“Worst Start Since 1788”: A Closer Look At The Catastrophic First Half Performance

As discussed yesterday…

Worst first half for stocks in 52 years. pic.twitter.com/mOYvbJ6pvo

— zerohedge (@zerohedge) June 30, 2022

… and again this morning, when Rabobank’s Michael Every said that “if you bought stocks in H1, you lost; if bonds, you lost; if commodities, you were doing great until recently; if crypto you lost; if the US dollar, you were fine” but lost purchasing power to inflation, the first six months of the year were terrible.

Just how terrible? To quantify the destruction, we go to the latest chart of the day from DB’s Jim Reid who writes that “the good news is that H1 is now over. The bad news is that the outlook for H2 is not looking good.”

To demonstrate just how bad H1 was, Reid shares three charts. They show that:

1) Deutsche Bank’s US 10yr Treasury proxy index did indeed see the worst H1 since 1788 in spite of a sizeable late June rally, and…

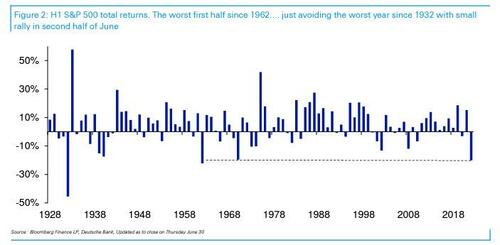

2) the S&P 500 saw the worst H1 total return since 1962 after a rally last week just pulled it back from being the worst since 1932.

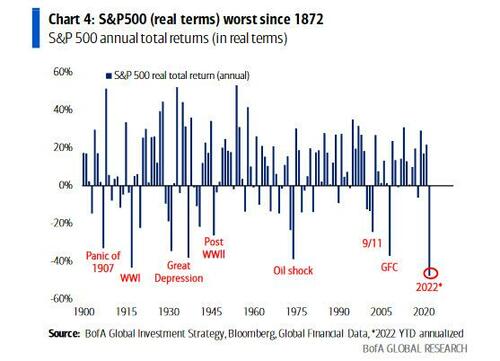

Here, BofA has outdone DB, and notes that in real timers, the S&P500’s performance was the worst since 1872!

As Reid further notes, “I’ve found through my career that these type of charts are always the most demanded as investors want to put their performance in context.” Which is why he also added a the third chart which is an abridged version of one published by DB’s Henry Allen in a report fully reviewing H1, June and Q2 (more below, and also available to professional subs in the usual place).

As Reid concludes, “if you like horror stories its an alternative to Stranger Things which returns to our global screens today. Obviously if you run a commodity fund you may think differently!”

