Draghi Resigns As Premier, Plunging Italy Into New Political Crisis; Euro, Bonds, Stocks Slide

Mario Draghi resigned as Italy’s prime minister, an inevitable outcome after the former Goldman banker and ECB head failed to round up enough support for vote of confidence on Wednesday, ending a national unity government formed to tackle unpopular reforms, plunging Italy into turmoil and putting it on course for snap elections as soon as early Sept 18 (according to Rai TV), in the process sparking a new political crisis for Europe at a time of already acute economic challenges.

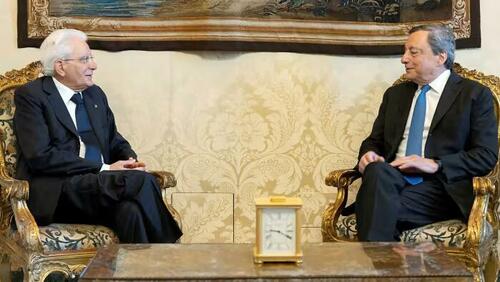

In a statement, President Sergio Mattarella’s office on Thursday said that Draghi would remain in charge of current affairs.

Mattarella, who accepted the resignation just hours before the ECB will announce Europe’s first rate hike in 11 years, will meet Thursday afternoon with the speakers of both houses of parliament to agree on the next steps, which will likely include an emergency vote after the summer. The ballot may take place on Oct. 2. Fall elections are unprecedented in Italy, a time when parliament is usually preparing the annual budget.

Draghi’s national unity coalition, established early last year in the depths of the Covid-19 crisis, unravelled on Wednesday after a rancorous parliamentary debate. His exit comes as the eurozone’s third-largest economy faces mounting challenges including slowing growth, inflation and higher borrowing costs.

“After yesterday’s debate I have drawn my conclusions,” Draghi said during a brief appearance at the lower house of parliament before his meeting with the president.

In the parliamentary debate on Wednesday, Draghi accused some members of his cross-party coalition of attempting to subvert his reform agenda and demanded that they recommit to it. But two centre-right parties – Matteo Salvini’s League and Silvio Berlusconi’s Forza Italia – together with the populist Five Star Movement led by Giuseppe Conte boycotted the vote of confidence in his leadership.

Foreign minister Luigi Di Maio, who led a walkout from Five Star last month in protest at Conte’s sniping at Draghi’s policies, called the government’s collapse “a black page for Italy”.

“We played with the future of Italians,” Di Maio wrote on Twitter after Wednesday’s developments. “The effects of this tragic choice will remain in history.”

Italy’s inflation rate hit 8 per cent in June, its highest level since 1986, according to the statistical agency. Faltering on a tight schedule of promised reforms would also jeopardise Rome’s ability to receive the next tranches of its €200bn in funds from the EU’s Covid recovery programme.

Draghi had agreed an ambitious schedule of reforms with the EU with a plan to enhance competition and cut red tape to make Italy more attractive to investment, and to guarantee the sustainability of its heavy public debt, now at about 150 per cent of gross domestic product.

Investor reaction was clear, with the yield on the Italy’s 10-year note jumping as much as 21 basis points to 3.6%, its highest since June. The spread over equivalent German bonds, a common gauge of risk, rose to 233 basis points, reflecting a widening of 0.22 percentage points in just two days.

The turmoil in Italy’s bond markets comes as the ECB is expected to raise interest rates in the eurozone on Thursday for the first time since 2011, and announce new policies to limit the divergence between the borrowing costs of the bloc’s strongest and weakest economies, including Italy.

Draghi’s exit will also be a setback to the western alliance against Russia’s invasion of Ukraine. The Italian leader has taken an uncompromising stand towards Moscow and was a key architect of the tough sanctions against Russian president Vladimir Putin.

A FTSE gauge of Italian stocks slid more than 2% in morning dealings, taking its losses over the past two days to almost 4%, but it has since recovered much of the losses. The country’s largest banks, which are major holders of Italian debt, led the declines, with Intesa Sanpaolo and UniCredit each down about 5 per cent.

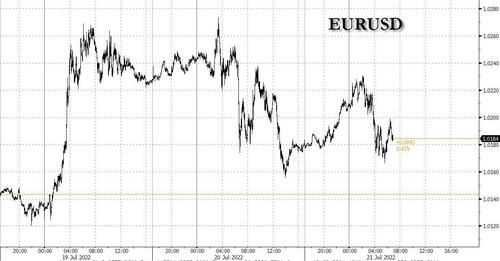

The euro fell; the common currency retreated from earlier gains in choppy trade as investors wait for the European Central Bank to raise interest rates for the first time in more than a decade. Draghi’s resignation triggered a retreat in the single currency, as the 10-year Italian bond yield surged, widening the spread with German bonds; selling accelerated after a report that Russia is planning to hold referendums to annex occupied Ukranian regions. EUR/USD fell as low as 1.0171 in European trade, retreating from an intraday high of 1.0231 hit earlier in the day after Nord Stream AG said flows through Russia’s biggest pipeline to Europe restarted Thursday after a 10-day maintenance period.

Tyler Durden

Thu, 07/21/2022 – 07:01

via ZeroHedge News https://ift.tt/P6mLu9y Tyler Durden