Fed’s Favorite Inflation Indicator Dips, US Spending Slows In May

The headline-maker from this morning’s macro melange is The Fed’s favorite inflation indicator – Core PCE Deflator – printed lower than expected at +4.7% YoY (vs +4.9% expected and +4.9% prior). The headline May PCE printed +6.3%, equal to the April data

Source: Bloomberg

As a reminder, however, this is May data, and gas prices have soared in June.

Americans pace of spending slowed significantly in May to just +0.2% MoM (half the expected +0.4%) while incomes rose +0.5% MoM (as expected)…

Source: Bloomberg

Americans spending rose slower than their incomes for the first time since December…

On a year over year basis, incomes grew at 5.3% but spending rose at 8.5%…

Source: Bloomberg

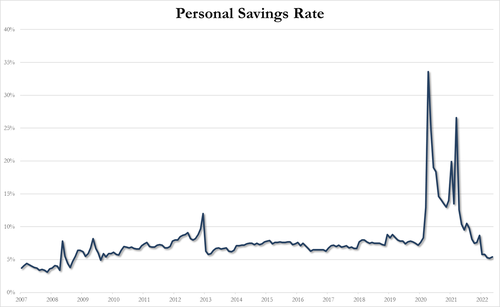

The BEA revised historical data which lifted April’s savings rate from 4.4% to 5.2% and May’s print upticked to 5.4% – the highest since February…

So this is good news – inflation rolling over and Americans pulling back from over-spending?

The question is – will the former re-accelerate in June while the latter continues?

Developing…

Tyler Durden

Thu, 06/30/2022 – 08:43

via ZeroHedge News https://ift.tt/gj12qMV Tyler Durden