Is Ethereum’s Censorship-Resistance Under Attack: A Recap Of The Biggest Crypto News In The 2nd Week Of August

By Lucas Campbell of Bankless

The recent sanction of Tornado Cash from the U.S. treasury has had a windfall of effects on crypto.

A developer was arrested and a string of “decentralized” applications have banned wallets that have touched Tornado Cash.

People are afraid of OFAC. These guys are nothing to mess with. If you don’t comply with their demands, there’s a really good chance you go to jail.

This collective fear and action from OFAC are sparking debate among the community.

On one hand, protocol teams are worried. For most, prison time is not an option to consider (understandably). Companies will comply if threatened with jail time.

At the very least, if these companies are working in the best interest of crypto, they’ll fight it in the legal system. But that will take years and millions (and millions and millions) of dollars.

On the other hand, crypto is about open, unstoppable access to money and finance. The idea that “DeFi” apps are banning access because certain wallets directly (or indirectly) used a sanctioned code goes against the ethos and mission of crypto.

Satoshi would be pissed. This isn’t what we’re here for.

Regardless, this looming threat becomes a serious issue when looking at Ethereum’s validator set.

Start with the big, current one.

Currently it looks like over 66% of the beacon chain validators will adhere to OFAC regulations, @LidoFinance @coinbase @krakenfx @stakedus @BitcoinSuisseAG pic.twitter.com/qyq23tPnqV

— eylonverse X 🏴 (@TheEylon) August 14, 2022

A handful of companies are responsible for operating a majority of the validators on Ethereum.

What happens if OFAC starts demanding these companies to censor specific transactions via their validators (or go to jail)?

Will they bend the knee?

Will they shut down their staking services?

Will validators accept it and get slashed by the network, losing user deposits?

This is a big unknown right now, but any of these outcomes are possible.

Before you say “Ethereum would never support censorship”, there are a lot of nuances behind this, primarily with Flashbots and block building, that go above my head.

Regardless, this was a major discussion on the Ethereum Core Devs meeting this week, and there’s a lot to unpack here. I recommend listening to the discussion and reading Tim Beiko’s thread on the topic to get the full rundown.

Starts at 18:11.

Is Ethereum’s censorship resistance under attack?

The honest answer is that it’s not entirely clear right now.

The Best Monetary Asset

Four weeks from now, Ethereum will be in a post-merge world. Issuance will be reduced by 90% and net inflation will virtually become neutral, if not negative.

This creates a compelling case for ETH as a monetary asset in an increasingly inflationary world.

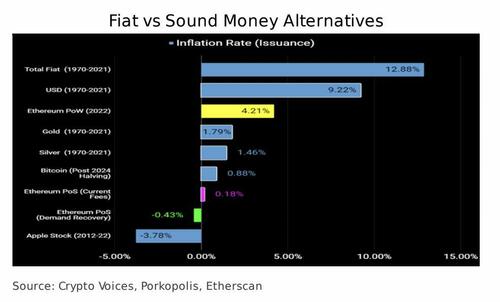

- Fiat is currently inflating at 12.8% per year.

- Gold sits at 1.79%

- After the next Bitcoin halving in 2024, BTC’s inflation rate will be 0.88%.

Post-Ethereum Merge?

ETH issuance falls to 0.18% based on current demand levels where it could potentially go negative if demand recovers to same the levels as a few months ago.

Most people looking at this graph might respond “But Apple is sitting at -3.78%! That’s the better store of value.”

True—sort of.

But Apple stock is not a monetary asset. You can’t instantly transfer it to anyone in the world. You can’t buy anything with it. You don’t have global access to lending, borrowing, trading, or earning yield.

Apple stock has no credible neutrality. There’s no decentralization.

It’s not a Medium of Exchange or a Unit of Account.

Issuance is just one part of it.

But when you factor in all of it, ETH becomes a highly favorable monetary asset in the current landscape.

Other News

Celsius owes $6.7 billion in crypto tokens and only holds $3.8 billion; Genesis CEO quits amidst job layoffs; Mailchimp cracks down on crypto newsletters; The SEC sues Dragonchain; Canada lays new crypto regulations; The NFT market faces a potential liquidity crisis?

Tyler Durden

Sat, 08/20/2022 – 19:00

via ZeroHedge News https://ift.tt/Y25bFPn Tyler Durden