. Musk saw the move in Netflix’s stock ex-growth in [last week’s] trading session, and wanted to paint a picture that, no matter what, TSLA will not go ex-growth, on a unit sales basis, in 2Q22 (we believe his forecast here will prove [very] wrong).”

Tyler Durden

Wed, 05/11/2022 – 11:50

via ZeroHedge News https://ift.tt/OkejYgp Tyler Durden