“I Need A Dollar”

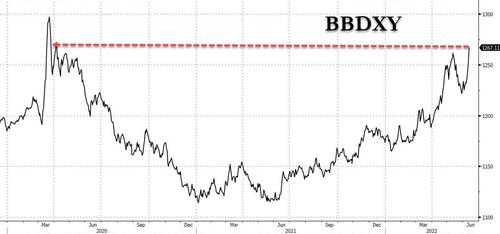

There are some powerful forces in the FX market at the moment: looking at the Bloomberg US Dollar index, shows that the global dollar short squeeze is almost as powerful as the depths of the covid crisis…

… and as Jim Reid writes today, one can make a strong argument that the USD is at extreme overvaluation territory but for the moment the prevailing driver of the continued rally seems to be a stagflation/ recession/flight to quality hedge (i.e., the world is on the verge of a historic market crash).

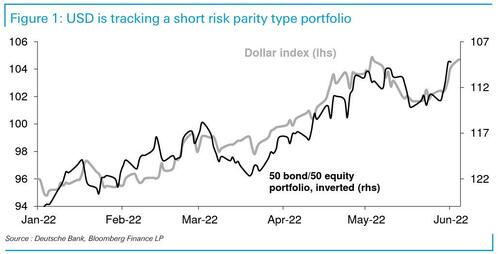

DB’s George Saravelos goes two for two, and after his must-read observations on the Japanese MMT endgame, put out an excellent piece over the weekend showing the high inverse correlation between a UST and S&P 500 equal weighted portfolio and the USD this year.

George explains that the dollar has assumed the role of the global stagflation hedge with USD cash being one of the few financial assets offering returns. This is aligned with the feedback he and his team have received from extensive client meetings in the Continent over the last few weeks: European investors are telling them that they are selling down their (overweight) US bond and equity positions. But instead of repatriating the cash, they are hoarding it in dollars. This is clearly evident in US capital flow data which show the foreign dollar cash pile is close to record peaks.

As Reid concludes, “this is unlikely to go on indefinitely but at the moment the USD’s flight to quality qualities are overpowering everything and sending valuations to extreme territory.”

Tyler Durden

Tue, 06/14/2022 – 10:24

via ZeroHedge News https://ift.tt/ClK6NOM Tyler Durden