Stocks & Bonds Dump As Short-Squeeze Ammo Runs Dry At Critical Technical Level

After an ugly overnight session turned uglier at the cash equity open, the US majors all spiked on the FOMC Minutes – for no good reason – then puked it all back into the close to end the day down relatively hard. Small Caps were the worst with the Dow the prettiest horse in the glue factory (but still lower on the day)…

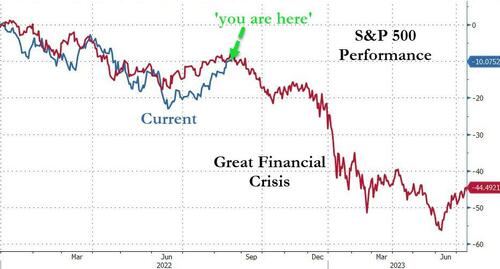

The S&P 500 tagged its 200DMA today and reversed…

And for those who were alive in 2008 and trading stocks, here’s a reminder of what happened after the S&P tagged its 200DMA then…

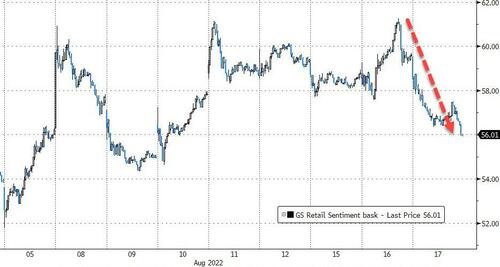

It appears the ammo for the short-squeeze is running dry…

Source: Bloomberg

And meme stock mania appears to have also lost its appeal…

Source: Bloomberg

Treasuries were sold across the board today with the belly underperforming. The long- and short-end of the curve were the least ugly horses in the glue factory despite an ugly 20Y auction. Notably Treasury yields dropped significantly after the FOMC Minutes…

Source: Bloomberg

The 10Y yield traded up to its 100DMA again today, but remains well below the 3.00% level…

Source: Bloomberg

The dollar extended the recent gains, erasing all of the post-CPI losses…

Source: Bloomberg

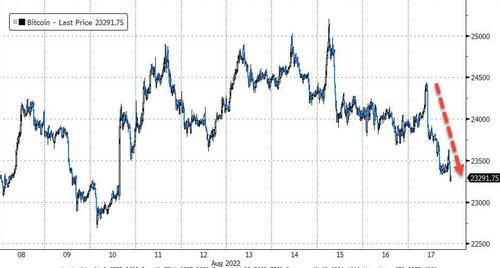

Crypto sold off today with Bitcoin back below $23500…

Source: Bloomberg

Oil ended higher on the day with WTI roller-coastering around $87-88…

Gold closed back below $1800 once again…

Finally, “You Are Here”…

Source: Bloomberg

Brace!

Tyler Durden

Wed, 08/17/2022 – 16:00

via ZeroHedge News https://ift.tt/opyxZUn Tyler Durden