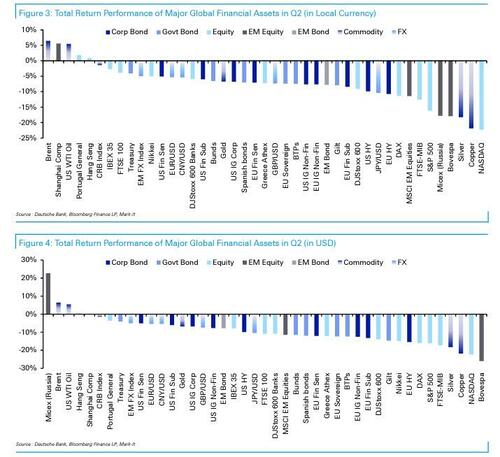

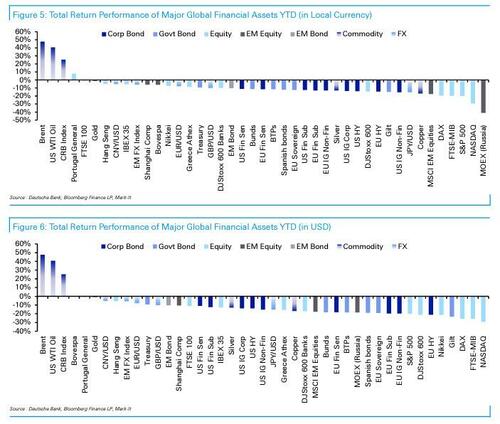

Stepping back from this narrow take, we look at the full performance review for June and Q2 conducted by Reid’s colleague, Henry Allen, which finds that “it’s hard to overstate just how bad markets have performed over recent months, with the returns in Q2 very much following in Q1’s footsteps… a range of asset classes saw significant losses, including equities, credit and sovereign bonds, whilst the US dollar and some commodities like oil were among the few exceptions. In fact, in total return terms we’ve just seen the biggest H1 decline for the S&P 500 in 60 years, and in June alone just 2 of the 38 non-currency assets in our sample were in positive territory, which is the same as what we saw during the initial market chaos from the pandemic in March 2020.”

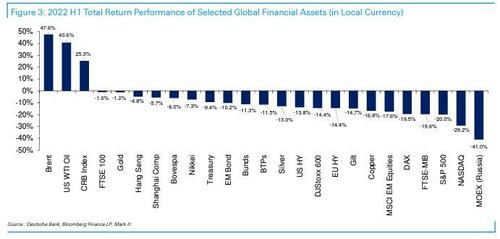

On a YTD basis as well, just 4 of 38 tracked assets are in positive territory, which as it stands is even lower than the 7 assets that managed to score a positive return in 2008.

The main reason for these broad-based declines is the fact that recession and stagflation risks have ramped up significantly over Q2. This has been for several reasons, but first among them is the fact that inflation has proven far more persistent than the consensus expected once again, requiring a more aggressive pace of rate hikes from central banks than investors were expecting at the start of the quarter. For instance, the rate priced in by Fed funds futures for the December 2022 meeting has risen from 2.40% at the end of Q1 to 3.38% at the end of Q2. A similar pattern has been seen from other central banks, and the effects are beginning to show up in the real economy too, with US mortgage rates reaching a post-2008 high. The good news is that as of today, the market is now pricing in not just rate hikes to peak in Q4, but about 14bps of rate cuts in Q1.

in any case, the big worry from investors’ point of view is that the cumulative effect of these rate hikes will be enough to knock the economy into recession, and on that front we’ve seen multiple signs pointing to slower growth recently in both the US and Europe. For instance, the flash Euro Area composite PMI for June came in at a 16-month low of 51.9, whilst its US counterpart fell to a 5-month low of 51.2. Other recessionary indicators like the yield curve are also showing concerning signs, with the 2s10s Treasury curve still hovering just outside inversion territory at the end of the quarter, at just +5.1bps. The energy shock is adding to these growth concerns, and that’s persisted over Q2 as the war in Ukraine has continued. Brent crude oil prices built on their sizeable gains from Q1, with a further +6.4% rise in Q2 that left them at $115/bbl. Meanwhile, European natural gas is up by +14.8% to €145 per megawatt-hour. However, fears of a global recession have knocked industrial metals prices significantly, and the London Metal Exchange Index has just seen its first quarterly fall since the initial wave of the pandemic in Q1 2020, and its -25.0% decline is the largest since the turmoil of the GFC in Q4 2008.

That decline in risk appetite has knocked a range of other assets too:

- The S&P 500 slumped -16.1% over Q2, meaning its quarterly performance was the second worst since the GFC turmoil of Q4 2008.

- Sovereign bonds built on their losses from Q1,

- Euro sovereigns (-7.4%) saw their worst quarterly performance of the 21st century so far as the ECB announced their plan to start hiking rates from July to deal with high inflation.

- Cryptocurrencies shared in the losses too, with Bitcoin’s (59.0%) decline over Q2 marking its worst quarterly performance in over a decade

Which assets saw the biggest gains in Q2?

- Energy Commodities: The continued war in Ukraine put further upward pressure on energy prices, with Brent crude (+6.4%) and WTI (+5.5%) oil both advancing over the quarter. The rise was particularly noticeable for European natural gas, with futures up by +14.8% as the continent faces up to the risk of a potential gas cut-off from Russia.

