Stocks Stumble, Memes Mauled In Sleepy Session Fit For Sandman

If one had to describe today’s session with one word it would be “sleepy.”

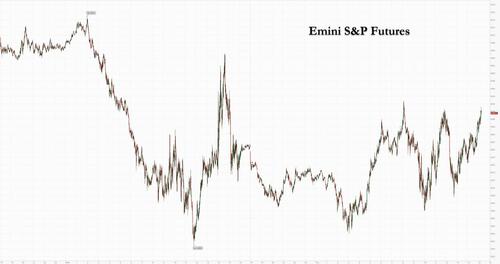

After yesterday’s early selloff, driven by sharply higher rates, the 2pm FOMC failed to provide traders any clear direction on what the Fed plans to do, and an early dovish read of the minutes fizzled quickly, ending any upward momentum. Fast forward to today when stocks traded in a narrow range bound by the pre-FOMC lows and post-FOMC highs (yet one which nonetheless makes the Fed nervous as it is far too high to constrict financial conditions).

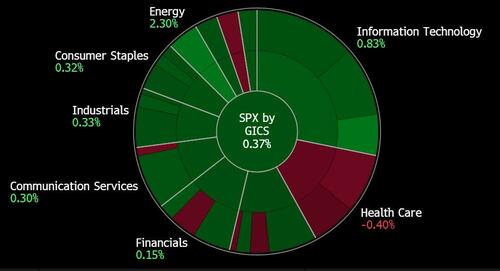

While most sectors were in the green – though energy led the pack thanks to a surge in oil prices…

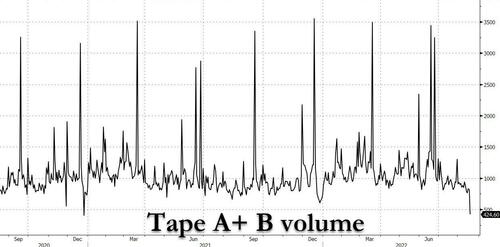

… volumes were dismal (to be expected with more than half of traders out on vacation) and liquidity was non-existent …

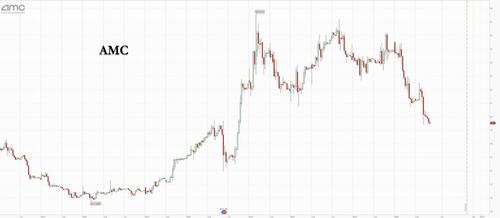

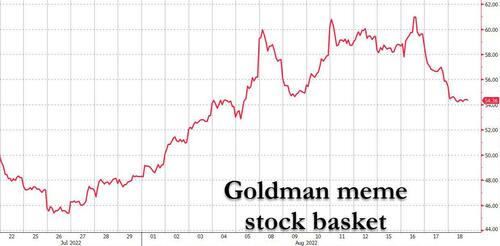

… and what little action there was, was in “meme stonks” where recent insolvent, multi-bagging superstars like BBBY crumbled after even the apes were forced to accept that it’s just a matter of time before “papa Cohen” and his diamondhands dump their BBBY stake (and who knows what else).

The news sent BBBY stock plunging more than 20% and almost half off yesterday’s $30 high….

… AMC hit ten-day lows…

… and GME was also hammered…

… as the broader basement trader space got deflated now that the Fed has made it clear it will likely hike another 75bps in September.

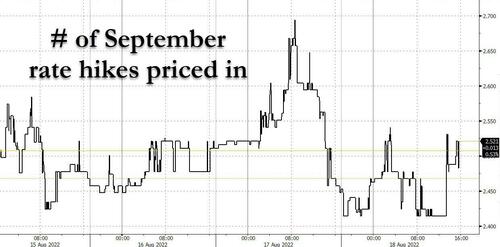

And speaking of September rate hikes, after odds of a 75bps hike post yesterday’s FOMC from 70% to 40%, we got the usual confusion today when former uber-hawk Esther George came out dovish today while recent uber-dove Bullard James Bullard said he backs a 75bps rate hike.

However, since not even the algos care about Fed forecasts any more, there was little impact on either the Euro$ market or risk assets.

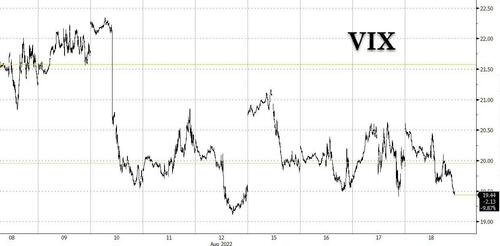

The rest of today’s session was, as noted, boring: the dollar rose, rates went nowhere, the VIX crunch resumed, pushing it back below 20…

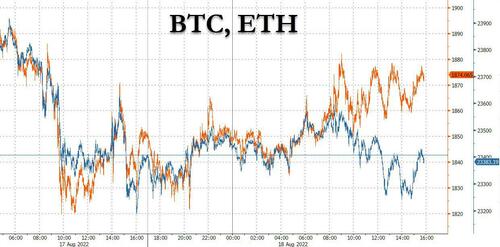

… gold went nowhere, same as bitcoin, while ETH saw a stead trickle of inflows as traders continue to expect outperformance from the token before (and after) the merge.

Crude was probably the only other interesting move besides memes, as it was finally able to rally out of its previous rut due to Wednesday’s EIA report, which showed that markets are still very tight and gasoline soared. Along with multiple stockpile draws, the report revealed that recessionary risks haven’t trickled over to crude consumption just yet as demand remains high. Bolstering gains were Xi’s comments about Chinese reopening (even though the comments appeared to reference globalization rather than the country’s Covid-zero policy, but whateves), as well as continued geopolitical risk with Bloomberg noting that talks between Ukrainian President Zelenskiy and Turkey’s President Erdogan didn’t prove fruitful, as Zelenskiy says he sees no end to the war without troop withdrawals. Finally, Goldman said that an Iran nuclear deal is actually not going to happen and will instead be an extended “stalemate”, which however won’t help the supply picture. As a result, WTI crude briefly rallied above $91 on Thursday after previously dropping to a seven-month low earlier in the week.

Tyler Durden

Thu, 08/18/2022 – 16:06

via ZeroHedge News https://ift.tt/2HVwjQO Tyler Durden