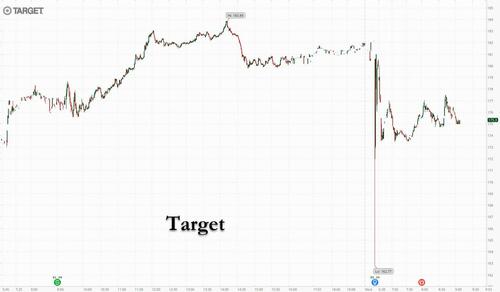

Target Slumps Amid Growing Inventory Glut As Consumer Spending Continues To Shrink

Unlike Walmart, whose stock yesterday soared the most in years after reporting solid earnings which beat (repeatedly slashed) expectations and even raised its (dismal) guidance, following not one but two kitchen-sinking earning warnings, its top bricks and mortar competitor, Target, did not fare quite as well and its stock slumped after the retail giant reported profit which badly lagged Wall Street estimates in the second quarter, even as the retailer ratcheted up the pressure on its fiscal second half by sticking with its forecast of a dramatic rebound in its results, almost as if the bottom half of the US population isn’t in a staggering recession. In other words, the company has bet its reputation and credibility that there will be a second half rebound.

Here is a summary of what Target reported:

-

Sales $25.65 billion, +3.3% y/y, missing estimates of $25.84 billion

-

Customer transactions +2.7%

-

Average transaction amount 0%, missing estimates of +0.15%

-

-

Adjusted EPS 39c vs. $3.64 y/y, missing estimates of 72c and also missing the lowest Bloomberg estimate.

-

Comparable sales +2.6%, missing estimates of +2.84%

-

Gross margin 21.5% vs. 30.4% y/y, missing estimates 23.9%

-

Operating margin 1.2%, missing estimates of 2.41%

-

Operating income $321 million, missing estimates $534.9 million

-

EBIT $329 million, -87% y/y

-

EBITDA $979 million, -68% y/y, estimate $1.19 billion

-

-

Digital sales as share of total sales 17.9% vs. 17% y/y

-

Total stores 1,937, estimate 1,947

-

SG&A expense $5.00 billion, estimate $5.15 billion

Net earnings were just $183 million, compared with $1.8 billion a year earlier. Revenue rose, boosted by strong sales of food and beverage, beauty and household items and more shopper visits but missed expectations. Comparable sales, those from stores and digital channels operating at least 12 months, rose 2.6% from a year earlier; this too missed expectations.

Adjusted earnings tumbled to 39 cents a share during the three months ending July 30, hit by an aggressive push to reduce inventory. That number trailed the lowest analyst estimate compiled by Bloomberg.

Operating margin declined to 1.2% in the quarter ended July 30, Target said in its quarterly earnings report Wednesday. In June the company predicted it would shrink to roughly 2% for the period as it rapidly worked through a glut of inventory. The company cited a swift reversal of buying behavior, with shoppers cutting spending on discretionary items as inflation pressured their spending and product shipments arrived late.

The decision to quickly move through excess inventory “had a meaningful short-term impact on our financial results,” Target Chief Executive Brian Cornell said on a call with reporters. He said the company didn’t want to spend years dealing with excess inventory, potentially degrading the customer and worker experience; however it looks like the company is still not done eliminating said excess inventory.

“While the company is planning cautiously for the remainder of the year, current trends support the company’s prior guidance for full-year revenue growth”, CEO Brian Cornell said, adding that “today the vast majority of the financial impact of these inventory actions is now behind us.” The company expects operating margin to grow to 6% in the second half of the year. Good luck with that.

“The vast majority of our inventory right-sizing costs have already been incurred,” Chief Financial Officer Michael Fiddelke said in a briefing with reporters. “We feel really good about our inventory position heading into the back half of the year.”

Remarkably, despite the crushing quarterly earnings, the company said that it still sees full-year revenue growth “in the low- to mid-single digit range”, suggesting it now sees second half consumer spending getting supercharged somehow. How that happens is a mystery.

The comments were similar to Walmart which said Tuesday that sales rose as prices rose, and it continues to see signs that shoppers are reducing spending on nonfood items as prices rise. The company has discounted goods to move through its own glut of inventory as people spend more on food and other goods. Those efforts ate into last quarter’s profits and will continue in the current quarter, executives said Tuesday. Also on Tuesday, Home Depot said that sales rose in the most recent quarter, in part due to higher prices, while traffic fell. Walmart said sales rose, also helped by higher prices, while traffic increased 1%.

