Eco Surprises Show The Consensus Is Wrong About The Cycle

By Simon White, Bloomberg markets live commentator and analyst

Economic surprises imply that economists in the aggregate are incorrectly gauging where we are in the cycle. This could give valuable insight on potential market positioning before data releases.

US economic surprises have been falling, but we can glean additional information about what the consensus is inferring by looking at a breakdown in the surprise indices.

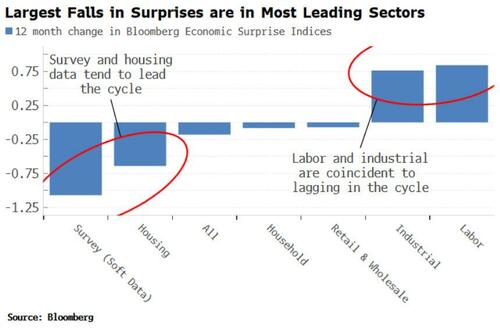

The chart below shows the 12-month change in all of the sub-components of Bloomberg’s US surprise index. Overall, the change in economic surprises is roughly flat, suggesting economists over the last year have been pretty consistent in their forecasts.

However, economists have also been increasingly overestimating leading data over the last year (i.e. eco surprises in more leading components such as the ISM and housing data has fallen), while they have been underestimating more lagging data (e.g employment data). This suggests that economists in the aggregate are incorrectly gauging how late in the cycle we are.

This opens up opportunities for traders able to be nimble. As pointed out earlier, data-release days are becoming riskier for long-only equity portfolios. But they will likely offer more volatility and therefore more opportunity as the importance of data-release days rises due to the Fed’s abnegation of forward guidance.

If the consensus is consistently underestimating how late we are in the cycle, this gives added background about potential positioning before releases, making it easier to be on the right side of the post-data market move.

Tyler Durden

Wed, 08/17/2022 – 10:47

via ZeroHedge News https://ift.tt/4mHBoLr Tyler Durden