US Producer Price Inflation Hovers Near Record Highs, Energy Costs Dominate

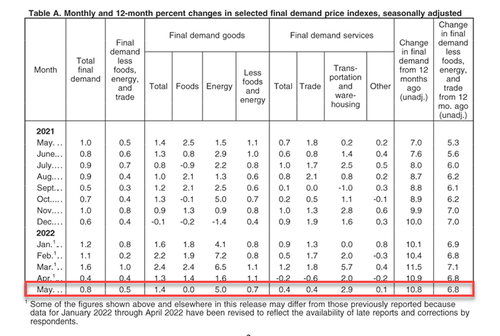

Following CPI’s unexpected crushing of the ‘peak inflation’ narrative, analysts expected PPI to slow modestly from 11.0% YoY to 10.9% YoY in May. US Producer Prices actually printed a slight miss at +10.8% YoY and was up 0.8% MoM – the 25th straight month of increasing prices…

Source: Bloomberg

Nearly two thirds of the May increase was due to an advance in goods prices, especially energy.

Core PPI also missed expectations (to the downside), rising 0.5% MoM (vs +0.6% exp) and +8.3% YoY (vs +8.6% exp). Notably April’s data was revised significantly lower across the board.

The pipeline for producer price inflation remains troublesome as intermediate demand goods prices stubbornly remained notably above the headline…

Source: Bloomberg

Finally, margins remain under pressure as the CPI-PPI proxy remains significantly underwater…

Source: Bloomberg

So, will a 75bps hike tomorrow fix all this?

Tyler Durden

Tue, 06/14/2022 – 08:38

via ZeroHedge News https://ift.tt/k3DOCb2 Tyler Durden