That said, target executives said traffic gains and overall strength of its core shoppers are evidence that the retailer can put the inventory issues behind it. The retailer believes it is gaining market share by unit sales in all major categories, executives said. “We’ve got a guest that is still out shopping,” said Mr. Cornell.

Target executives said the company is cautiously buying discretionary categories that it has worked to unload in recent months, such as furniture and some apparel, and buying aggressively in categories like food that shoppers are spending more on.

At the same time, the retailer has imported some seasonal goods early to make sure shelves are stocked. “We continue to see a choppy supply-chain environment,” Finance Chief Michael Fiddelke said. “You will see us continue to take that approach in the back half of the year.”

Target’s inventory rose nearly 10% in the second quarter to $15.3 billion as it prepares for fall and holiday shopping, he said. Revenue rose 3.5% to $26 billion. The retailer maintained previous estimates for the full year of percentage revenue growth in the low-to-mid single digits.

“The company reduced its inventory exposure in discretionary categories while investing in rapidly growing frequency categories,” Target said in the statement.

Target’s latest miss follows a string of cuts to the company’s profit forecast. In March, the Minneapolis-based retailer said operating income would amount of 8% of sales this year. In May, the company lowered that to 6%. In early June, it said it would attain the 6% goal only in the second half — the same line in the sand it maintained in its latest earnings statement, even as it plunged to just 1.2% in Q2.

Looking at the sellside reactions to the company earnings, Citi sees the “door open” for more additional cuts, while DA Davidson says “this should be the bottom.” Still-high inventory is also a hot topic among Wall Street analysts.

Citi (buy, $184)

- Investors won’t like combo of a 2Q miss and no reduction to second-half operating margin expectations because it “leaves the door open for more disappointments,” writes analyst Paul Lejuez

- Even with cutting guidance on June 7, TGT still “significantly” missed its lowered forecast, mostly due to gross margin pressure resulting from efforts to “clear inventory,” plus higher freight/transportation costs, although TGT doesn’t provide “‘a lot of detail about what changed vs its 6/7 expectations”

- Inventory levels are still “extremely high” despite management noting that it has meaningfully reduced exposure to discretionary categories

- Focus on call will be around inventory composition and current trends

DA Davidson (buy, PT $185)

- “We knew TGT’s second quarter would be down significantly,” and disappointing 2Q operating margins and adjusted EPS aren’t as important as the fact that TGT aggressively worked to right size its inventory, writes analyst Michael Baker

- Maintaining 2H guidance should support shares as it “alleviates fears that yet another guide down was coming even as full year estimates will come down on the 2Q22 miss”

Baird (outperform, PT $180)

- “An ugly margin quarter, though directionally as expected,” writes analyst Peter Benedict

- Says TGT is “making progress” on reducing exposure to discretionary categories — via markdowns, cutting fall receipts — and management reaffirmed its prior 2H EBIT margin guidance of ~6%

RBC (outperform, PT $231)

- This was a “tough quarter,” writes analyst Steven Shemesh

- Says investors should focus on 2 questions: 1) Are we past the worst of the problem?; and 2) What’s the path/timeline back to 7-8% operating margins?

- “If we can get conviction on these two questions, we believe investors will be willing to look through near-term volatility,” he says

Navellier & Associates

- “Although TGT had a big earnings miss because it was dumping overstocked inventory, the company was optimistic about the upcoming months and holidays,” founder and Chief Investment Officer Louis Navellier tells Bloomberg in an emailed statement

- “Bottom line is TGT will likely surprise moving forward, especially in the wake of WMT’s upbeat sales outlook”

- Navellier expects TGT shares to recover over the next few days

Wells Fargo (overweight, PT $195)

- “It’s clear the cost to clear excess product was even higher than management anticipated, and there is still plenty of work to do,” writes analyst Edward Kelly

- Still, the 2Q “pain” should help the back half of the year, he adds, noting the canceled $1.5 billion of fall receipts, though acknowledges the high inventory may suggest added markdown risk in 2H

- “Overall, there were puts and takes to the Q2 results and near-term uncertainty remains, but we saw nothing to change our positive view around the 2023 recovery story”

- Tells clients to use weakness to buy shares

Target shares were down about 2.3% premarket after, erasing an even bigger drop.

Tyler Durden

Wed, 08/17/2022 – 09:25

via ZeroHedge News https://ift.tt/Jml7rjo Tyler Durden