Inflation ‘Off’, Recession ‘On’: Stocks Purged As Bonds & The Dollar Surged

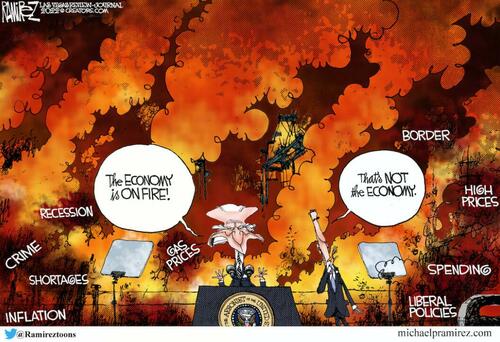

“You Are Here”… in the “strongest economy in the world”

Well that was a week…

All of a sudden the world stopped worrying about inflation and started fearing recession.

Economic data has been collapsing recently…

Source: Bloomberg

With ‘soft’ survey data now leading the drop – to its weakest level since August 2019 as hope collapses…

Source: Bloomberg

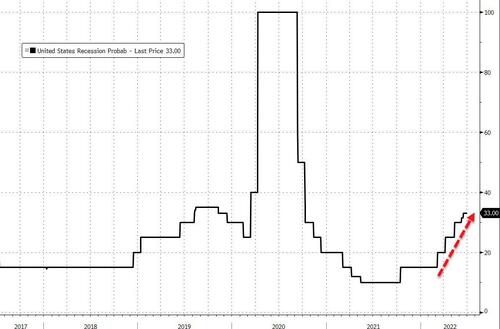

Consensus recession odds rose…

Source: Bloomberg

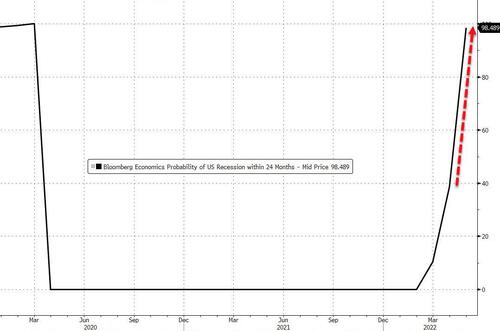

Modeled – macro-data-driven – recession odds are a lock now…

Source: Bloomberg

And US inflation breakevens have cratered – making it look like The Fed’s jawboning rate-hike expectations higher has reinforced some of their credibility…

Source: Bloomberg

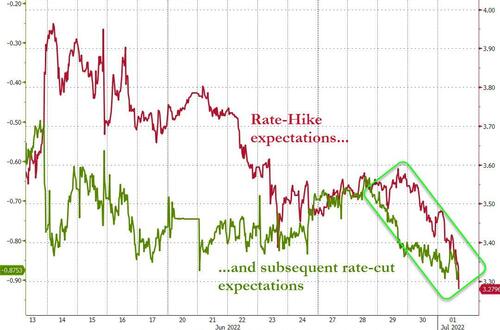

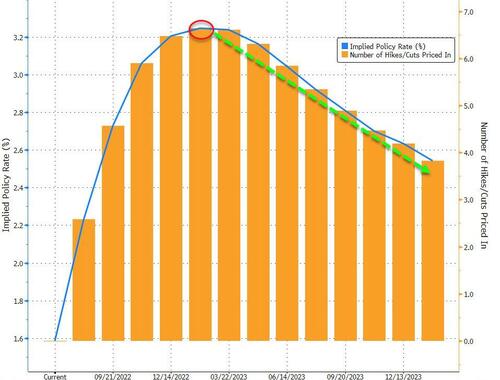

The big question – as we saw this week with rate-hike expectations tumbling (and rate-cut expectations rising) – is if The Fed will actually stick to this plan… or fold like a cheap lawn chair…

Source: Bloomberg

Source: Bloomberg

The market is now pricing in a policy error and fast reversal by The Fed…

Source: Bloomberg

The biggest gainer from all this sentiment shifting was bonds… globally.

European bond yields crashed this week with German 2Y yields seeing the widest high to low swing in their history! Italian bonds ripped, compressing their spread (defragmentation risk) to Bunds to the lowest in 7 weeks.

