The Only Soft Landing In 50 Years Was Captain Sully On The Hudson

Authored by Vincent Cignarella, FX & Macro Strategist, Bloomberg,

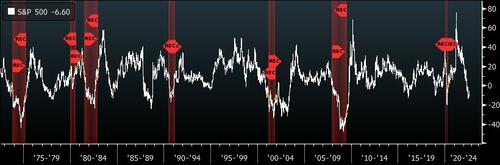

History does not support the idea the Fed can engineer a soft landing.

Since 1972, every single time inflation — as measured by yearly CPI — spiked higher, the Fed followed with tightening. And what happened, each and every time with the exception of 1984, a recession soon followed. This time will not be different.

The good news is that after every recession, stocks rallied year-over-year and, with the lower rates that followed, bonds also gained.

Since January 1991, the Fed has changed the Fed Funds target rate a whopping 91 times. Every time it raises, it has to cut again.

So why is there a 2% target and why, each time inflation rises above it, does the Fed need to orchestrate a recession?

It makes you wonder what kind of growth cycles the economy would have if the Fed just picked a number, stayed there and let market supply and demand set rates.

Tyler Durden

Fri, 08/05/2022 – 14:48

via ZeroHedge News https://ift.tt/fMB7RJm Tyler Durden