- US Dollar: The dollar was the best-performing of the G10 currencies in Q2 as it dawned on investors that the Fed would hike more aggressively than they expected, and the YTD gains for the dollar index now stand at +9.4%.

Which assets saw the biggest losses in Q2?

- Equities: Growing fears about a recession led to significant equity losses in Q2, with the S&P 500 (-16.1%) seeing its second-worst quarterly performance since the GFC turmoil of Q4 2008. That pattern was seen across the world, with Europe’s STOXX 600 down -9.1%, Japan’s Nikkei down -5.0%, and the MSCI EM index down -11.4%.

- Credit: For a second consecutive quarter, every credit index we follow across USD, EUR and GBP moved lower. EUR and USD HY saw some of the worst losses, with declines of -10.7% and -9.9% respectively.

- Sovereign Bonds: As with credit, sovereign bonds lost ground on both sides of the Atlantic, and the decline in European sovereigns (-7.4%) was the worst so far in the 21st century. Treasuries also lost further ground, and their -4.1% decline over Q2 brings their YTD losses to -9.4%.

- Non-energy commodities: Whilst energy saw further gains over Q2, other commodities saw some major declines. Industrial metals were a significant underperformer, with the London Metal Exchange Index (-25.0%) seeing its largest quarterly decline since the GFC turmoil of 2008. Precious metals lost ground too, with declines for both gold (-6.7%) and silver (-18.2%). And a number of agricultural commodities also fell back, including wheat (-13.6%).

- Japanese Yen: The Japanese Yen weakened against the US Dollar by -10.3% over Q2, which also marked its 6th consecutive quarterly decline against the dollar. By the close at the end of the quarter, that left the Yen trading at 136 per dollar, which is around its weakest level since 1998. That came as the Bank of Japan has become the outlier among the major advanced economy central banks in not hiking rates with even the Swiss National Bank hiking in June for the first time in 15 years.

- Cryptocurrencies: The broader risk-off tone has been bad news for cryptocurrencies, and Bitcoin’s -59.0% decline over Q2 is its worst quarterly performance in over a decade. Other cryptocurrencies have lost significant ground as well, including Litecoin (-59.2%) and XRP (-61.2%).

June Review

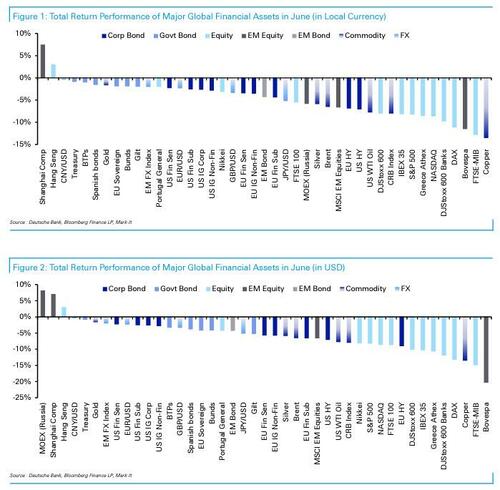

Looking specifically at June rather than Q2 as a whole, the picture looks even worse in some ways since just 2 of the 38 non-currency assets are in positive territory for the month, which is the same number as in March 2020 when global markets reacted to the initial wave of the pandemic. The two positive assets are the Shanghai Comp (+7.5%) and the Hang Seng (+3.0%), which have been supported by improving economic data as Covid restrictions have been eased. Otherwise however, it’s been negative across the board, and even commodities have struggled after their strong start to the year, with Brent crude (-6.5%) and WTI (7.8%) posting their first monthly declines so far this year as concerns about a recession have mounted. The main catalyst for this was the much stronger-than-expected US CPI print for June, which triggered another selloff as it dawned on investors that the Fed would be forced to hike rates even more aggressively to rein in inflation, which they followed through on at their meeting when they hiked by 75bps for the first time since 1994.

Finally, without further ado, here are the charts showing total returns for the month of June…

… for Q2…

… and for YTD.

Tyler Durden

Fri, 07/01/2022 – 15:00

via ZeroHedge News https://ift.tt/LXZkyuV Tyler Durden