Source: Bloomberg

“The two-way volatility seems to be feeding off poor liquidity conditions and off-side positioning today,” said Tanvir Sandhu, chief global derivatives strategist at Bloomberg Intelligence

Treasury yields were clubbed like a baby seal today, extending the week’s drop with the belly outperforming (5Y -30bps, 30Y -15bps)…

Source: Bloomberg

US Treasury Bonds are rallying from their cheapest level in 11 years relative to stocks…

Source: Bloomberg

This was the 10Y yields biggest weekly drop since March 2020 – seemingly finding it hard to hold yield gains above 3.00% again…

Source: Bloomberg

Despite today’s late-day ramp into the green (quarter-start flows), US equity markets continued lower on the week with the Nasdaq the ugliest horse in the glue factory, down over 4%…

Did stocks start pricing in The Fed’s response to the recession?

Bonds pricing in the recession. Stocks have yet to price in the Fed’s response

— zerohedge (@zerohedge) July 1, 2022

Utilities were the week’s best performer as Consumer Discretionary stocks and Tech were slammed…

Source: Bloomberg

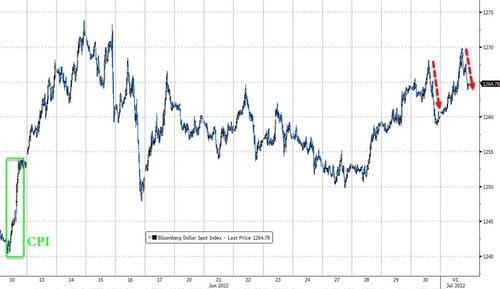

The dollar ended the week higher, trading back near post-CPI highs but notably the last two days have seen overnight strength hit hard during the US session…

Source: Bloomberg

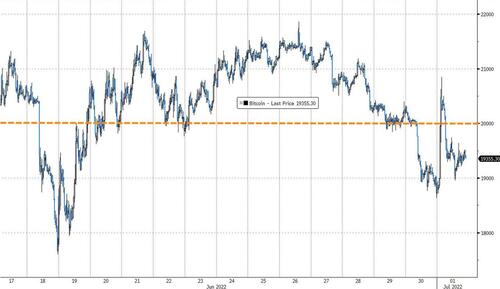

Cryptos were hammered again with Bitcoin tumbling back below $20,000 (despite an overnight panic bid up near $21k)…

Source: Bloomberg

Oil prices bounced today after OPEC+ reported that they missed their production goals (again) by an ever growing amount and ended the week very marginally higher…

Gold ended the week down around 1%, rebounding notably today after breaking back below $1800. Silver was slammed on the week, down over 6%…

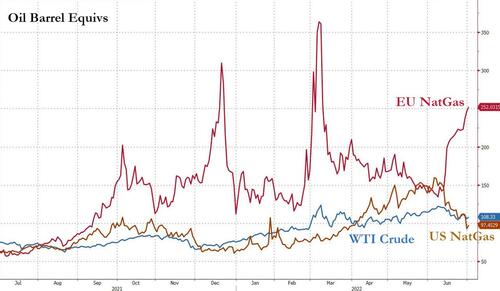

European NatGas continues to soar higher amid Russia restrictions and the absence of US exports due to Freeport LNG’s closure. In ‘oil barrel equivalent’ terms, US NatGas is now cheaper than WTI Crude, and EU NatGas is way more than double the cost…

Source: Bloomberg

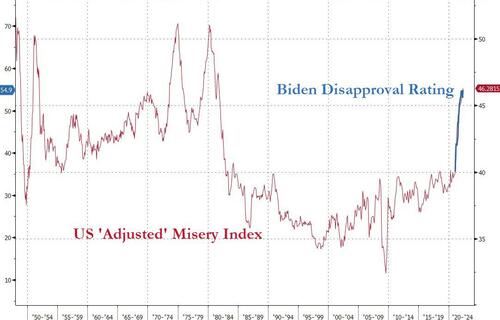

Finally, we note that President Biden’s disapproval rating has hit a record high… as Americans are the most miserable since Jimmy Carter was president…

Source: Bloomberg

And for those who think “it can’t get any worse”… equity market valuations have only dropped to the same level they were at during the peak of the DotCom bubble…

Source: Bloomberg

And the lower that gets… the more layoffs and misery will come.

Tyler Durden

Fri, 07/01/2022 – 16:01

via ZeroHedge News https://ift.tt/odBTkD4 Tyler Durden