QT2 Officially Begins: What Happens Next?

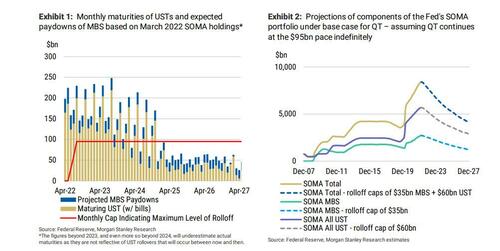

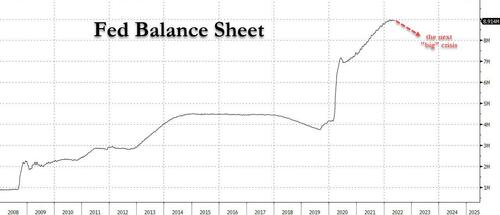

For the second time in the past decade, the Fed will try (and fail) to shrink its balance sheet to some “reasonable” size, a process known as Quantitative Tightening 2. What this means in theory is that, as shown below, the Fed’s balance sheet will shrink by $95BN or so every month for the foreseeable futures as existing TSYs ($60BN/month) and MBS ($35BN/month) matures.

What it means in practice, is that we will get a brief period of BS shrinkage for a few months before the “next big crisis” emerges and the Fed blows up the balance sheet again.

We know this will happen with 100% certainty and without a trace of doubt, if for no other reason than the green agenda of the anti-climate change crusaders, the one event that western politicians have been salivating over for decades, will cost $150 trillion over the next 50 years, of which roughly $2 trillion will come in the form of global QE every year (as we explained in “Here is The Hidden $150 Trillion Agenda Behind The “Crusade” Against Climate Change“.)

But while everyone knows what happens in the medium-to-long term, traders are more focused on how to trade the next few weeks.

For one answer we go to the latest note from JPMorgan flow trader Andrew Tyler who writes that “the question the market needs answered is whether growth is stabilizing after a move lower or if there is more decay to come…. I think it is premature to call the bottom in stocks, which appears to be a consensus view, given QT is about to launch and we are going to get another 100bps in rate hikes over the next 8 weeks.” We wonder if his permabullish “buy the dip, any dip” co-worker Marco Kolanovic has read this… we doubt it.

Tyler then pivots to JPM’s preview of QT2, as follows:

- QT2 kicks off tomorrow

- Today, on the Rates Sales podcast, they hosted JPM Economist Peter McCrory, who discuss the impact of QT on markets. Podcast is here.

- The TL; DR version is that QT2 could act as a 25bps rate hike in 2022.

- Mike Feroli had published a note, A Roadmap for QT2 (full note available to pro subscribers). The note contains information on the mechanics, impact on financial conditions, the long pathway to normalization, and some thoughts on bank deposits.

- As noted above, by the end of 2023, the Fed is set to shed over $1T in longer-duration assets (in theory), with JPM speculating that “the reduction in bank reserves should have little effect on lending or deposit growth” (it’s very wrong).

And here it gets really funny: JPM calculates that “to get back to a “normal” size balance sheet, QT2 may last until 2026 or 2027.” Uh, we have some bad news: by 2027, the US will have been in at least one depression, and we will be lucky if the Fed’s balance sheet is only twice as large as it is now (and the price of cryptos will be about 10-100x higher than it is now). In any case, readers can track the Fed’s activities in real-time in Treasuries (here) and MBS (here).

QT2 aside, there is still the question of the Fed’s rate hikes, at least until the Fed pulls a 180 some time around the August Jackson Hole symposium and the Fed “pauses” in September. According to JPM, here’s what to look for: the market continues to price according to Fed guidance (50bps hikes in June and July; 50% of maximum QT pace). Currently, the market has a ~50% probability of a 25bps hike in Sept and 50% probability of a 50bps hike. The market then prices in 25bps in both November and December. This week, keep an eye on whether Waller’s narrative is echoed by other speakers; or, if the Bostic mention of a September pause remains. If we see the Fed pivot and/or turn dovish, then this would benefit stocks.

* * *

Finally, going back to square one, the question is how does all of this impact the market in the coming days and weeks? According to Andrew Tyler, “the question is one of whether the US bounce is a bear market rally or the continuation of the longer-term bull trend. It is tough to say that we have seen the bottom in stocks given that we have seen a bottom when we still have potential for the Fed to increase its hawkish behavior due to the uncertainty surrounding the next few inflation prints. That said, if an investor wants to short this market, there are challenges given the relatively light positioning among hedge funds and the potential for vol-targeting funds to re-gross and for CTAs to reverse from short to long. Tactically, I think you ride the momentum higher which should be led by Tech and Energy; but, Energy is an idiosyncratic long play given the supply/demand dynamic and supercycle hypothesis.”

Tyler Durden

Tue, 05/31/2022 – 22:40

via ZeroHedge News https://ift.tt/9Y8cloM Tyler Durden