US Consumer Implodes As RH Cuts Guidance For 2nd Time This Month, Warns Of Cratering Demand

One month ago, Snapchat shares cratered after the company unexpectedly slashed guidance for the second time in under one month (it had guided lower in late April and said that since then “the macroeconomic environment has deteriorated further and faster than anticipated.”)

Well, fast forward to today when moments ago RH – aka Restoration Hardward – just pulled a Snapchat and just three weeks after the company with the outspoken CEO saw its shares tumble after it guided lower for Q2 and the full year despite sold Q1 results, RH just cut guidance again with CEO Gary Friedman saying that “the deteriorating macro-economic environment has resulted in lower than expected demand since our prior forecast, and we are updating our outlook, particularly for the second half of the year.”

Taking into account the macro-economic conditions and our current business trends, RH provided the following outlook for the second quarter and full year, which assumes demand will continue to soften during the remainder of fiscal 2022:

- Fiscal 2022 net revenue growth in the range of (2%) to (5%), with adjusted operating margin in the range of 21.0% to 22.0%.

- Previously the company had seen revenue growth of 5% to 7% and operating margin of 23.0% to 23.5%, so a huge hit to both the top-line and profit margins.

- For Q2, RH sees net revenue growth in the range of (1%) to (3%), with adjusted operating margin in the range of 23.0% to 23.5%. The second quarter outlook remains unchanged versus our prior forecast due to faster backlog relief offsetting lower than expected demand.

Friedman’s catastrophic forecast continued, “With mortgage rates double last year’s levels, luxury home sales down 18% in the first quarter, and the Federal Reserve’s forecast for another 175 basis point increase to the Fed Funds Rate by year end, our expectation is that demand will continue to slow throughout the year.”

Friedman concluded, “While we anticipate the next several quarters will pose a short-term challenge as we cycle the extraordinary growth from the COVID-driven spending shift, shed less valuable market share as we continue to raise our quality, and choose not to promote our business while we navigate through the multiple macro headwinds, we continue to believe our long-term investments will enable us to drive industry-leading performance over a longer term horizon.”

The Company also noted that it has not repurchased any shares since announcing the expansion of its common stock repurchase authorization on June 2, 2022.

Which reminds us that just two weeks ago we wrote that “the debate is now over on the dismal state of the US consumer“, after Morgan Stanley unloaded on the driving force behind 70% of US GDP. It now appears that this particular realization is starting to finally trickle through to the rest of the economy.

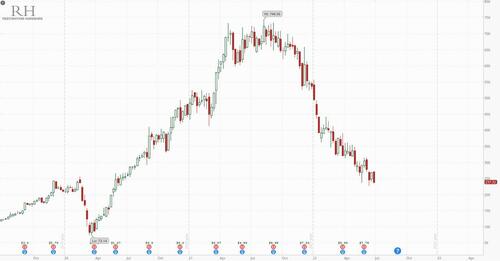

RH stock, of course, tumbled, 5% taking its decline for 2022 to a new low of 55%, and down much more than half from its 2021 all time high of $744

As for the broader implications, in case this needs to be said again – the US consumer is now, and has been for months, in a recession, one which has shocked corporate America with its size and speed, and it’s only a matter of time before we get a deflationary tsunami for most non-food and energy goods and services. And, as we have said previously, we also fully expect that the Fed will recognize said recession just around the time of this year’s Jackson Hole symposium where recession will become the new Fed baseline.

Tyler Durden

Wed, 06/29/2022 – 16:43

via ZeroHedge News https://ift.tt/jenLdx6 Tyler Durden