Bullard Backs 75bps Hike As George Says Fed Has “Already Done A Lot”

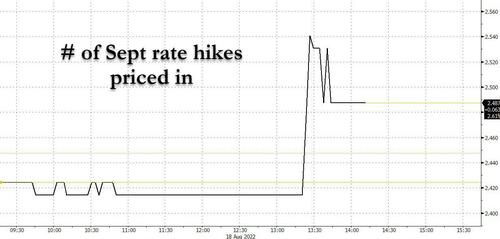

Market odds for 75bps rate hike next month jumped from 42% to 50% this afternoon after St. Louis Fed president James Bullard backed another 75 basis-point move next month, which if effectuated would be the third consecutive 75bps rate hike, something the Fed has never done in its modern history.

Bullard, a voting member of the FOMC and one of the biggest hawks at the US central bank, told the Wall Street Journal in an interview published Thursday that he backed another 75 basis-point increase in September, arguing “we should continue to move expeditiously to a level of the policy rate that will put significant downward pressure on inflation.”

Ironically, Kansas City Fed President Esther George, who until not too long ago was the biggest hawk at the Fed (and is now more dovish than Bullard who a few years ago was the biggest Fed dove), said the US central bank had already “done a lot” on raising interest rates.

George backed the July hike but dissented in June in favor of a smaller half-point increase, citing concern the larger move could stoke policy uncertainty. Her remarks Thursday continued to to tilt dovish.

“I think the case for continuing to raise rates remains strong. The question of how fast that has to happen is something my colleagues and I will continue to debate, but I think the direction is pretty clear,” she said in Independence, Missouri, on Thursday.

“We have done a lot, and I think we have to be very mindful that our policy decisions often operate on a lag. We have to watch carefully how that’s coming through.”

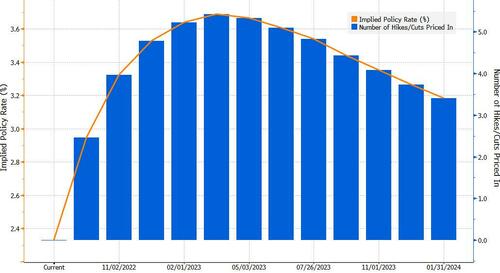

Policy makers saw the federal funds rate reaching a range of 3.25% to 3.5% this year, according to the median estimate of their June projections. The forecasts will be updated in September when the Fed next meets.

Earlier on Thursday, San Francisco Fed President Mary Daly told CNN that she was open to raising rates by 50 or 75 basis points next month and that officials would be in no hurry to reverse course next year. That pushes back against investor bets that the Fed will cut rates before the end of 2023.

The Fed officials spoke a day after the release of minutes from the July Fed policy meeting, which showed officials judged it would eventually be appropriate to slow the pace of interest-rate increases, with some advocating the Fed keep them at elevated levels for some time after increases concluded while others said a time will come to start easing (obviously).

In reaction to Bullard’s comments stocks initially dipped but have since rebounded and are again solidly in the green as the market clearly no longer cares about anything the Fed has to say.

Tyler Durden

Thu, 08/18/2022 – 14:40

via ZeroHedge News https://ift.tt/cEUP1A5 Tyler Durden