WTI Extends Gains After ‘Delayed’ DoE Data Confirms Crude Draw, US Production Rises

After “systems issues” ‘delayed’ last week’s inventory, supply, and demand data from the EIA, the admin will report this week’s data as well as last week’s combined following API reported a notable build the prior week and a surprise draw last week.

-

Crude +5.607mm

-

Cushing -390k

-

Gasoline +1.216mm – first build since March

-

Distillates -1.656mm

API (this week)

-

Crude -3.799mm

-

Cushing -650k

-

Gasoline +2.852mm

-

Distillates +2.613mm

So over the last two weeks, API reports (net) a small crude build, notable Cushing draw, large gasoline build and small distillates build.

Oil prices are notably higher again today following reports that Iran-deal-talks have failed and news that Libya has halted oil exports. Additionally, OPEC’s pre-meeting reportedly concluded with no discussion of oil policy, focusing instead on administrative affairs, including an update to the group’s manifesto of guiding principles known as its Long-Term Strategy.

Meanwhile, a deluge of ugly macro data provides some fodder for the oil bears (though it is being dominated by supply fears for now)…

“Recession fears are just that — fears,” said Stephen Brennock, an analyst at brokerage PVM Oil Associates Ltd.

“In the meantime, oil fundamentals remain solid.”

So all eyes are back on the official inventory and demand data…

DOE (net of the two weeks)

-

Crude -2.762mm

-

Cushing -782k

-

Gasoline +2.645mm

-

Distillates +2.559mm

The official data shows a small crude draw (API showed a small crude build), Cushing a 6th weekly draw of the last 7 (confirming API’s net draw). On the product side both gasoline and distillates showed unexpectedly large inventory builds (also confirming API’s data)…

Source: Bloomberg

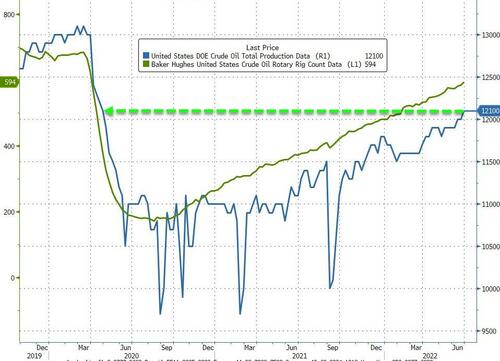

US Crude Production rose to its highest since April 2020…

Source: Bloomberg

WTI was hovering around $113.50 ahead of the EIA data and extended gains modestly after the data…

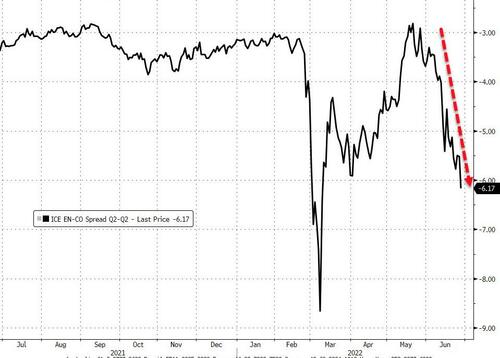

Finally, we note that the tight supply situation in oil (especially European) is revealing itself in the WTI-Brent spread, grew to $6.19, the widest in almost three months.

Source: Bloomberg

“European demand will remain robust, especially as natural gas supplies run out, while the North American demand for crude is weakening,” said Ed Moya, senior market analyst at Oanda.

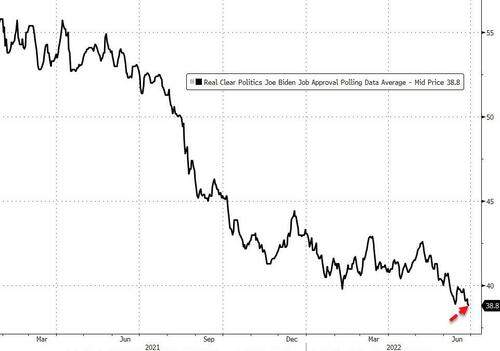

This is not good news for President Biden as prices are rising…

Source: Bloomberg

And his ratings are hitting record lows.

Tyler Durden

Wed, 06/29/2022 – 10:37

via ZeroHedge News https://ift.tt/k2lTagR Tyler Durden