Oil Tumbles As Demand Falters, Supply Fears Ease

WTI Crude is back below $100 this morning, down almost 5%, after a perfect mini-storm of headlines hit energy bulls (in the short-term).

On the demand side there were drivers on both sides of the Atlantic.

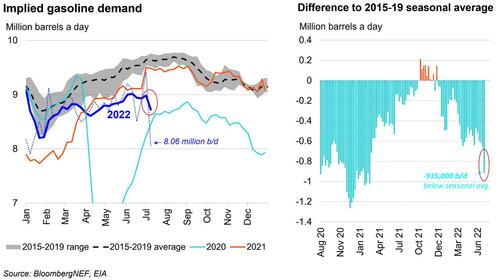

Official US data on gasoline inventories showed significant demand destruction (building 3.5mm barrels despite a modest cut in refinery runs) – a particularly negative development in the middle of what’s known as summer driving season in the US.

“In aggregate,” wrote analysts at Sevens Report Research, “all of these data points continue to suggest high prices are resulting in demand destruction among consumers as inflation continues to pressure personal balance sheets.”

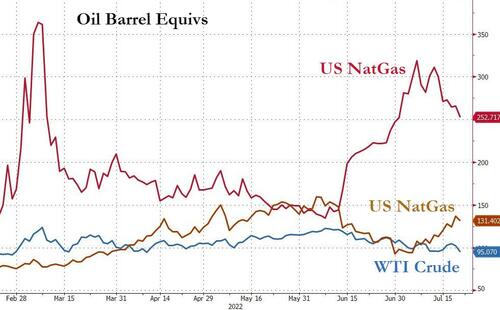

The resumption of natgas flows from Russia through Nord Stream 1 removes the potential demand overhang from utilities and end-users forced to transition from has to oil for their energy needs.

On the supply side, Libya’s National Oil Corporation said Wednesday that preparations were under way to export crude oil after the lifting of force majeure on terminals and oil fields.

Production in Libya now stands above 700,000 barrels a day, after restrictions on the country’s exports were lifted in recent days. Output is expected to return to 1.2 million barrels a day within seven to 10 days.

The reaction was swift to all this news…

After rallying for most of the first half of the year following Russia’s invasion of Ukraine, oil prices have been dragged lower in recent weeks by fears of recession, central bank tightening, and a broad move by investors away from commodities. Prices have swung sharply at times this week as volatility reigns over the market.

And today’s ECB actions are unlikely to help on the demand side.

Tyler Durden

Thu, 07/21/2022 – 08:03

via ZeroHedge News https://ift.tt/59tvIEz Tyler Durden